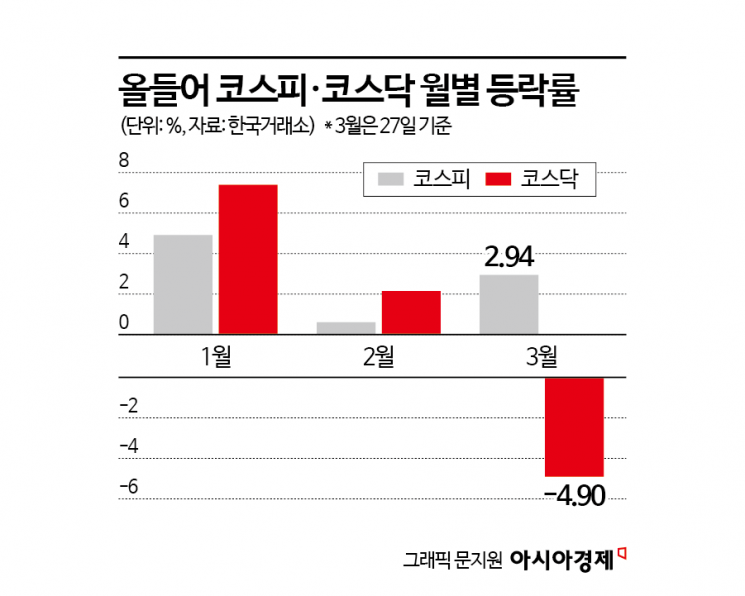

KOSPI Rises Nearly 3% This Month, While KOSDAQ Falls Over 4%

Foreign and Institutional Buying Concentrated in KOSPI

Short Selling Creates Favorable Environment for Large-Cap Stocks

Since the beginning of this year, KOSDAQ had shown superiority over KOSPI, but it has been underperforming this month. While KOSPI has risen nearly 3% this month, KOSDAQ has fallen by almost 5%, widening the performance gap. This is attributed to the influx of buying by foreigners and institutions into the KOSPI market ahead of the resumption of short selling.

According to the Korea Exchange on the 28th, KOSPI rose 2.94% through yesterday of this month. In contrast, KOSDAQ declined by 4.90%.

In January and February, KOSDAQ's returns outperformed KOSPI, but the trend reversed this month.

This reversal is believed to be due to supply and demand factors. The buying momentum of foreigners and institutional investors concentrated in the KOSPI market reversed the returns. This month, foreigners net purchased 552.8 billion KRW in the KOSPI market. Institutions bought 972.3 billion KRW. Conversely, in the same period, foreigners net sold 166.3 billion KRW and institutions net sold 505.8 billion KRW in the KOSDAQ market.

Foreigners and institutions focused their net purchases on large-cap KOSPI stocks. Foreigners have net purchased Samsung Electronics the most this month, with 1.7883 trillion KRW, followed by Hanwha Aerospace (435.5 billion KRW), SK Hynix (375.5 billion KRW), and Hyundai Motor (322.2 billion KRW). Institutions bought SK Hynix (458.2 billion KRW) the most, followed by KB Financial Group (164.6 billion KRW), Kia (150.1 billion KRW), and Hanwha Vision (115.3 billion KRW). On the other hand, the top net sold stocks included KOSDAQ's large-cap stocks. Institutions net sold Alteogen (108.5 billion KRW), JYP Entertainment (89.8 billion KRW), and Rainbow Robotics (84.4 billion KRW). Foreigners also sold Alteogen (117.5 billion KRW) and JYP Entertainment (88.2 billion KRW).

In particular, there is an analysis that the environment is more favorable for large-cap stocks due to the resumption of short selling at the end of this month. Yu Myung-gan, a researcher at Mirae Asset Securities, said, "Ahead of the resumption of short selling on the 31st, foreign net buying continues, and in past cases of short selling resumption, stock prices and foreign demand tended to synchronize with the macroeconomic environment or corporate earnings at the time." He added, "Considering corporate earnings and exchange rate levels in the first half of this year, foreign demand is expected to remain favorable even after the resumption of short selling. Large-cap stocks, which are sensitive to foreign demand and have attractive valuations, are in a favorable environment."

Lee Seong-hoon, a researcher at Kiwoom Securities, analyzed, "On average, in the one month after the resumption of short selling, KOSPI (2.2%) recorded better returns compared to KOSDAQ (-0.9%). KOSDAQ has relatively higher valuation burdens compared to the KOSPI market and a high proportion of bio and secondary battery stocks that could be targets of short selling, so it recorded poor returns in the short term." He added, "This suggests that fundamentally sound large-cap stocks may show relative superiority after the resumption of short selling."

The performance of the top market cap stocks in both markets also influenced the indices. KOSPI's leading stock Samsung Electronics rose 13.39% this month, while KOSDAQ's leading stock Alteogen fell 9.04%. Kang Jin-hyuk, a researcher at Shinhan Investment Corp., explained, "Last week, the domestic market's performance diverged due to the mixed movements of leading stocks. Foreign demand flowed into the semiconductor sector due to memory price rebounds, and Samsung Electronics returned to 60,000 KRW for the first time in five months. Meanwhile, Alteogen surged on news of a license agreement for ALT-B4 with AstraZeneca's subsidiary but gave up all gains due to profit-taking and absorption of demand by semiconductors." Additionally, SK Hynix rose 8.83%, LG Energy Solution increased 1.28%, but Ecopro BM fell 9.08%, and Ecopro declined 6.43%. Notably, HLB, ranked 4th in KOSDAQ market cap, dragged down the index by falling 34.38% due to the failure of U.S. approval for its liver cancer drug.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.