140.6 Billion KRW Raised from 765 Policyholders Through Fraudulent Fundraising

Approached Young Adults by Offering Salary Management in Study Groups

FSS: "Strict Punishment for Those Involved Under Zero-Tolerance Policy"

The Financial Supervisory Service (FSS) announced on the 23rd that it has detected fraudulent fundraising activities by insurance planners affiliated with corporate insurance agencies (GA) and has launched an urgent on-site inspection of two such GAs.

According to the FSS investigation, 97 individuals, including planners affiliated with the two GAs, solicited 140.6 billion KRW in fraudulent funds from 765 insurance policyholders under the pretext of insurance sales. Of this amount, 34.2 billion KRW remains unpaid.

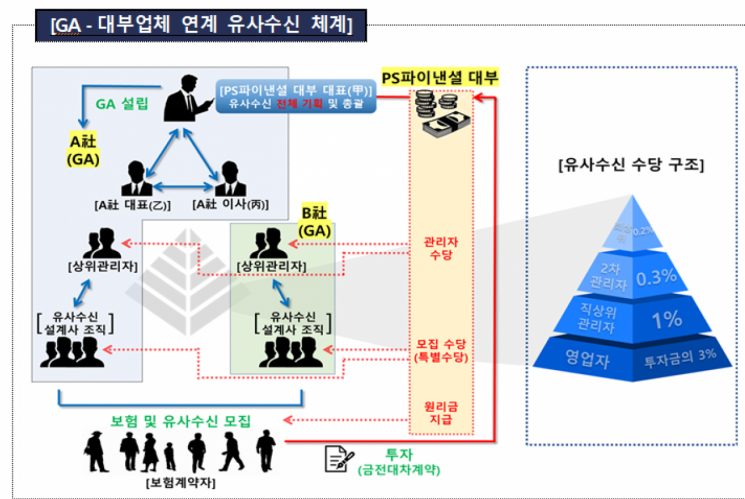

Mr. A, a former insurance planner and head of a lending company, directly established a GA and mobilized a planner organization within the GA to raise fraudulent funds. To attract funds, Mr. A formed a pyramid structure with upper-level managers (branch managers) and lower-level sales agents, offering sales performance promotions and recruitment commissions by rank.

These organizations promoted themselves as financial and wealth planning experts through planners and approached young adults via advertisements such as monthly salary management study groups. They introduced investment products guaranteeing high returns and engaged in fraudulent fundraising by receiving investment funds into personal accounts.

When the lending company lacked funds to repay customers involved in fraudulent fundraising, there were signs of circular financing, such as misappropriating insurance recruitment commission income from the GA to repay fraudulent funds.

Despite being large GAs with over 500 affiliated planners, the two GAs detected in this case lacked proper monitoring systems, such as failing to appoint compliance officers. Internal control mechanisms also failed, as planners posted unauthorized advertisements on social networking services (SNS) for years without proper blocking, violating review regulations.

Structure of quasi-deposit activities and profit distribution status of A lending company detected by the Financial Supervisory Service. Provided by the FSS

Structure of quasi-deposit activities and profit distribution status of A lending company detected by the Financial Supervisory Service. Provided by the FSS

The FSS plans to take strict measures under a zero-tolerance policy to prevent those involved in this fraudulent fundraising from operating in the insurance market. Illegal activities will be reported to investigative authorities to ensure that those involved receive penalties commensurate with consumer damages through close cooperation.

Legislative amendments will also be pursued to add records of fraudulent fundraising and related punishments as grounds for cancellation of GA and planner registrations. Guidelines will be established to require insurance companies outsourcing sales to more closely manage GAs linked to lending companies.

An FSS official stated, "We will continuously develop effective improvement measures, such as strengthening internal controls within GAs in response to the movement of planners with fraudulent fundraising histories."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)