BOK Reconstructs Global Projection Model (BOK-GPM) for Analysis

Diversification of Export Markets Needed Amid Potential Intensification of US-China Trade Disputes

Stronger Monitoring of Dollar Trends and US Financial Conditions Required

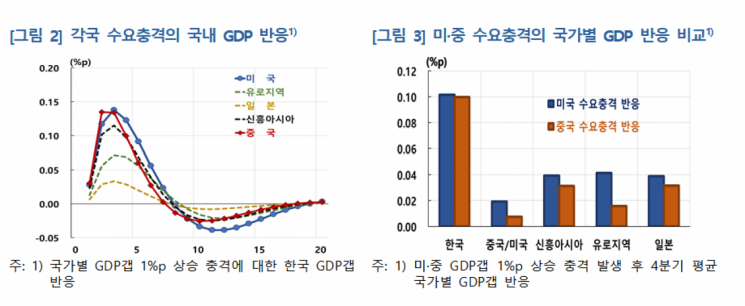

The decline in South Korea's gross domestic product (GDP) due to demand shocks from the United States and China was found to be the largest among the surveyed countries. While the influence of China decreased following the 2018 US-China trade conflict and the 2020 COVID-19 pandemic, the impact of the United States expanded. This is the result of an analysis using the newly reconstructed global projection model (BOK-GPM) by the Economic Modeling Department of the Bank of Korea.

On the 1st, the Bank of Korea announced this through the 'BOK Issue Note - Results of BOK-GPM Reconstruction.' Using the newly reconstructed BOK-GPM, the Bank analyzed ▲demand shocks from major countries ▲US monetary policy shocks ▲US financial shocks and their effects on South Korea's GDP. The results showed that demand shocks from the US and China had the greatest impact on South Korea's GDP, followed by emerging Asia, the Euro area, and Japan in order of influence. In particular, the magnitude of South Korea's GDP response to demand shocks from the US and China was the largest among the analyzed countries.

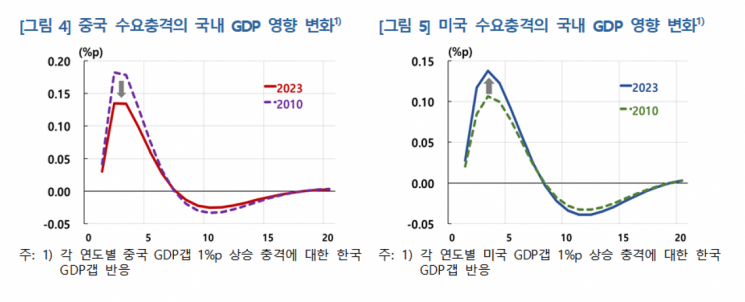

While the impact of China's demand shocks somewhat decreased in 2023 compared to 2010, the influence of US demand shocks expanded. Yoon Hyuk-jin, a researcher at the Bank of Korea's Financial Modeling Team, explained, "This reflects the fact that, since the late 2010s, the influence of China on our economy has somewhat diminished due to the fragmentation of global trade and the US-China trade conflict, whereas exports to the US have increased significantly."

The impact of US monetary policy shocks on the domestic economy also expanded compared to previous models when considering the US dollar's role as a global trade currency and inter-country financial linkages mediated by credit spreads. This is because the mechanism whereby a US policy rate hike leads to a stronger dollar, contraction in global trade, and a rise in credit spreads in the US bond market?thereby worsening financial conditions in other countries?was more precisely captured.

The impact of a rise in US credit spreads on South Korea's GDP was also greater and more persistent than the impact of a rise in South Korea's own credit spreads. Researcher Yoon explained, "This reflects the effect that the deterioration of US financial conditions is not confined domestically but leads to a reduction in global dollar liquidity supply, thereby worsening financial conditions in other countries dependent on dollar borrowing."

Researcher Yoon added, "It is necessary to promote diversification of export markets in preparation for the possibility of intensified US-China trade disputes in the future, along with close monitoring of the direction of the US dollar and US financial conditions."

Meanwhile, the reconstructed BOK-GPM reflects changes in the global trade environment. In addition to the existing five economies?South Korea, the US, China, the Euro area, and Japan?the emerging Asia bloc was added. The exchange rate channel was refined, and inter-country financial linkages were also strengthened. The Bank of Korea explained that it will use this model for future global economic forecasts and policy analyses related to external shock impacts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)