Daewoo E&C Falls for Three Consecutive Sessions After LTPZ Re-Designation

"Regulatory Moves Likely to Weigh on Investor Sentiment and Share Price"

The stock prices of construction companies are plummeting as a result of Seoul City's re-designation of land transaction permit zones (LTPZs). This comes at a time when the construction market is already in a slump and political instability has made it difficult even to set sales schedules, and now, major areas in Seoul are facing new transaction restrictions. Growing concerns over additional regulations are deepening shareholders' worries.

According to the Korea Exchange on March 24, as of 9:18 a.m. that day, Daewoo E&C's stock price was trading at 3,310 won, up 1.85% from the previous trading day. This represents a slight recovery from recent declines. Daewoo E&C's stock price fell by 7.18% from March 19 to March 21 following the LTPZ re-designation, showing a clear downward trend. The stock dropped for three consecutive sessions after the re-designation, with a single-day decline of over 3%, marking the steepest fall.

HDC Hyundai Development Company also saw its stock price weaken after the LTPZ re-designation, falling by 5.95% over three trading days starting March 19. DL E&C and GS E&C also declined by 4.47% and 1.34%, respectively, during the same period.

The LTPZ re-designation is being cited as the main factor dragging down construction company stock prices. Designation as an LTPZ imposes various restrictions on transactions, which could potentially dampen the real estate and construction markets. Earlier, the city re-designated the three Gangnam districts (Gangnam, Seocho, and Songpa) and Yongsan District as LTPZs for a six-month period starting March 24. When an area is designated as an LTPZ, transactions involving apartments above a certain size require approval from the relevant district mayor. Residential land must be used exclusively for actual residence for two years, and sales or leases are prohibited during this period. 'Gap investment,' or purchasing a home with a jeonse deposit, is strictly forbidden.

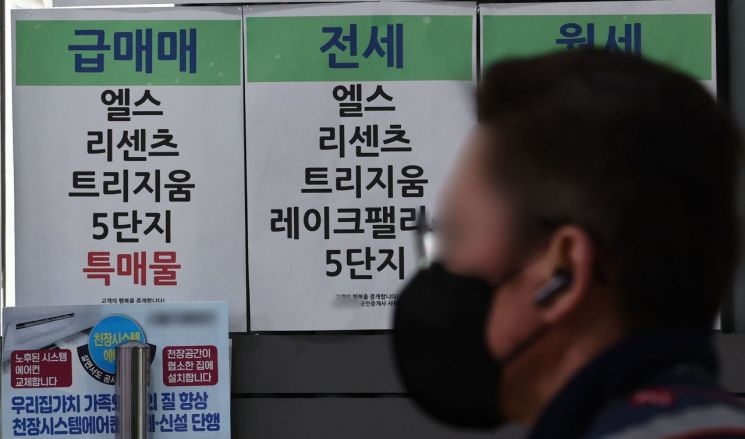

On the ground, there are signs that sellers are lowering their asking prices in anticipation of a transaction freeze. For example, in the 'Elite' (Els, Lecentz, Trizium) apartment complex in Jamsil-dong, Songpa District, Seoul, the asking price for an 84-square-meter Lecentz unit had risen to 3.2 billion won before the re-designation, but on March 19, three listings appeared with prices between 2.9 billion and 2.95 billion won.

Bae Seho, a researcher at iM Securities, commented, "While the volatility of apartment prices in Seoul has only a very limited impact on construction company earnings, the government's latest regulations could negatively affect construction stocks by dampening investor sentiment." He added, "The recent housing stabilization measures also hinted at further controls, such as designating speculative zones and tightening loan management, which were additional negative factors." Shin Daehyun, a researcher at Kiwoom Securities, also stated, "This announcement is likely to have a negative short-term impact on both the real estate market and construction company stock prices," noting, "With the domestic economic recovery still uncertain, the growth rate of liquidity is not exceeding average levels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)