Both Consumers and Investors Shift Toward ESG

Corporate Response Essential Amid Strengthening Regulations

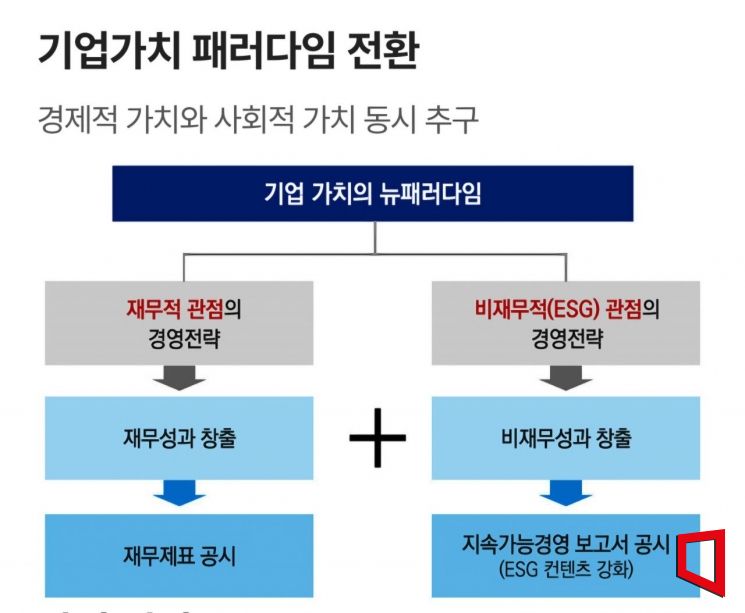

The paradigm of corporate management is shifting toward ESG (Environmental, Social, and Governance). Achieving sustainable management, beyond simply generating profits, has become a key factor determining a company's survival.

◆ What is ESG?

ESG is a set of criteria used to evaluate whether a company protects the environment, fulfills its social responsibilities, and maintains transparent governance. In the past, unique products and marketing determined a company's competitiveness, but now, the implementation of ESG management has emerged as a core factor.

◆ Consumers are changing as well.

Consumers are increasingly considering a company's values and ethical management, rather than just evaluating product quality. In particular, the MZ Generation prefers companies that practice ESG management, and this directly impacts corporate brand image.

◆ Investors also prioritize ESG

From the perspective of investors, ESG is becoming increasingly important. As the perception grows that companies practicing sustainable management have greater long-term growth potential, global investors are using ESG indicators as major investment criteria. There are also more cases where companies with insufficient ESG management are excluded from investment targets.

Companies that practice ESG management are seeing positive effects not only in attracting investment but also in management efficiency. Analyses show that companies with high ESG scores achieve sustainable growth based on trust with stakeholders.

◆ Strengthening ESG regulations... Corporate response is essential

Governments and international organizations around the world are also strengthening ESG regulations. If a company neglects ESG management, it cannot avoid regulatory and market pressures. Accordingly, global companies are making various efforts to meet ESG standards, such as environmental protection, improving labor conditions, and establishing transparent governance.

In fact, as many companies strengthen their ESG activities, they are expanding their social responsibilities and actively changing to build sustainable business models. For example, cases of ESG management such as developing eco-friendly products or collaborating with local communities are increasing.

◆ ESG, an opportunity factor for small and medium-sized enterprises as well

Some believe that ESG management is advantageous only for large corporations. However, ESG can also be an opportunity for small and medium-sized enterprises. SMEs that adopt ESG standards can gain the trust of consumers and investors, and in the long term, this can positively impact corporate value.

Ultimately, ESG has become an essential criterion for evaluating corporate sustainability, not just a trend. Only companies that practice ESG management will be able to survive and grow in the new era. It is now time for companies to place ESG at the center of their management strategies and actively respond to the changing market environment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)