Increased from 5.5756 Trillion to 7.1114 Trillion Won

Nonghyup Bank Tops with 1.6314 Trillion Won

Busan Bank Leads Growth Rate at 112%

"Empty-can Loans" and Non-Performing Credit Also Rising

Loan Loss Provision Coverage Ratio Drops

"SMEs and Small Business Owners Facing Hardship"

Banks with Higher SME Loan Ratios Hit Hardest

Despite achieving record-high performance, the banking sector saw a significant increase in the volume of non-performing loans. The same applies to non-performing credit, which refers to loans on which even interest is not being received. Moreover, the ability to prepare for non-performing loans has deteriorated. This is due to the rise in borrowers unable to repay their debts amid high interest rates and unfavorable domestic and international economic conditions. Banks with a large proportion of loans to small and medium-sized enterprises (SMEs) or small business owners were particularly hard hit.

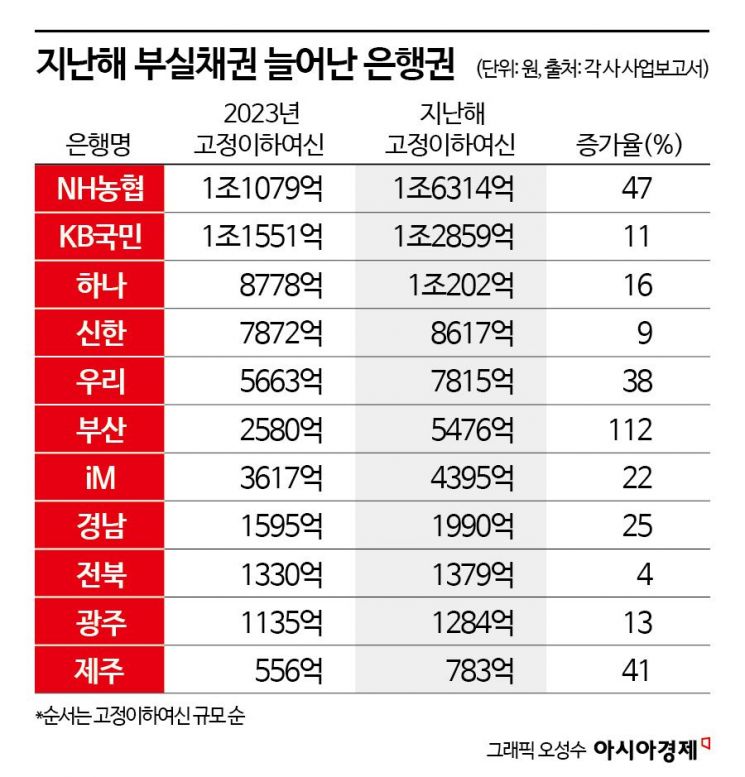

According to the financial sector on the 24th, the total amount of non-performing loans classified as fixed and below by 11 banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup, Busan, Gyeongnam, iM, Jeonbuk, Gwangju, Jeju) increased from 5.5756 trillion won in 2023 to 7.1114 trillion won last year. This represents an increase of about 28%.

Loan receivables are classified into five categories based on soundness: normal, precautionary, fixed, doubtful recovery, and estimated loss. Among these, fixed, doubtful recovery, and estimated loss loans are collectively referred to as fixed and below non-performing loans, which are loans overdue for more than three months and difficult to recover. The larger the balance of fixed and below non-performing loans, the greater the amount of bad assets is considered.

Specifically, Nonghyup Bank (1.6314 trillion won) holds the largest amount of fixed and below non-performing loans among banks (excluding policy banks such as IBK Industrial Bank of Korea). It also recorded the largest increase of 523.5 billion won compared to the previous year. In 2023, KB Kookmin Bank (1.1551 trillion won) was ranked first, but Nonghyup Bank has overtaken it. The highest growth rate was recorded by Busan Bank at 112%. Busan Bank also ranked second in terms of increase amount, with an increase of 289.6 billion won, following Nonghyup Bank. Woori Bank saw an increase of 215.2 billion won, ranking third in the banking sector for the growth in fixed and below non-performing loans.

Comparing the growth rates of fixed and below non-performing loans between the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) and regional banks (Busan, Gyeongnam, iM, Jeonbuk, Gwangju, Jeju), the average growth rate of regional banks was 36%, which was steeper than the 24% increase seen in the five major banks, indicating a faster rise in the scale of bad loans among regional banks.

The volume of non-performing credit, loans on which neither principal nor interest is being received, also increased. The volume of non-performing credit at the 11 banks rose from 4.3839 trillion won to 5.6591 trillion won, a 29% increase. Similar to fixed and below non-performing loans, Nonghyup Bank holds the largest amount of non-performing credit at 1.1949 trillion won, while Busan Bank recorded the highest growth rate at 100%. Unlike its ranking in fixed and below non-performing loans (third), Hana Bank ranked second in non-performing credit volume (990.9 billion won), following Nonghyup Bank. Non-performing credit includes loans overdue on principal repayment for more than three months plus loans on which interest has not been accrued. Since no interest income is generated, it is classified as more severe than fixed and below non-performing loans and is also referred to as "empty-can loans."

Although non-performing loans in the banking sector increased, the ability to prepare for them declined compared to the previous year. Looking at the loan loss provision coverage ratio, an indicator showing the extent of provisions set aside for problem loans, all 11 banks saw a decrease last year compared to the previous year. Busan Bank's coverage ratio fell from 270.4% in 2023 to 142.29% last year, showing a 47% decrease. Nonghyup Bank's ratio dropped from 282.27% to 214.51% during the same period, a 24% decrease. Comparing the five major banks and regional banks, the average decrease rate was 18% for the five major banks and 15% for regional banks. In other words, the five major banks showed a greater decline in their ability to prepare for non-performing loans than regional banks.

The reason for this phenomenon is that the high interest rate trend has continued over the past few years, while domestic and international economic conditions have worsened, leading to an increase in borrowers unable to repay their debts on time. Banks with a high proportion of loans to SMEs and individual business owners were particularly affected. Last year, 81% of Nonghyup Bank's corporate loans were to SMEs, higher than other commercial banks (77-78%). Individual business loans accounted for 61% of SME loans. Busan Bank's regional companies are mostly engaged in manufacturing and are often SMEs. Busan Bank's total overdue amount last year was 378.8 billion won, of which SME overdue loans accounted for 242.1 billion won, or 64%. Borrowers at both banks had higher delinquency rates compared to other banks. According to data from the Financial Supervisory Service as of December last year, the average delinquency rate for SME loans was 0.64%, and for individual business owners, it was 0.6%. Nonghyup Bank's SME delinquency rate last year was 0.82%, and Busan Bank's was 0.68%.

Meanwhile, according to the Financial Supervisory Service's "2024 Domestic Bank Business Performance," the net profit of commercial banks (including iM Bank) last year was 13 trillion won, a 7% increase from the previous year, while regional banks recorded 1.3 trillion won, up 19.4%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.