Robo-advisor (RA) services that automatically manage retirement pensions are set to be fully implemented.

On the 27th, the Financial Services Commission announced the launch of the 'Retirement Pension Robo-advisor Discretionary Service,' which automatically manages retirement pensions using robo-advisors.

The first provider of this service is Hana Bank in partnership with Fount Investment Advisory. The retirement pension RA discretionary service will begin on the 28th. Following this, six RA discretionary service providers, including Mirae Asset Global Investments, Korea Investment Trust Management, Mirae Asset Securities, and NH Investment & Securities, will launch their services next month.

Last December, the Financial Services Commission designated the retirement pension robo-advisor discretionary service, applied for by 17 investment discretionary service providers, as an innovative financial service to improve the returns on retirement pensions, which had been concentrated in principal-guaranteed products.

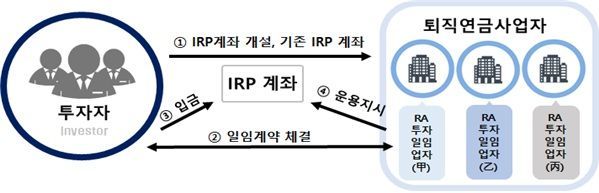

The retirement pension robo-advisor discretionary service automatically creates customized portfolios based on verified algorithms tailored to the investor's profile. It is a service that directs the management of funds in individual retirement pension (IRP) accounts.

Previously, IRP subscribers had to directly instruct the management of their funds. However, with the implementation of the discretionary service, robo-advisors will manage the funds on behalf of the subscribers.

Each retirement pension provider partners with different investment discretionary service providers, and a single retirement pension provider may collaborate with multiple discretionary service providers to launch robo-advisor discretionary services. Therefore, subscribers can choose robo-advisor services that match their investment preferences and objectives. Additionally, subscriptions can be made through the IRP accounts of the retirement pension providers. Only one account per financial company is allowed.

The subscription limit is 9 million KRW per IRP account annually, with an increase of 9 million KRW each year. Any unused limit from a year without a discretionary contract can be carried over to the following year.

When entering discretionary contracts with multiple discretionary service providers affiliated with retirement pension providers and IRP accounts, the combined amount managed by multiple robo-advisor discretionary services must not exceed the subscription limit. Also, within a single IRP account, subscribers can mix direct management and robo-advisor discretionary management.

The Financial Services Commission stated, "With the launch of the retirement pension robo-advisor service, subscribers will be able to access professional asset management services at reasonable costs, enhancing user convenience. In the long term, it is expected that the expansion of performance-based product investments by IRP subscribers will improve retirement pension returns and contribute to securing workers' retirement income."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)