The increase in household loans at the five major banks slowed down last month.

On the 1st, the outstanding household loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) amounted to 738.5511 trillion won last month. This is an increase of 1.7992 trillion won compared to February (736.7519 trillion won).

The increase in household loans surged to 9.6259 trillion won in August last year but has steadily declined since September due to government regulations on the total volume of household loans. In January this year, it decreased by 476.2 billion won compared to the previous month. After rebounding in February due to interest rate cuts at the beginning of the year, the increase continued for two consecutive months until March. However, the increase was about 42% lower than in February (3.0931 trillion won).

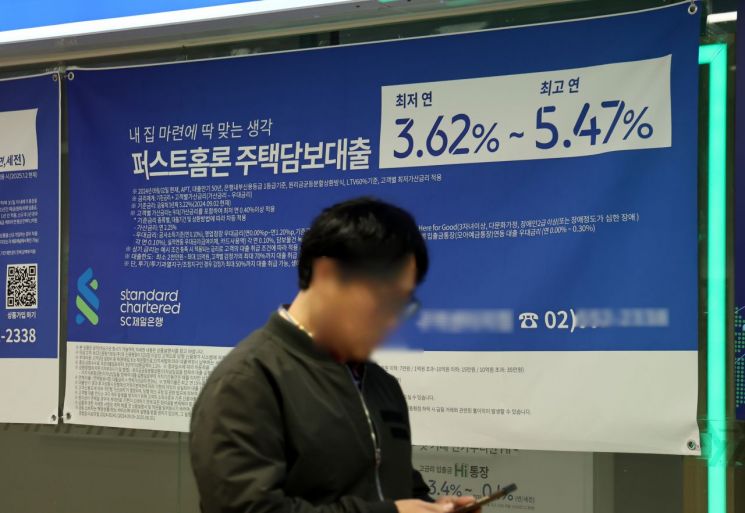

Specifically, the outstanding balance of mortgage loans (including jeonse deposit loans) was 585.6805 trillion won, an increase of 2.3198 trillion won compared to the previous month. The increase was about 1 trillion won less than in February (3.3836 trillion won).

In the case of unsecured loans, the balance decreased by 352.6 billion won from 101.9589 trillion won at the end of February to 101.6063 trillion won at the end of March.

Time deposits at the five major banks decreased by 15.5507 trillion won last month (from 938.04 trillion won to 922.4497 trillion won). Meanwhile, demand deposits, which are considered liquid funds, increased by 24.977 trillion won during the same period, from 625.1471 trillion won to 650.1241 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)