Mega Coffee's Operating Profit Surpasses 100 Billion KRW Last Year

Operating Profit Margin at 21.7%... Starbucks at 6.1%

Product Sales Jump by 120 Billion KRW, Cost of Goods Sold Rises by Only 60 Billion KRW

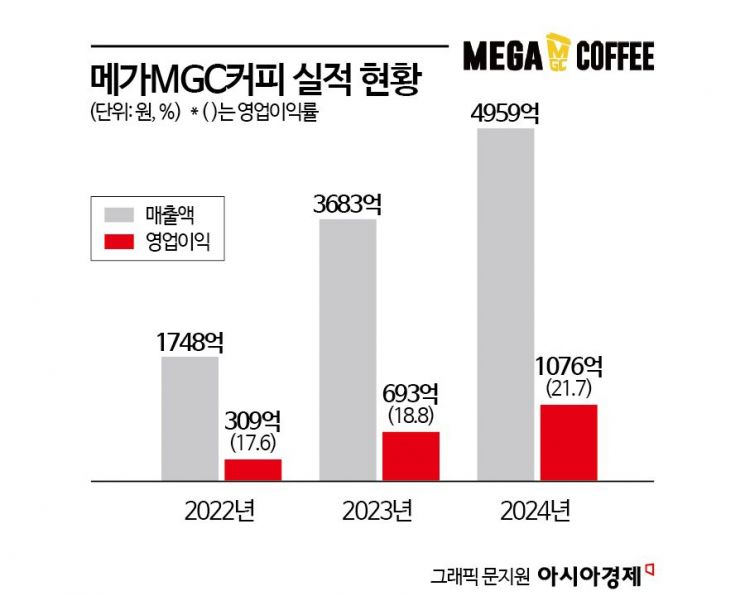

Mega MGC Coffee's operating profit surpassed 100 billion KRW last year. By selling low-priced coffee at 1,500 KRW per cup, it achieved higher profitability than Starbucks, the epitome of premium coffee.

According to the Financial Supervisory Service's electronic disclosure system on the 3rd, Anhouse, which operates Mega Coffee, recorded sales of 495.9 billion KRW and an operating profit of 107.6 billion KRW last year. These figures represent increases of 34.6% and 55.2%, respectively, compared to the previous year. The operating profit margin was 21.7%, significantly exceeding Starbucks Korea (SCK Company)'s 6.1%.

Starbucks posted sales of 3.1 trillion KRW last year and an operating profit of 190.8 billion KRW. The average price of a cup of coffee at Mega Coffee is 1,500 to 2,500 KRW, less than half of Starbucks' 5,000 to 6,000 KRW, yet Mega Coffee leads in profitability.

Franchise Business Structure... Driving High Profitability

The difference in profitability stems from the 'business model.' Domestic coffee brands are divided into direct-operated store brands and franchise models. Direct-operated brands include Starbucks and Coffee Bean, with Starbucks operating over 2,000 stores nationwide directly. In contrast, the franchise business Mega Coffee operates mainly through franchises, with fewer than 20 direct-operated stores out of 3,500 nationwide.

Direct-operated stores bear high fixed costs such as labor and rent, so increasing the number of stores does not directly translate into operating profit. On the other hand, the franchise business generates revenue by supplying coffee beans and materials to franchisees, collecting franchise fees, royalties, and training fees, so the more franchise stores there are, the greater the headquarters' profit. In fact, Mega Coffee's product sales from supplying coffee beans and other items to franchisees reached 467.2 billion KRW last year, a sharp increase of over 120 billion KRW (34.48%) from 347.4 billion KRW the previous year. During the same period, the cost of goods sold (purchase cost of raw materials such as coffee beans) rose only from 226.7 billion KRW to 289.3 billion KRW, an increase of 62.6 billion KRW (29%). The number of Mega Coffee franchise stores grew from 2,709 in 2023 to 3,500 last year.

There are also concerns that the burden on franchisees is increasing alongside Mega Coffee headquarters' high profits. According to the Fair Trade Commission, Mega Coffee's initial franchise investment costs (franchise fee, training fee, deposit, and other expenses) rose 11% from 66.79 million KRW in 2022 to 74.22 million KRW in 2023. The franchise fee and training fee were each raised by 3.3 million KRW and 1.1 million KRW. It is understood that the burden increased further last year. According to data disclosed on Mega Coffee's website, the current franchise fee and training fee have increased by 1.2 million KRW and 600,000 KRW compared to 2023, reaching 10 million KRW and 5 million KRW, respectively. Advertising costs are shared equally between headquarters and franchisees.

Meanwhile, the average sales of franchise stores did not show significant growth. Average sales per 3.3㎡ increased slightly from 20.25 million KRW in 2021 to 20.9 million KRW last year. This is the background for criticism that profitability improvements are concentrated at headquarters.

Most of Mega Coffee's Profits Distributed as Dividends

Mega Coffee paid out 38.2 billion KRW in dividends from a net profit of 81.4 billion KRW last year. The dividend payout ratio was 46.8%. In 2023, it paid 50.2 billion KRW (89% payout ratio) out of 56.4 billion KRW net profit. Although lower than 2022 (98.1%) and 2021 (100%), it remains at a high level. In 2021, all but 1,000 KRW of net profit was used for dividends.

Mega Coffee is 82.3% owned by Woo Yoon, the largest shareholder and chairman of Anhouse, Kim Daeyoung, and 17.7% by the private equity fund (PEF) Premier Partners. Ultimately, most of the profits earned by Mega Coffee flow to the management and the PEF investors.

Over the past two years, Mega Coffee has repaid 25 billion KRW to investors through Redeemable Convertible Preferred Shares (RCPS), with 10 billion KRW in 2023 and 15 billion KRW in 2024. Industry insiders analyze that alongside dividends, capital repayments are underway, marking the start of investors' capital recovery. A franchise industry official said, "Franchise businesses can achieve rapid growth and high profitability initially, but if the headquarters' profits are passed on as burdens to franchisees, it can negatively affect the brand's sustainability," adding, "A balance between investor-centered profit structures and mid-to-long-term strategies is necessary."

Meanwhile, Mega Coffee will raise prices of major products, including Americano, by 200 to 300 KRW starting from the 21st of this month. The price of a hot Americano will increase from 1,500 KRW to 1,700 KRW. This price hike is the first in 10 years since the brand's launch.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.