Corporate Tax Payment Reaches 2.5782 Trillion Won... Comparable to Hyundai Motor and SK Hynix

"Total Revenue Rises, Driven by Securities Trading Gains and Interest Income"

U.S. Dollar Assets Account for 71.9%... Up 1.0 Percentage Point

The Bank of Korea's net profit last year exceeded 7.8 trillion won. This marks an increase of more than 5.5 times compared to the previous year, which recorded around 1 trillion won, approaching the record-high net profit level achieved in 2021.

BOK's Net Profit Last Year 7.8189 Trillion Won... Total Revenue 26.5179 Trillion Won

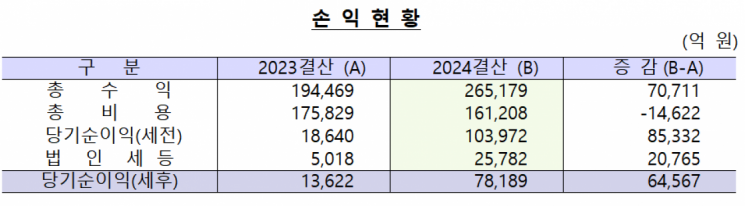

According to the '2024 Annual Report' released by the Bank of Korea on the 18th, last year's net profit was 7.8189 trillion won, a sharp increase of 6.4567 trillion won compared to the previous year (1.3622 trillion won). This is the second-largest amount in history.

The Bank of Korea recorded its highest-ever net profit (7.8638 trillion won) in 2021 due to the global stock market boom. However, from 2022, due to rising interest rates, interest on monetary stabilization bonds increased while bond prices and stock prices fell, shrinking the net profit to the 1 trillion won level in the previous year before rebounding this year to near the record high. A Bank of Korea official explained that the increase in last year's net profit was "due to an increase in total revenue centered on gains from securities trading and interest on securities."

Last year, the Bank of Korea's total revenue was 26.5179 trillion won, a sharp increase of 7.071 trillion won compared to 19.4469 trillion won the previous year. Meanwhile, total expenses decreased by 1.4622 trillion won from 17.5829 trillion won to 16.1208 trillion won.

Based on last year's performance, the Bank of Korea will pay 2.5782 trillion won in corporate tax this year, which is five times the amount paid last year (501.8 billion won). The amount of corporate tax paid this year ranks third, following Hyundai Motor and SK Hynix.

Of the net profit of 7.8189 trillion won last year, 30% (2.3457 trillion won) was allocated to statutory reserves. 241 billion won was allocated as discretionary reserves for the purpose of contributing to the Agricultural and Fishery Household Savings Encouragement Fund. The Bank of Korea plans to make contributions in five installments this year in accordance with the Act on Agricultural and Fishery Household Savings. The remaining 5.4491 trillion won was paid to the government as revenue. After the disposition of net profit, the balance of reserves, excluding discretionary reserves for fund contributions, stands at 22.8923 trillion won.

Among Foreign Currency Assets, Dollar Accounts for 71.9%... Cash Equivalents 8.0%, Up 0.7%p

Among the Bank of Korea's foreign currency assets (excluding International Monetary Fund positions, gold, and special drawing rights), the proportion of U.S. dollar assets stood at 71.9% at the end of last year. This is an increase of 1.0 percentage point compared to 70.9% at the end of 2023. The share of U.S. dollar assets expanded due to the strong U.S. dollar driven by a solid U.S. economic trend and political uncertainties in major countries. The share of other currencies was 28.1%, down 1.0 percentage point from 29.1% the previous year.

The Bank of Korea manages foreign currency assets by dividing them into cash equivalents and investment assets according to management purposes. Investment assets are further divided into direct investment assets and entrusted assets based on management methods. At the end of last year, cash equivalents accounted for 8.0%, direct investment assets 67.2%, and entrusted assets 24.9%. Cash equivalents increased by 0.7 percentage points compared to the previous year. Entrusted assets also rose by 0.6 percentage points, but the largest share, direct investment assets, decreased by 1.3 percentage points.

The composition by product was government bonds 47.3%, government agency bonds 10.1%, corporate bonds 10.4%, asset-backed securities 11.6%, and stocks 10.2%. A Bank of Korea official explained, "Given the high volatility in domestic and international financial markets, the management focused on liquidity and safety, leading to an increased share of government bonds."

As of the end of last year, the Bank of Korea's total assets amounted to 595.5204 trillion won, an increase of 59.1185 trillion won from 536.4019 trillion won at the end of 2023. This was largely due to the impact of exchange rate increases, which significantly raised the won-converted value of foreign currency assets. The balance of securities, including foreign currency securities, was 426.8516 trillion won, up 26.3196 trillion won compared to the previous year. Deposits and repurchase agreement securities balances were 46.033 trillion won and 19.55 trillion won, respectively, increasing by 10.337 trillion won and 6.55 trillion won from the previous year. Liabilities increased by 52.2531 trillion won to 567.1549 trillion won from 514.9018 trillion won the previous year, mainly due to a significant rise in foreign exchange valuation adjustments caused by exchange rate increases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)