Core Musical Instrument Business Faces Accelerating Profitability Decline

Energy Business Emerges as a 'Firefighter' for Performance

Samick Musical Instruments Draws a Line on 'Identity Controversy'

Samick Musical Instruments, a musical instrument manufacturer famous for 'Samick Piano,' is attracting attention as its 'district energy business,' promoted as a new growth engine, is showing solid results. While its core musical instrument business has turned to a loss, the district energy business supplying heating and cooling to the region has improved profitability, helping to defend the overall performance. Despite the shift in the company's revenue structure, Samick Musical Instruments appears to be making efforts not to let go of its main business.

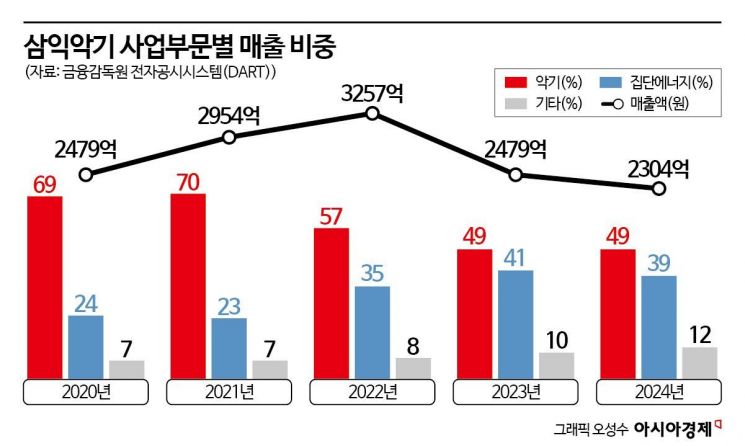

According to the Financial Supervisory Service's electronic disclosure system on the 1st, Samick Musical Instruments reported consolidated sales of 230.4 billion KRW and operating profit of 5.9 billion KRW last year, down 7.1% and 8.2% respectively from the previous year. Net profit also decreased by 7.9% to 3.1 billion KRW compared to the previous year.

Looking at the operating segments, the profitability of the district energy business stands out. Consolidated sales from the energy business last year were 89.3 billion KRW, down 11.5% from 100.9 billion KRW the previous year. However, operating profit surged 65.8% to 7.4 billion KRW, exceeding the total operating profit. In effect, the energy business drove the company's earnings.

Samick Musical Instruments supplies electricity and heating and cooling to the Suwan district in Gwangju through 'Suwan Energy,' acquired from Gyeongnam Enterprise in 2017. The electricity produced is sold to Korea Electric Power Corporation, and heat is supplied to a total of 89 sites, including 68 apartment complexes (40,902 households), commercial buildings, and public facilities. This business, entered in response to the downturn in the musical instrument market, now accounts for about 40% of Samick Musical Instruments' total sales and has become a major source of revenue. A company representative explained, "The number of supplied households was the same as in 2023, but the heating price increase in the second half of last year seems to have contributed to improved profitability."

On the other hand, the profitability of the core musical instrument business declined. Consolidated sales from the musical instrument business last year were 112.5 billion KRW, down 10.4 billion KRW from 122.9 billion KRW the previous year. Operating profit turned into a loss, shifting from 2.9 billion KRW profit to a 1.3 billion KRW loss. A Samick Musical Instruments representative explained, "The significant sales decline in the Chinese subsidiary was a major cause of the downturn in the musical instrument business performance."

Accordingly, Samick Musical Instruments plans to reduce costs to recover profitability in the musical instrument business. Since the musical instrument business itself is on a downward trend, they are exploring ways to reduce raw material purchases at the Indonesian production plant and gradually decrease existing inventory. However, they currently do not consider relocating production bases to other countries to reduce labor or other production costs. It is interpreted that they aim to improve profitability by enhancing internal efficiency while maintaining the existing production system for the time being.

Some interpret that if this revenue structure continues, a long-term redefinition of the company's identity will be inevitable. Samick Musical Instruments cautioned against overinterpretation. A company representative stated, "Just because the energy business proportion has increased does not mean we will withdraw from the musical instrument business or consider a business transition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)