Foreign Investors Continue Net Selling for Eight Consecutive Months Through March

Nearly 3 Trillion Won Sold on the 31st as Short Selling Resumes

KOSPI Falls Below 2,500 Amid Foreign Selling Pressure

Improvements in Exchange Rate and Corporate Earnings Needed for Foreign Demand Recovery

Foreign investors continued their net selling streak for eight consecutive months until last month. On the first day of the short-selling resumption, the 31st of last month, foreign investors dumped over 1 trillion won worth of stocks, dragging the KOSPI below the 2,500 level. While the return of foreign investors is necessary for the index recovery, surrounding conditions such as the exchange rate remain challenging.

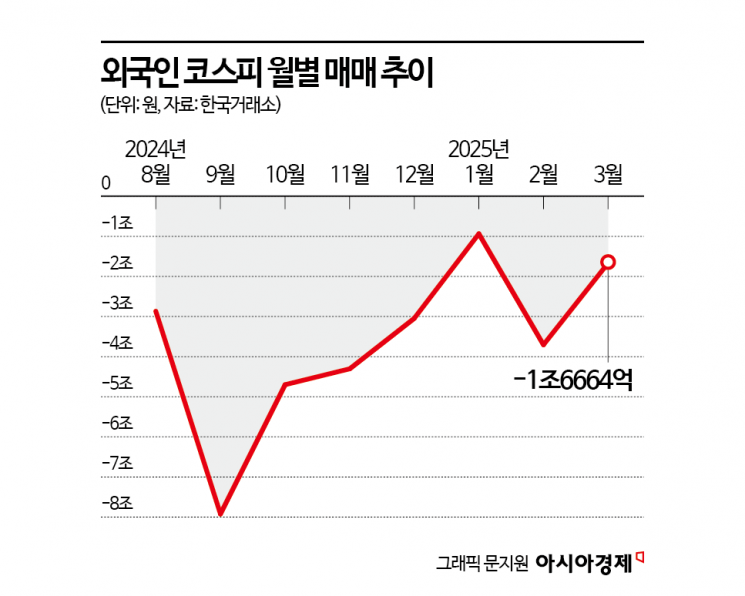

According to the Korea Exchange on the 1st, foreign investors sold a net 2.1635 trillion won in the domestic stock market last month. This marked eight consecutive months of net selling since August last year. By market, they net sold 1.6664 trillion won in the KOSPI market and 497 billion won in the KOSDAQ market.

Foreign investors recorded a net purchase of 386.5 billion won from the 1st to the 27th of last month, raising expectations that the continuous net selling streak would be broken. However, they sold stocks for two consecutive days on the 28th and 31st, ultimately continuing the net selling streak for eight months. Over the eight months, foreign investors sold a total of 29.729 trillion won in the domestic stock market.

In particular, on the 31st of last month, when short selling resumed, they sold nearly 3 trillion won including futures, driving the index down. On that day, the KOSPI and KOSDAQ each fell by 3%, with the KOSPI dropping below 2,500 and the KOSDAQ falling to the 670 level. Although individual and institutional investors net bought in both markets, it was insufficient against the flood of sell orders from foreign investors.

Lee Woong-chan, a researcher at iM Securities, said, "After rebounding in early January and settling at the 2,500 level, the Hang Seng rally in mid-February and semiconductor optimism in mid-March served as catalysts for two attempts to break through the 2,700 level, but they failed." He explained, "To break through 2,700, foreign demand must be strong enough to overcome domestic profit-taking selling pressure, making the breakthrough difficult. On the other hand, if the index falls below 2,500, domestic demand will support the market again."

Foreign demand is crucial for the index rebound, but unfavorable conditions such as the exchange rate persist. Kim Dae-jun, a researcher at Korea Investment & Securities, analyzed, "Foreign investors' movements are very important for the index outlook. Along with corporate earnings, the exchange rate is unfavorable for foreign investors. The won-dollar exchange rate has been on an upward trend since the fourth quarter of last year." The previous day, the won-dollar exchange rate closed at 1,472.9 won, up 6.4 won, marking the highest level in 16 years since the 2009 financial crisis.

However, there is also an analysis that this selling pressure from foreign investors is a temporary outflow of stocks. Lee Kyung-min, a researcher at Daishin Securities, said, "The foreign investors' selling of spot and futures at the end of March is considered temporary," adding, "After foreign investors bought 3.1 trillion won in spot and 2.7 trillion won in futures since the 17th of last month, this is a temporary outflow."

Although the net selling streak continued, signs of change appeared in foreign investors' supply and demand last month. While they had maintained a selling focus on semiconductors such as Samsung Electronics, the selling of semiconductors decreased last month. Researcher Lee Kyung-min analyzed, "Foreign selling had been concentrated on semiconductors, but this year, semiconductor selling has significantly decreased and turned into buying. Semiconductors had already priced in negative factors and concerns about the industry and earnings, but as semiconductor prices rebounded, a reversal appeared in foreign investors' supply and demand and sentiment."

He added, "As concerns about stagflation in the U.S. ease, the won-dollar exchange rate passes its peak, and improvements in the Chinese economy, Korean exports, and corporate profits are confirmed, foreign investors' supply and demand will also improve."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)