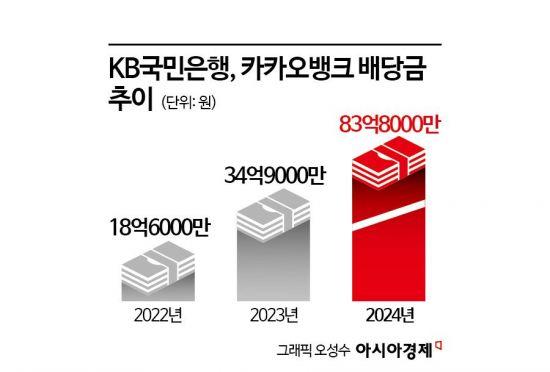

KB Kookmin Receives Dividends for Three Consecutive Years... 8.4 Billion KRW Last Year

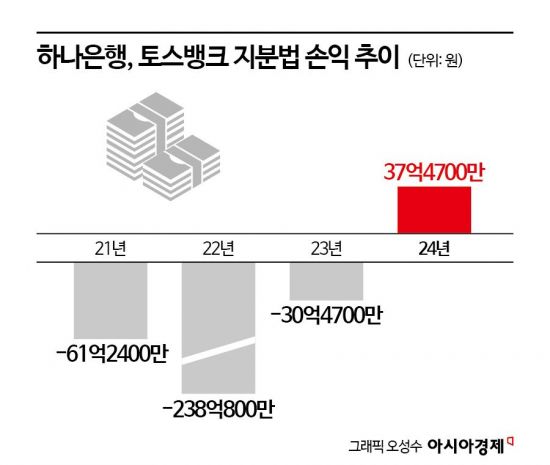

Hana Bank Records First Equity-Method Profit This Year Thanks to Toss Bank's Growth

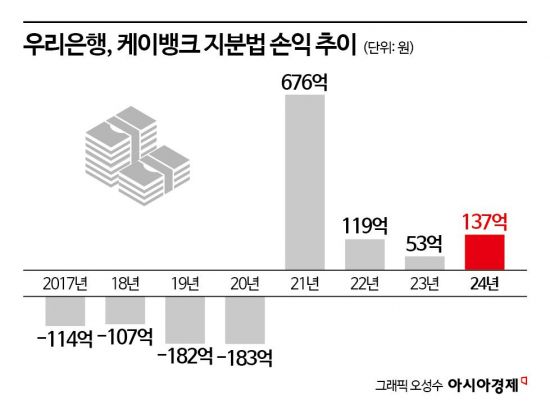

Woori Bank Also Achieves Equity-Method Profit for Four Consecutive Years

As the launch of the country's fourth internet-only bank (InBank) approaches, attention is turning to the performance records of commercial banks that previously invested in InBanks. Hana Bank and Woori Bank have positively impacted their net income as equity-method profits from InBank growth were reflected as gains. KB Kookmin Bank, after realizing substantial profits from selling its shares, has been receiving dividends for three consecutive years, generating ongoing income.

According to the financial sector on the 27th, KB Kookmin Bank received a total dividend of 8.38 billion KRW following the approval of the financial statements agenda, including a settlement dividend of 360 KRW per share, at the Kakao Bank shareholders' meeting held the previous day. The dividend payment is expected to be deposited within one month.

Kookmin Bank has been receiving dividends for three consecutive years since 2022. As the share price increased, the dividend amount also grew. It rose from 1.86 billion KRW in 2022 to 3.49 billion KRW in 2023, and then nearly 2.5 times to 8.38 billion KRW last year. Over three years, dividend income has totaled 13.73 billion KRW.

KB Kookmin Bank has effectively recovered its investment. It invested 230 billion KRW in 2016 to acquire an 8.02% stake in Kakao Bank and later sold 3.14% of its shares for 425 billion KRW in August 2022. However, its current stake has decreased to 4.88%, making it difficult to expect intangible benefits such as management participation. KB Kookmin Bank classifies its Kakao Bank investment as 'available-for-sale securities' and does not reflect it in equity-method profits or losses.

Hana Bank, which invested in Toss Bank, recorded its first equity-method profit last year. This was thanks to Toss Bank posting its first annual profit four years after its launch in 2021. Hana Bank is a major shareholder holding an 8.96% stake in Toss Bank. Toss Bank reported a net income of 43.268 billion KRW last year, of which Hana Bank recognized 3.747 billion KRW as equity-method profit.

Equity-method profit is linked to net income. Although it does not secure cash, it affects net income as non-operating income. It is also an indicator to gauge the performance of equity investments. Hana Bank had not shown financial gains for three years after investing in Toss Bank. It recorded a loss of 6.124 billion KRW in 2021 and an expanded loss of 23.8 billion KRW in 2022. However, from the second half of 2023, Toss Bank began posting quarterly profits, reducing the loss to 3 billion KRW, signaling a turnaround.

Woori Bank, which invested in K Bank, the country's first internet-only bank, has recorded equity-method profits since 2021. Last year, it posted 13.747 billion KRW, the largest amount since 67.6 billion KRW in 2021. However, it endured hardships, recording losses in the hundreds of billions until turning profitable five years after K Bank's launch. Despite holding an 11.96% stake as the second-largest shareholder, it has not received dividends for eight years.

However, it is the only commercial bank owning more than 10% of shares in an InBank and participates in management. Being the longest-standing investor and having a policy-driven rather than purely investment purpose, it is regarded as experiencing the InBank ecosystem most closely. As K Bank accelerates its initial public offering (IPO), the recovery of investment funds is also anticipated.

A financial industry insider said, "Although investment returns from InBanks do not significantly impact bank earnings, the situation has evolved from a strategic investment approach to one where profits can also be expected. The reasons why not only commercial banks but also regional banks and other financial institutions are rushing to participate in the four InBanks are not much different."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)