Half of Korean Automobile Exports Go to the U.S.

Significant Impact on Upstream and Downstream Industries

Exports and Production Frontloaded in Q1 Before Tariffs

"Negative Impact Expected on Q2 GDP"

Automobiles Face the Greatest Impact Among Major Export Items

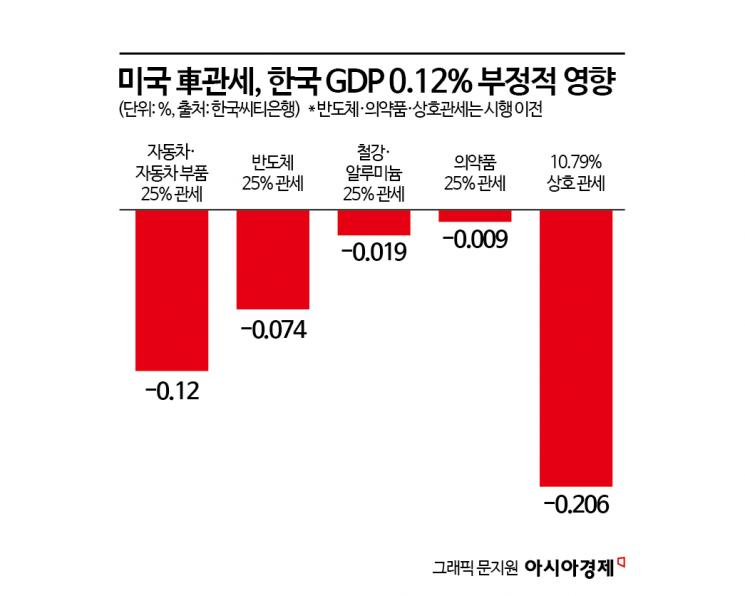

Mutual Tariffs to Have a -0.206% Effect

However, Room for Negotiation Remains

The U.S. Donald Trump administration has announced plans to impose a 25% tariff on imported automobiles, with analyses suggesting this will have a particularly negative impact on the South Korean economy. Given the significant share of automobiles in exports, it is expected to adversely affect the country's second-quarter gross domestic product (GDP) growth rate. However, there is also an opinion that negotiations between South Korea and the U.S. could take place if South Korea offers negotiation cards such as increased imports of U.S.-made liquefied natural gas (LNG) and expanded direct investment in the U.S.

On the 28th, economist Jinwook Kim of Citi stated this in a recently released report. Economist Kim analyzed that the U.S. automobile tariff will clearly affect South Korea. First, the U.S. is the largest export market for South Korea's automobile industry. As of last year, 49% of South Korean automobile exports and 36% of automobile parts exports were destined for the U.S., accounting for about 6.3% of total exports. Additionally, South Korea accounts for 17% of U.S. passenger car imports, making it the fourth-largest exporter of passenger cars to the U.S. Automobiles and automobile parts make up 14% of South Korea's total exports. Since the South Korean automobile industry is linked with various sectors such as steel, batteries, petrochemicals, and other electronics industries, the backward ripple effects are expected to be significant. If tariffs are imposed on automobiles, demand for Korean-made cars will decrease, and demand for raw materials needed to manufacture automobiles will also decline.

It was also analyzed that Korean automobile parts exported to Mexico and Canada would be negatively affected. Under the United States-Mexico-Canada Agreement (USMCA), automobile parts produced in Mexico and Canada have been considered equivalent to U.S.-made parts. Additionally, cars and parts made in Mexico, Canada, and South Korea have been exempt from tariffs under free trade agreements (FTA). However, the White House clarified that while tariffs on Canadian and Mexican parts covered by USMCA will be temporarily suspended, the U.S. Secretary of Commerce will establish related procedures to impose tariffs in the future.

Economist Kim predicted that these negative effects will be particularly evident in the second-quarter growth rate this year. He said, "In the first quarter, frontloading of exports and production likely occurred ahead of the U.S. tariff imposition," adding, "This is expected to increase downside risks to South Korea's GDP growth rate in the second quarter, and the reaction to frontloading will have an impact." He further analyzed, "Frontloading is a primary response for emerging Asian countries including South Korea, China, Taiwan, and Hong Kong, but if global demand slows and China continues to divert exports, there will be additional pressure on manufacturing in emerging countries such as South Korea."

Regarding the mutual tariffs scheduled for the 2nd of next month, it is also predicted that they will have a negative impact of about 0.206% on South Korea's GDP. He said, "The average tariff on U.S. imports is expected to rise from 10% to 15%, and South Korea's mutual tariff was assumed to be 10.79%," explaining this prediction. This estimate is based on last year's tariff South Korea imposed on the U.S. (0.79%) plus a 10% value-added tax. According to Citi data, the impact of tariffs on major export items on South Korea's GDP showed that automobile tariffs were the most negative at -0.12%, followed by semiconductors (-0.074%), steel and aluminum (-0.019%), and pharmaceuticals (-0.009%).

However, Economist Kim believes that there is still room for negotiation between South Korea and the U.S. He suggested, "To reduce tariff risks, South Korea can respond by expanding purchases of U.S.-made liquefied natural gas, oil, weapons, and aircraft," and added, "If Korean companies in the shipbuilding industry, as well as automobile, battery, and semiconductor sectors, increase direct investment in the U.S., they could become indispensable to the U.S.'s economic and geopolitical interests." He also mentioned that expanding the cost-sharing for the stationing of U.S. troops in South Korea could be another negotiation card. Hyundai Motor Company is a primary example of direct investment in the U.S. On the 24th, Hyundai announced plans to invest $21 billion (approximately 31 trillion won) in production facilities in the U.S. from this year through 2028. Currently, 40% of Kia vehicles sold in the U.S. are produced locally, 45% are exported from South Korea, and 15% are exported from Mexico.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)