KOSDAQ Newcomers Plunge as Short Selling Resumes on the 31st

Thezen and Simple Platform Fall Below IPO Price

Concerns Rise Over Weakened Investor Sentiment for Pre-IPO Demand Forecasts

On the 31st, with the full resumption of short selling, newly listed companies in the KOSDAQ market experienced relatively large declines in their stock prices. Concerns are growing that this will also affect the public offering prices of companies preparing for listing.

According to the financial investment industry on the 1st, the KOSDAQ index fell 3.01% to 672.85 the previous day. The KOSDAQ, which closed at 678.19 at the end of last year, once rose to 781.54 during trading on February 20 but then dropped back to the 670 level. Although individuals recorded net purchases worth 3.127 trillion KRW in the KOSDAQ market, foreigners and institutional investors showed net selling dominance of 1.428 trillion KRW and 1.226 trillion KRW respectively, causing the index to return to the level of three months ago.

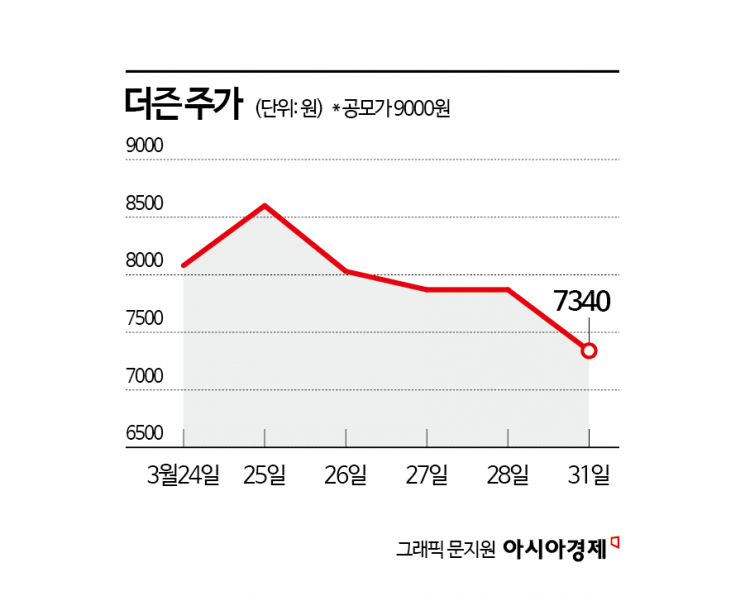

Along with the sharp drop in the KOSDAQ index the previous day, newly listed stocks also fell significantly. The newly listed company Thezen, which entered the KOSDAQ market on the 24th of last month, fell nearly 7%.

Founded in 2017, Thezen entered the enterprise financial value-added network (VAN) business in 2019 through dualization technology. Its sales grew from 6 billion KRW in 2020 to 42.1 billion KRW in 2023, achieving an average annual growth rate of 91.9%. During the same period, operating profit increased from 1.9 billion KRW to 10.7 billion KRW, recording an average annual growth rate of 77.9%.

Despite high growth potential, the stock price declined after listing. It dropped 18.4% compared to the public offering price of 9,000 KRW. During the demand forecast, institutional investor participation was low, leading to the public offering price being set at 9,000 KRW, lower than the expected range of 10,500 to 12,500 KRW. A representative from Korea Investment & Securities, which underwrote Thezen's listing, said, "Considering the subdued public offering market conditions, we decided on a market-friendly price."

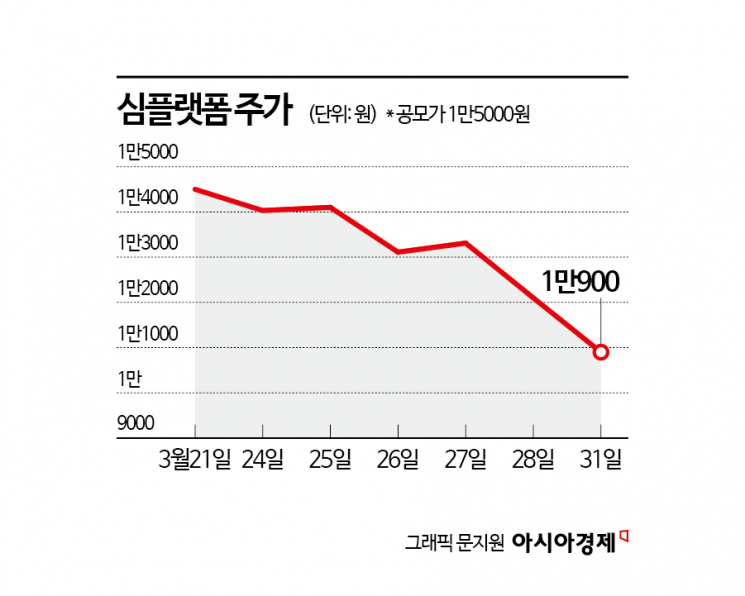

The stock price of Simple Platform, which was listed on the 21st of last month, is also continuing a weak trend. The stock price plunged nearly 10% the previous day, falling to 10,900 KRW. This is a 27.3% decrease compared to the public offering price of 15,000 KRW.

Founded in 2011, Simple Platform is a company that efficiently collects, analyzes, and utilizes industrial data based on AIoT technology, which combines artificial intelligence (AI) and the Internet of Things (IoT).

Among the newly listed companies that entered the KOSDAQ market last month, the stock prices of Wooyang HC, Hantech, MD Device, and SMCG also fell simultaneously the previous day. Only two newly listed companies, Daejin Advanced Materials and TXR Robotics, escaped the impact of the market plunge.

A financial investment industry official explained, "Newly listed companies that have been listed for less than a month can be seen as going through a process of finding their appropriate stock price," adding, "They can be vulnerable to external negative factors."

Since the resumption of short selling and tariff issues could negatively affect investor sentiment, the initial public offering (IPO) market is also expected to be impacted for the time being. Investors participating in demand forecasts and public offering subscriptions are likely to maintain a conservative stance. DS Investment & Securities researcher Yang Hae-jung said, "The timing of the resumption of short selling coinciding with tariff issues is creating a good reason to sell," and added, "The market direction will become clearer during the earnings season."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)