Insurance Companies Must Review Incomplete Sales Rates When Entrusting Sales to GAs

Sales Entrustment to GAs with Unsound Business Practices Will Be Suspended

FSS to Implement Guidelines Within the First Half of the Year

From now on, when insurance companies entrust insurance sales to corporate insurance agencies (GA), they must carefully examine incomplete sales rates, the number of complaints, sanction histories, and more. GAs engaging in unsound business practices will find it difficult to receive work from insurance companies.

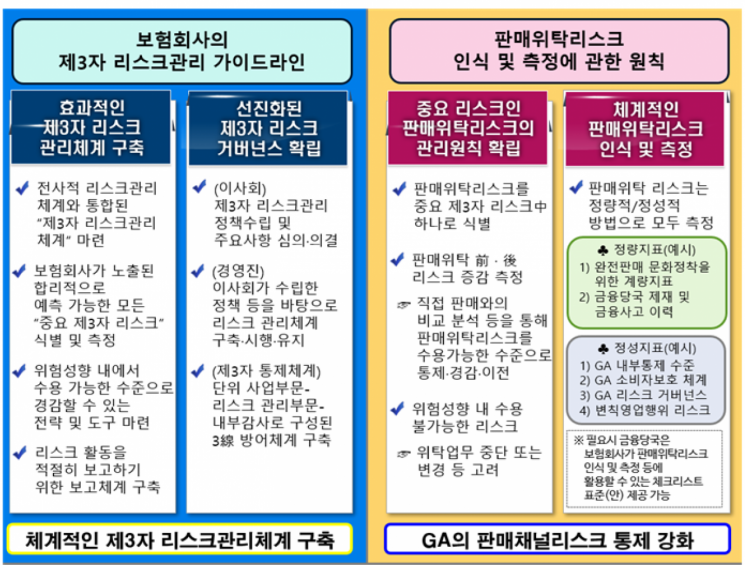

On the 25th, the Financial Supervisory Service (FSS) announced that it is promoting the establishment of the "Guidelines for Third-Party Risk Management by Insurance Companies."

Recently, concerns about consumer damage such as incomplete sales have increased due to growth-focused sales through GAs and excessive competition. Accordingly, the importance of systematic management of sales entrustment risks arising in the process of insurance companies entrusting insurance product sales to GAs has also increased.

The FSS requires insurance companies to identify and measure third-party risks and to establish strategies to control and mitigate these risks to levels acceptable within the company’s risk appetite.

The board of directors must establish risk management policies, deliberate and resolve key matters, and management must implement control measures based on these policies and report back to the board.

Insurance companies must identify sales entrustment risk as one of the important third-party risk management targets and systematically measure the risk. If sales entrustment risk is unacceptable within the risk appetite or difficult to control, mitigate, or transfer, the company plans to consider suspending entrusted work and preparing special supplementary measures. This means that if a GA engages in unsound business practices, it will be difficult to receive work orders from insurance companies.

Insurance companies can measure sales entrustment risk using quantitative and qualitative methods. Quantitative indicators include various metrics to establish a culture of complete insurance sales, as well as sanction and financial accident histories of GAs and affiliated planners. Qualitative indicators can include GA internal controls and governance, consumer protection systems, and risks of irregular business practices.

The FSS plans to conduct an industry opinion-gathering process by April regarding the application of these guidelines. During the first half of this year, it plans to establish and implement the "Guidelines for Third-Party Risk Management by Insurance Companies" in the form of a model code (self-regulation) by the Insurance Association. A standard checklist for insurance companies to recognize and measure their own sales entrustment risks will also be prepared within the first half of the year.

An FSS official said, "The recruitment practices that have so far focused only on quantitative expansion without considering qualitative aspects such as consumer utility and insurance contract quality when entrusting sales to GAs will gradually improve," adding, "We plan to encourage insurance sales channels to prioritize consumers through strengthening responsibility for incomplete sales and establishing internal controls."

Key contents of the 'Third-Party Risk Management Guidelines for Insurance Companies' prepared by the Financial Supervisory Service on the 25th. Provided by the Financial Supervisory Service

Key contents of the 'Third-Party Risk Management Guidelines for Insurance Companies' prepared by the Financial Supervisory Service on the 25th. Provided by the Financial Supervisory Service

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)