Top 10 Investments Concentrated in M7 and S&P 500 Index-Tracking ETFs

Individual Investors Allocate $45.4 Billion to These Stocks, Making Up 43.2% of Total

Focus on Leveraged Investments... Tendency Toward Excessive Risk-Taking

"Losses Exceed Resident Average and Index Returns During Market Downturns"

The Bank of Korea advised Seohak Gaemi (individual investors investing in overseas stocks such as those in the United States) to "reduce concentration in certain U.S. stocks and increase investments in other domestic and international stocks to diversify risk." This comes amid growing concerns about volatility in the U.S. stock market due to policy uncertainties under the second Trump administration, while Seohak Gaemi continue to heavily invest in well-known stocks such as 'M7 (Apple, Microsoft (MS), Nvidia, Amazon, Google (Alphabet), Meta, Tesla)' and high-risk products like leveraged exchange-traded funds (ETFs). Even during the U.S. stock market downturn caused by the 2022 shift in U.S. monetary policy, individual investors are estimated to have suffered greater losses than the S&P 500 index.

On the 26th, the Bank of Korea emphasized this in a blog post titled "Seohak Gaemi, Now Is the Time for Diversified Investment" on its website. According to the International Investment Position (IIP), at the end of 2019, the stock investment balance of individual investors was $15.2 billion, accounting for only 4.4% of the total overseas stock investment balance of residents including institutions. However, by the end of last year, it had increased about eightfold to $116.1 billion, expanding its share to 15.6%. During the same period, the investment balances of financial institutions?including general government such as the National Pension Service, banks, insurance companies, and asset management firms?approximately doubled.

The proportion of U.S. stock investment balances among all residents increased from 47.0% at the end of 2019 to 63.1% at the end of 2023. However, according to data from the Korea Securities Depository (SEIBro) on foreign securities custody, the share in individual investors' portfolios rose significantly from 58.2% to 88.5% during the same period, far exceeding the overall average. This trend deepened even further after 2023, reaching 90.4% as of the 18th.

Individual investors still tend to invest heavily in specific stocks. In particular, certain U.S.-listed stocks dominate the top ranks in investment balances. According to the Korea Securities Depository, the investment balance of the top 50 stocks was $71.7 billion as of the 18th, showing a ratio of about 7 to 3 compared to the remaining stocks' balance of $33.5 billion. Among the top 50 stocks, the proportion of U.S.-listed stocks increased from 57.0% at the end of 2019 to 96.5% as of the 18th.

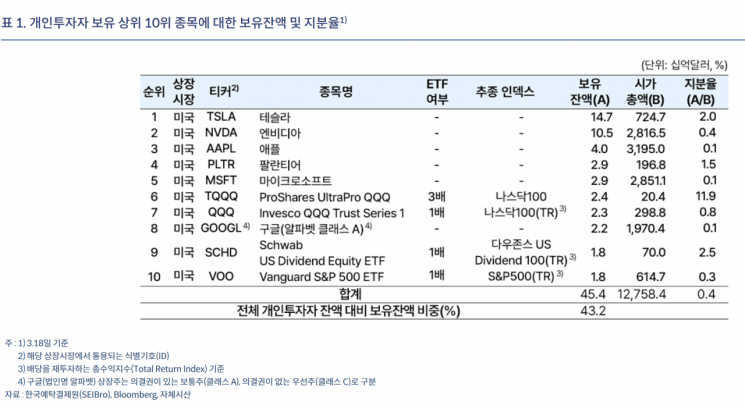

Examining the top 10 investment stocks reveals that most are M7 stocks and general or leveraged ETFs tracking indices such as the Nasdaq 100 and S&P 500. As of the 18th, individual investors' investment balance in these stocks was $45.4 billion, accounting for 43.2% of the total investment amount.

Compared to investors from other countries, individual investors also exhibit a tendency to pursue excessive risk, focusing on leveraged investments. Leveraged ETFs like TQQQ and inverse ETFs are among the seven stocks included in the top 50 investment stocks. Leveraged ETFs aim to track the returns of their underlying indices at two times or more, while inverse ETFs track the inverse multiple. These products have high return volatility and are mainly held by investors seeking short-term gains through risk-taking.

However, the share of individual investors in some of these stocks exceeds 40%. They also invest in stocks that track the returns of individual stocks such as Tesla and Nvidia rather than indices, confirming that Korean investors exhibit a higher risk-seeking tendency compared to investors from other countries.

Concentration in specific stocks and risk-seeking investment behavior make investors vulnerable to volatility. While this has driven positive investment performance when the U.S. stock market was strong, it also caused losses greater than the resident average and index returns during downturns. The evaluation gains and losses of individual investors in 2021 and 2022 illustrate this well. In 2021, the U.S. stock market benefited from abundant liquidity due to zero interest rate and quantitative easing policies continuing from the first half of 2020, as well as a surge in demand for durable goods, IT devices, and services triggered by COVID-19, leading to significant improvements in corporate earnings and sharp stock price increases across many stocks. Individual investors' returns were 24.1%, slightly below the annual return of the S&P 500 index but nearly double the average return of all residents.

However, the situation changed drastically in 2022. As inflation intensified, the U.S. Federal Reserve (Fed) sharply raised policy rates and shifted from quantitative easing to quantitative tightening, delivering a significant shock to the market, causing the S&P 500 index to fall by 19.4%. During this period, individual investors increased their holdings of M7 stocks to a peak, but the annual returns of these stocks ranged from -65% to -17%, mostly falling more than the index. Tesla, which had maintained the top rank in holdings since the second half of 2020, recorded the largest drop with a -65% return. As a result, individual investors suffered losses in 2022 that were nearly double those of the overall resident average and the index decline, the opposite of 2021.

With negative outlooks emerging for the U.S. stock market, there is an analysis that preparation for increased volatility is necessary. Despite recent market weakness, individual investors continued to buy undervalued overseas stocks, mainly U.S. stocks. They made net investments of $4.5 billion during the price declines. Of this, they purchased $4.0 billion worth of U.S.-listed stocks, including $0.8 billion in M7 stocks and $1.6 billion in major leveraged ETFs.

Negative forecasts for the U.S. stock market continue. Morgan Stanley expects the S&P 500 index to fall to 5500 in the first half of this year due to tariff policy risks and lower-than-expected government budget execution. Goldman Sachs projects that the S&P 500 total return index will yield an average annual return of about 3%, lower than bond yields, over the next decade.

In a situation of increasing uncertainty, recovering losses requires accumulating a certain level of returns over a long period. For example, after suffering an annual evaluation loss of -40% in the stock market similar to 2022, if one chooses to invest in a relatively stable S&P 500 index-tracking ETF instead of individual stocks, it would take at least 8.6 years to recover the principal. This calculation assumes that the ETF's returns remain stable at or above the average annual return during the holding period.

However, risks always exist in reality. Lee Jaemin, head of the Overseas Investment Analysis Team at the Bank of Korea's International Department, said, "To minimize losses and steadily accumulate stable investment profits, it is necessary to reduce excessive concentration in certain stocks such as M7 and leveraged ETFs and to diversify investments across other domestic and international stocks to spread risk."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.