Bank of Korea Releases Financial Stability Report

Real Estate Loan Balance Reaches 2,682 Trillion Won... Growth Slows

Mortgage and Jeonse Guarantee Loans Still Rising... Potential Risks Remain

The growth rate of real estate-related loans is slowing down. The growth rate decreased by 0.7 percentage points over one year, and the increase has been shrinking for four consecutive years. The ratio compared to the gross domestic product (GDP) also declined for the first time since statistics began in 2020.

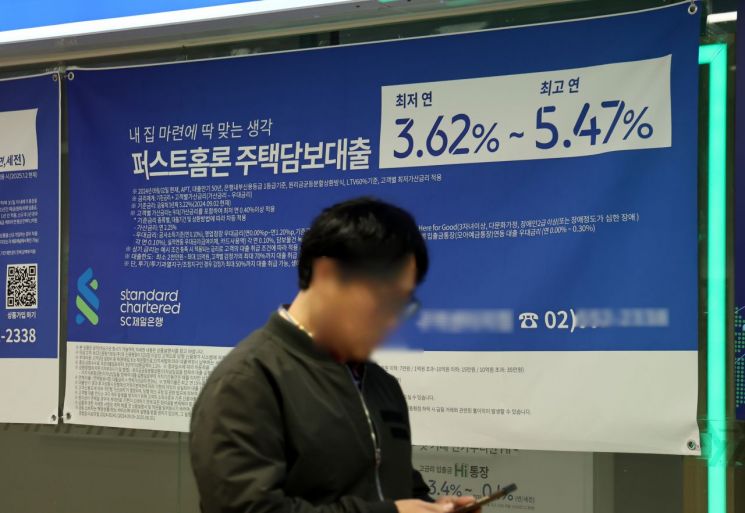

However, the growth rate of household mortgage loans and jeonse (key money deposit) guarantees continues to rise independently. The Bank of Korea warned that with the easing of financial conditions such as banks lowering interest rates, close monitoring is necessary to prevent a renewed concentration of finance into real estate.

According to the Financial Stability Report released by the Bank of Korea on the 27th, the outstanding balance of real estate-related loans was recorded at 2,681.6 trillion won last year. This amount includes household real estate loans, real estate-secured loans of general corporations, loans to real estate and construction sector companies, and real estate project financing (PF) loans.

The outstanding balance of real estate-related loans was 2,681.6 trillion won last year. It increased by 122 trillion won over one year, a 4.8% rise. The growth rate surged to 11.2% in 2021 but slowed to 7% in 2022 and 5.5% in 2023.

By sector, household real estate loans stood at 1,309.5 trillion won at the end of last year, up 3.6% from the previous year-end. Non-residential secured loans such as commercial real estate continued to decline due to worsening market conditions like rising vacancy rates in commercial buildings, but mortgage loans increased to 1,124 trillion won compared to the previous year-end.

Real estate-secured loans of general corporations amounted to 694.2 trillion won. The growth rate was 11.3%, maintaining a strong upward trend mainly in non-residential secured loans, though slightly lower than the 13.1% growth rate in 2023. Loans to real estate and construction sector companies totaled 623.3 trillion won, with the growth rate shrinking from 4.4% to 1.8%. In particular, the construction sector saw a decrease in outstanding balance compared to the end of 2023 due to strengthened risk management by financial institutions.

Real estate PF loans were 187.3 trillion won, showing an 11.8% decline from the previous year-end. Most sectors, including mutual finance, banks, insurance companies, credit finance companies, and savings banks, also saw decreases. The ratio to GDP was 105.2%, still high but down from 106.6% the previous year. This is the first decline since statistics began in 2020.

Real estate-related guarantees amounted to 1,064.1 trillion won, increasing by 4.8% year-on-year. While the growth rate of business guarantees remained low, the increase in personal guarantees related to jeonse guarantees caused a slight rise in the overall growth rate. The growth rate of real estate-related investment products (375.9 trillion won) sharply slowed from 11% at the end of 2023 to 3.7% last year.

A Bank of Korea official noted, "Domestic real estate finance exposure is showing signs of slowing growth, with the ratio to GDP declining due to restructuring of non-performing real estate PF and strengthened risk management by financial institutions in the real estate sector," but added, "Some areas, such as the increase in mortgage loans, still show potential risk accumulation." The official also pointed out, "Since the easing of financial conditions could stimulate preference for real estate, caution is needed to prevent a concentration of finance into the real estate sector."

The Bank of Korea official further stated, "If real estate finance expands excessively, there is a high possibility that financial instability could spread during an economic downturn, and concentration of funds in low-productivity sectors could hinder economic growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)