First Quarter Won-Dollar Average Exchange Rate at 1,452.91 Won

Highest Since March 1998 (1,488.87 Won)

U.S. Tariff Aftershocks and Stagflation Concerns

Political Uncertainty and Low Growth Signals Increase... Short-Term Threat to 1,500 Level

Key to Resolving Domestic and International Uncertainties: "Level to Decline by End of Second Quarter"

The won-dollar exchange rate in the first quarter of this year reached its highest level since the 1997 Asian financial crisis. Despite the weak dollar situation since the beginning of the year, persistent uncertainties in U.S. trade policies, domestic political instability, and concerns over economic sluggishness have continued to exert downward pressure unique to the Korean won. Experts noted that with the U.S. 'Super Tariff Day' on April 2 approaching and the impeachment trial verdict of President Yoon Seok-yeol delayed beyond market expectations, anxiety has increased, leading to concerns that the 1,500 won level could be threatened in the short term. However, they forecast that if domestic and international uncertainties ease in the second quarter, stability will gradually be restored.

First Quarter Won-Dollar Average Exchange Rate Hits Highest Since IMF Era... Short-Term Threat to 1,500 Level

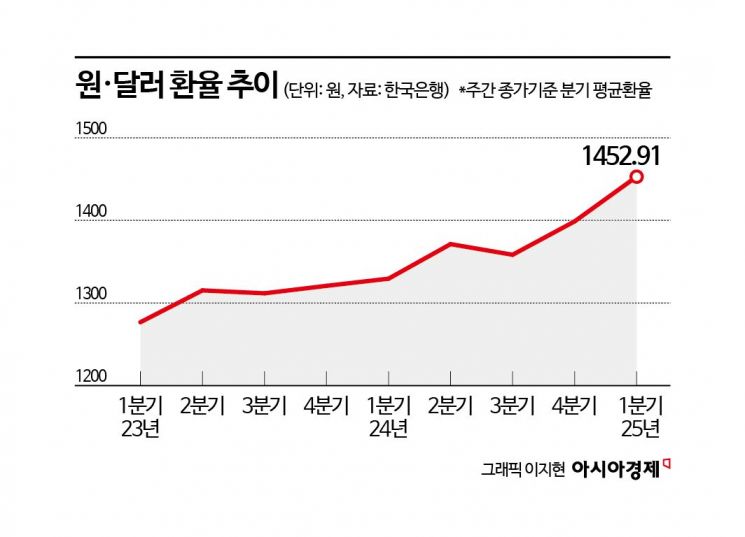

According to the Bank of Korea's Economic Statistics System (ECOS) on the 1st, the average weekly closing won-dollar exchange rate in the first quarter of this year was 1,452.91 won. This is the highest level since the first quarter of 1998 (1,596.88 won) during the financial crisis. Monthly figures also rose to 1,457.92 won in March, marking the highest level since March 1998 (1,488.87 won).

Since mid-February, despite a weakening outlook on 'American exceptionalism' and a weak dollar environment, the won-dollar exchange rate has shown little sign of decline. The dollar index, which reflects the value of the dollar against six major currencies, fell to around 104 points, but the won-dollar exchange rate instead rose above 1,470 won the previous day (1,472.9 won), reaching its highest level since March 13, 2009 (1,483.5 won).

The market expects the won-dollar exchange rate to threaten the 1,500 won level in the short term. This is due to anxiety over the imminent mutual tariff increases by the U.S. government and concerns about U.S. stagflation (economic slowdown accompanied by rising prices), which are expected to strengthen risk-averse sentiment.

External Factors Cause Anxiety: U.S. Tariff Aftershocks and Stagflation Concerns

Starting from the 2nd, reciprocal tariffs declared by U.S. President Donald Trump and a 25% tariff on automobiles are scheduled to be imposed. Overnight, the White House reaffirmed its position to announce country-specific reciprocal tariffs on the 2nd but did not disclose specific details such as the target countries. Moon Da-woon, a researcher at Korea Investment & Securities, noted, "Uncertainty will increase regarding whether tariffs will actually be imposed and the possibility of future negotiations."

Park Sang-hyun, a researcher at iM Securities, also said, "Whether the financial market perceives the reciprocal tariff announcement on the 2nd as a major negative factor or as a resolution of uncertainty will cause significant volatility in the exchange rate. Additionally, the speech by Jerome Powell, Chairman of the U.S. Federal Reserve, scheduled for the 4th, will be an important variable affecting the dollar's movement depending on how he assesses the economic impact of the reciprocal tariffs."

There is also heightened caution about whether the U.S. March employment report, to be released on the 4th, will reinforce stagflation concerns. Recently released U.S. inflation and sentiment indicators have all increased fears of stagflation. The U.S. core Personal Consumption Expenditures (PCE) price index for March rose 0.4% month-on-month, exceeding market expectations and last month's increase of 0.3%. The University of Michigan's final consumer sentiment index for March was 57.0, down from 64.7 the previous month, while the medium- to long-term inflation expectations surged to 4.1% from 3.5% the previous month.

Delay in Resolving Domestic Political Concerns, Increased Signals of Low Growth... Upward Pressure on Exchange Rate Expands

The Constitutional Court's impeachment trial verdict for President Yoon, expected in mid to late March, has been postponed to this month, leaving domestic political turmoil unresolved, which is also acting as upward pressure on the won-dollar exchange rate. Kwon Ah-min, a researcher at NH Investment & Securities, diagnosed, "The depreciation of the won is estimated to be about 3-4% larger compared to the real effective exchange rate and nominal effective exchange rate. Political uncertainty has continued for about three months, gradually increasing the explanatory power of domestic unique risks on the exchange rate."

Concerns over Korea's low growth, influenced by U.S. tariff policies, are factors that could structurally lower the won's value. The market is worried not only about the strength of economic recovery in the second half of the year but also about the growth trajectory beyond next year. The domestic stock market's weakness due to the resumption of short selling the previous day and foreign selling also had an impact. Additionally, in April, seasonal factors such as increased dollar demand due to foreign dividend remittances will further expand dollar demand.

Key to Resolving Domestic and International Uncertainties: "Level to Decline by End of Second Quarter"

However, for the entire second quarter, it is expected that as political instability is resolved and domestic economic recovery signals are observed, the won-dollar exchange rate is likely to decline toward the end of the quarter. In the medium to long term, it is forecasted that the exchange rate will gradually adjust to close the gap with other currencies amid a weak dollar environment.

Researcher Moon said, "The actual possibility of the U.S. entering a recession characterized by 'a substantial decline in economic activity across the economy lasting several months or more' is limited. If strong recession signs do not appear in real indicators or if the Fed does not cut the actual policy rate in the second quarter, the dollar index decline driven by sentiment will be partially reversed during the second quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)