The First Among the Three Major Telecom Companies to Make Core Investments

Profitability Declines Amid Competition from OTT Platforms

Divestment of Shares in Bread Barber Shop and Other Companies Continues

The LG Uplus's dedicated platform for infants and children, 'U+ Idle Nara,' which had surpassed 40 million cumulative users, remained in the early 4,000s for daily active users as of early last year. Photo by LG Uplus

The LG Uplus's dedicated platform for infants and children, 'U+ Idle Nara,' which had surpassed 40 million cumulative users, remained in the early 4,000s for daily active users as of early last year. Photo by LG Uplus

The kids content business, once considered a core project under former LG Uplus CEO Hwang Hyun-sik, has now become a target for divestment. According to last year's business report released on the 26th, LG Uplus is withdrawing from investments worth tens of billions of won made in 2022 and 2023 in animation and edutech companies to be integrated into its proprietary platform ‘U+ Idle Nara’. The cause is declining profitability as accessibility to free platforms like YouTube Kids has increased, and the emergence of major OTT (over-the-top) services such as Netflix and Disney Plus has narrowed its market space compared to the past.

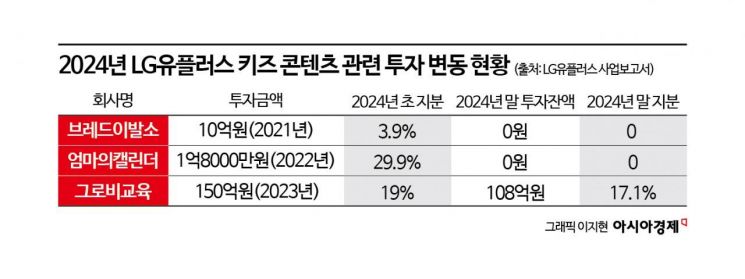

LG Uplus sold all 1,500 shares (3.9%) of the animation production company ‘Bread Barber Shop’, recovering an investment of 1 billion won. LG Uplus stated, "We had invested in ‘Walk’s World Tour’, a side content of Bread Barber Shop, and produced episodes featuring LG Uplus’s character ‘Muneo’, but ultimately sold the shares last year through mutual agreement."

The investment value in the educational content company ‘Groby Education’ significantly declined, resulting in a loss. LG Uplus invested a total of 15 billion won in Groby Education twice in 2023, but as of the end of last year, the book value dropped to 10.8 billion won.

LG Uplus also withdrew from ‘Mom’s Calendar’, a company related to early childhood education. It sold all 17,088 shares (29.9%) it held. Mom’s Calendar started as an in-house venture of LG Uplus and spun off as a company active in early childhood education, including visual arts education, but closed in February last year due to management difficulties.

Among the three major telecom companies, LG Uplus was the first to enter the kids market, surpassing 47 million cumulative users as of September 2021. Former CEO Hwang selected it as a core business of the ‘Uplus 3.0’ strategy and even considered spinning it off. However, as the market environment changed, growth potential diminished. The daily active users (DAU) of the ‘U+ Idle Nara’ app remained in the low 4,000s as of early last year.

An industry insider said, "The reduction in LG Uplus’s investment in kids content is the result of intensified competition centered on major overseas OTT platforms and poor performance failing to achieve results relative to the investment amount. Under the current CEO Hong Beom-sik, LG Uplus is expected to focus on selection and concentration with the goal of becoming an AX (Artificial Intelligence Transformation) company."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)