Danggeun Direct Transactions Surge 220 Times in 3 Years

Brokerage Offices Continue to Decline for Two Consecutive Years

Experts: "Differentiation Is the Key to Survival for Brokerages"

The expansion of the real estate direct transaction service on the secondhand trading platform 'Danggeun' is bringing changes to the traditional neighborhood real estate market. With the addition of platform-based direct transaction services like 'Danggeun Real Estate', the position of traditional brokerage businesses is narrowing even further, analysts say.

According to Danggeun on the 28th, the real estate direct transaction service 'Danggeun Real Estate' has been operating since March 2021 after undergoing significant enhancements. This service started when residential listings frequently appeared on the secondhand trading board in the early days of the Danggeun service, leading to the creation of a separate category in November 2015. Since then, features such as property search, connecting with brokers, and moving-in report guides have been added to improve user convenience. Recently, marketing efforts have been strengthened by expanding user touchpoints through collaborations with YouTube creators.

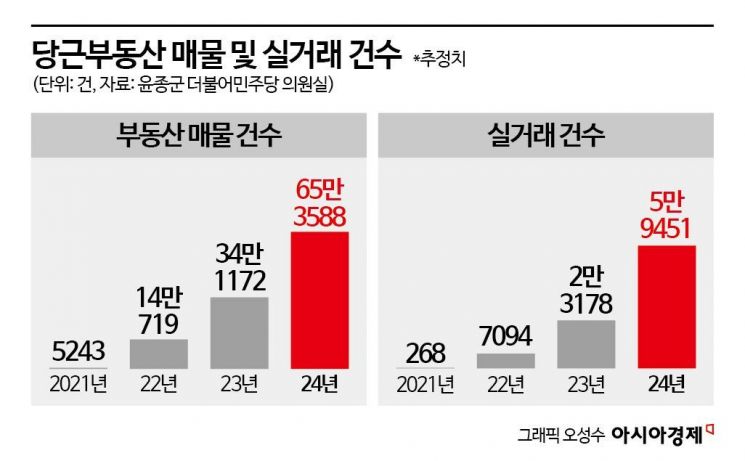

As the service has established itself, transactions have rapidly increased. According to data submitted by Danggeun to Yoon Jong-gun, a member of the National Assembly Land, Infrastructure and Transport Committee from the Democratic Party, the number of real estate listings on the Danggeun application (app) was ▲5,243 in 2021 ▲140,719 in 2022 ▲341,172 in 2023, and rose to 653,588 last year. This represents a 124-fold increase over three years. During the same period, the number of actual transactions soared more than 220 times, from ▲268 in 2021 ▲7,094 in 2022 ▲23,178 in 2023 to 59,451 last year.

This is due to Danggeun's 'platform power.' Currently, Danggeun has approximately 43 million cumulative users, becoming a lifestyle service frequently accessed in daily life, with weekly visitors approaching 14 million. Based on this, Danggeun Market recorded sales of 189.1 billion KRW last year, a 48% increase compared to the previous year. Operating profit reached 37.6 billion KRW, increasing 3.8 times year-on-year, marking two consecutive years of profitability and showing rapid growth.

The spread of direct transactions is driven by the burden of brokerage fees. Under current law, brokerage fee rates for housing sales are ▲0.4% for 200 million to less than 900 million KRW ▲0.5% for 900 million to 1.2 billion KRW ▲0.6% for 1.2 billion to less than 1.5 billion KRW ▲0.7% for 1.5 billion KRW or more. For example, if a 1 billion KRW apartment is sold, the brokerage fee excluding VAT amounts to 5 million KRW. Licensed brokers earn a total of 10 million KRW, receiving 5 million KRW each from the seller and buyer. Demand seeking to avoid this burden is shifting toward platform-based direct transactions.

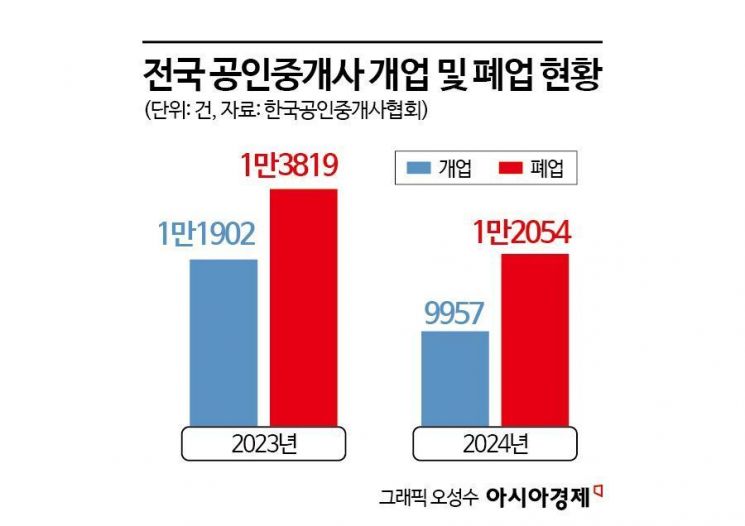

Moreover, the brokerage industry is in a slump due to economic recession and real estate stagnation. According to the Korea Association of Realtors, last year in Seoul, closures and suspensions of brokerage offices (2,948 cases) exceeded openings (2,437 cases). Nationwide, since August 2022, closures have outpaced openings. In 2023, there were 13,819 closures and 11,902 openings nationwide, and last year, 12,054 closures and 9,957 openings, marking a continuous decline for two years. Additionally, the number of applicants for the 35th licensed real estate agent exam held in October last year was 154,699, the lowest in eight years since 2016.

However, experts point out that it is unreasonable to interpret the industry's crisis as caused solely by platforms. Various factors are at play. Professor Kim Min-jung of the Department of Consumer Economics at Sookmyung Women's University said, "It is difficult to see Danggeun Real Estate as the 'main culprit' of brokerage office closures," but added, "It is clear that it acts as one of the factors narrowing the position of traditional brokerage businesses, intertwined with the real estate market slump, changes in consumer transaction methods, the increase in single-person households, and the development of online platforms. With the preference for online direct transactions centered on the MZ generation (Millennials + Generation Z) and the increase in single-person households, the role of brokerage offices in the one-room and monthly rent market is likely to shrink, and brokerage offices need to seek differentiated service strategies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)