Safeguard Revision Takes Effect

Duty-Free Export Volume to Drop by Up to 14%

Hot-Rolled Coil Quota Expected to Suffer Most

Double Blow After U.S. Tariffs

Industry Struggles to Prepare Countermeasures

Ilganseon: "Impact May Be Minimal"

The European Union (EU) has raised an alarm in the domestic steel industry as it strengthens the 'safeguard' measures to limit steel imports starting from the 1st of next month. This is expected to be another blow amid internal and external difficulties caused by U.S. tariffs and the influx of low-priced Chinese imports.

According to the related industry on the 26th, with the enactment of the revised EU safeguard measures, which include quota reductions and the abolition of rollover for unused volumes, the amount of Korean steel that can be exported to the EU duty-free will decrease by up to 14% starting next month. In particular, the hot-rolled coil quota, which has the largest export volume, is expected to be reduced the most significantly. Originally, the Korean hot-rolled coil quota for the period from April 1 to June 30 was 186,358 tons, but after the revision, only 161,144 tons, about 14% less, can be exported duty-free.

With the EU specifying concrete quota reductions, the domestic steel industry faces compounded difficulties. Domestic steelmakers are already in a situation of virtually unlimited competition in the U.S. steel export market after the quotas granted during U.S. President Donald Trump's first term were abolished. Trade barriers are rising worldwide, but defending the domestic market is not easy. Low-priced imported steel products are flooding the domestic market indiscriminately, threatening the profitability of domestic steelmakers.

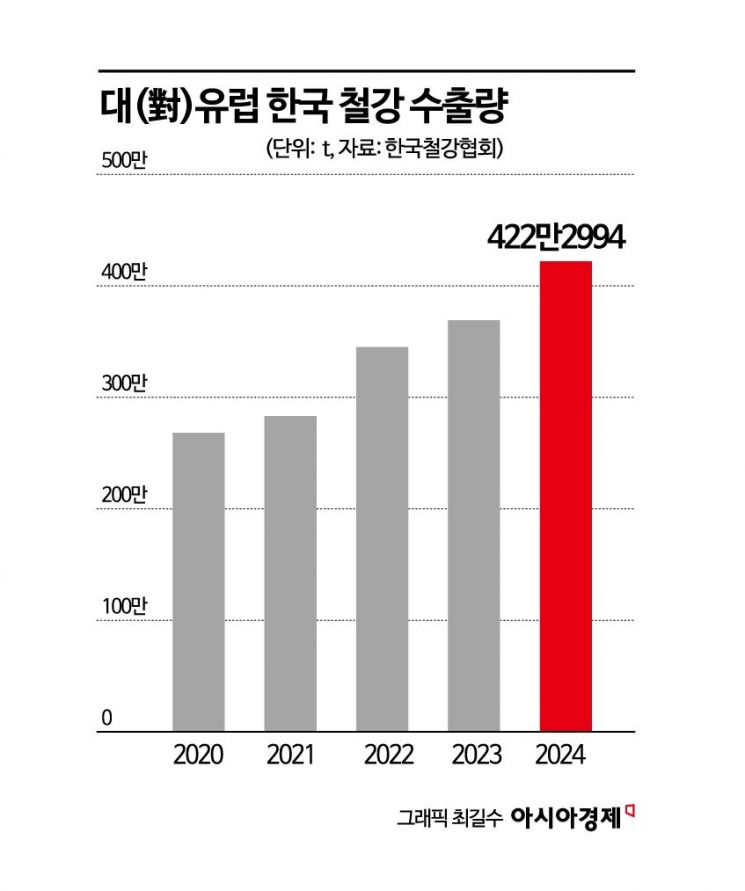

Europe is especially the largest export market for domestic companies. According to the Korea Iron & Steel Association, last year, 4,222,994 tons of steel were exported to Europe (including the UK), accounting for 14.89% of the total steel exports (28,350,411 tons). Considering the European economic zone rather than individual countries, the EU was the number one market for Korea in terms of both steel weight and export value.

The industry has begun to prepare countermeasures. An industry official said, "With the strengthening of safeguard measures, expanding exports has become difficult," adding, "We plan to respond by monitoring market conditions and focusing on high-profit products such as automotive steel sheets."

The Korea Iron & Steel Association reportedly analyzed the results of the EU Commission's notification to the World Trade Organization (WTO) earlier this month regarding the effectiveness review of steel safeguards and communicated them to member companies. At that time, steelmakers recognized quota reductions for some products such as hot-rolled coils and began preparing responses.

POSCO, the country's top steelmaker, recently established a Global Trade Policy Team directly under Chairman Jang In-hwa. Externally, the Global Trade Policy Team was created to strengthen the group's trade control tower function in preparation for the impact of the U.S.-originated tariff war, but it is also known that the EU's strengthened safeguard measures significantly influenced the establishment of this team. A POSCO official said, "The Global Trade Policy Team plans to actively respond to global trade issues, including the EU safeguard strengthening measures."

However, some in the industry argue that the impact of the EU's strengthened safeguard measures is not at a level to be overly concerned about. There is an interpretation that this is a form of reclaiming surplus volumes that had gone to the EU due to the Russia-Ukraine war. Another industry official said, "The volumes that could not go to Russia, which faced international sanctions after invading Ukraine, went to the EU," adding, "From the EU's perspective, import volumes increased, and this measure is to revert that to the previous state."

The EU is highly concerned that third-country products trying to avoid the U.S.'s high tariffs could flood into the EU market. Regarding this, Stefan Sejurne, the EU's Executive Vice President for Prosperity and Industrial Strategy, recently explained the plan to strengthen safeguards, stating that the goal is to reduce import volumes by up to 15%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)