Korea Economic Association Diagnoses Insolvent Companies

4,466 Audited Firms Suffer Complete Capital Erosion

Highest Insolvency Risk in Real Estate and Rental Services

Korea Economic Association: "Commercial Act Amendment Needs Reconsideration"

As the economic recovery delays and high interest rates worsen corporate profitability, the number of insolvent companies this year is expected to reach the highest level in six years.

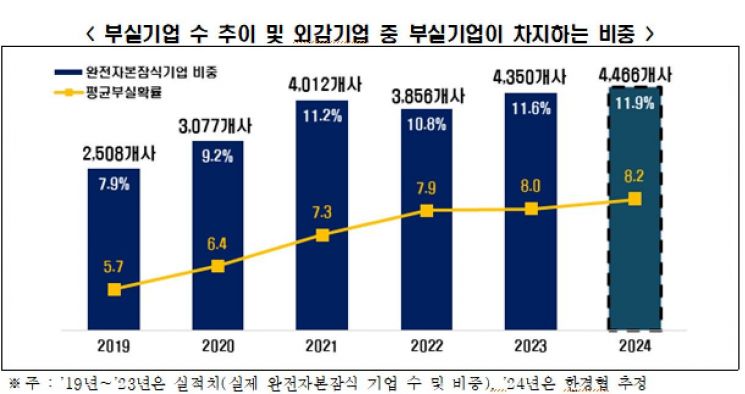

The Korea Economic Association announced on the 24th through its report titled "2024 Insolvent Company Diagnosis through Corporate Insolvency Prediction Analysis" that 4,466 companies subject to external audits (excluding financial industries) are estimated to be in a state of complete capital erosion this year. This accounts for 11.9% of all externally audited companies (37,510 companies), an increase of 116 companies compared to last year (4,350 companies).

The Korea Economic Association derives the annual insolvency probability of companies through logistic regression analysis. According to the report, the average insolvency probability of companies has increased every year from 5.7% in 2019 to 8.2% this year. This is the highest level in six years since just before the COVID-19 pandemic.

Trends in the Number of Insolvent Companies and the Proportion of Insolvent Companies Among Externally Audited Companies, Provided by the Korea Economic Association

Trends in the Number of Insolvent Companies and the Proportion of Insolvent Companies Among Externally Audited Companies, Provided by the Korea Economic Association

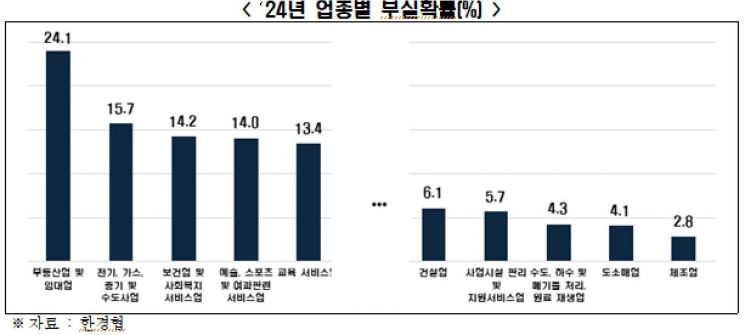

The industry with the highest insolvency risk was real estate and rental services (24.1%). This was followed by ▲electricity, gas, and water supply (15.7%) ▲health and welfare services (14.2%) ▲arts and leisure services (14.0%). In particular, the construction industry’s insolvency probability more than doubled over five years, soaring from 3.3% in 2019 to 6.1% this year.

The Korea Economic Association cited the causes of the increased insolvency risk in the construction industry as ▲poor order intake ▲high inflation ▲real estate project financing (PF) insolvency ▲investment contraction due to high interest rates. According to Statistics Korea, the construction production index in January this year recorded -27.2% compared to the previous year, and construction investment based on the Bank of Korea’s data has been declining for four consecutive quarters.

Lee Sang-ho, head of the Economic and Industrial Headquarters at the Korea Economic Association, stated, "The increase in insolvent companies leads to financial market instability and deterioration of the real economy, raising overall economic uncertainty." He added, "It is necessary to ease financial costs and expand liquidity support, while the amendment to the Commercial Act that hinders business restructuring needs to be reconsidered in the National Assembly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)