Losses from Parts Business Investment Due to Electrification Delays

CEO Change at Canadian Optical Device Design Company

Hanon Systems Undergoes Restructuring Including Workforce Reductions

Korea & Company’s investment in the electrification parts business, undertaken to lay the foundation for future growth, has been going in circles for several years. As the transition to electrification in the automotive market is delayed more than expected, major domestic and international investors are accumulating losses.

According to the industry on the 24th, Preciseley Microtechnology, a Canadian optical device design company in which Korea & Company is the largest shareholder, has recorded losses for three consecutive years. In November 2021, Korea & Company and Hankook Tire & Technology acquired a 60% stake in Preciseley for 204.5 billion KRW. This was the first major overseas investment since Chairman Cho Hyun-bum took office in 2021.

Preciseley has posted net losses of 1.5 billion KRW in 2022, 10 billion KRW in 2023, and 8.8 billion KRW in 2024, consecutively since the year following the acquisition. The core business area of Preciseley is the design of optical micro-electromechanical systems (MEMS), which are used as LiDAR components for autonomous driving and 5G optical communication network parts.

However, as the global development pace of autonomous driving has slowed, demand for such designs has decreased, causing sales to drop from 153.4 billion KRW in 2022 to 141.1 billion KRW last year, an 8.0% decrease over two years. Due to continued profitability deterioration, David Somo, the CEO who led Preciseley for over four years, reportedly resigned in September last year. Currently, Bruce Scatchard, who had been serving as Vice President of Manufacturing and Operations, is leading the company.

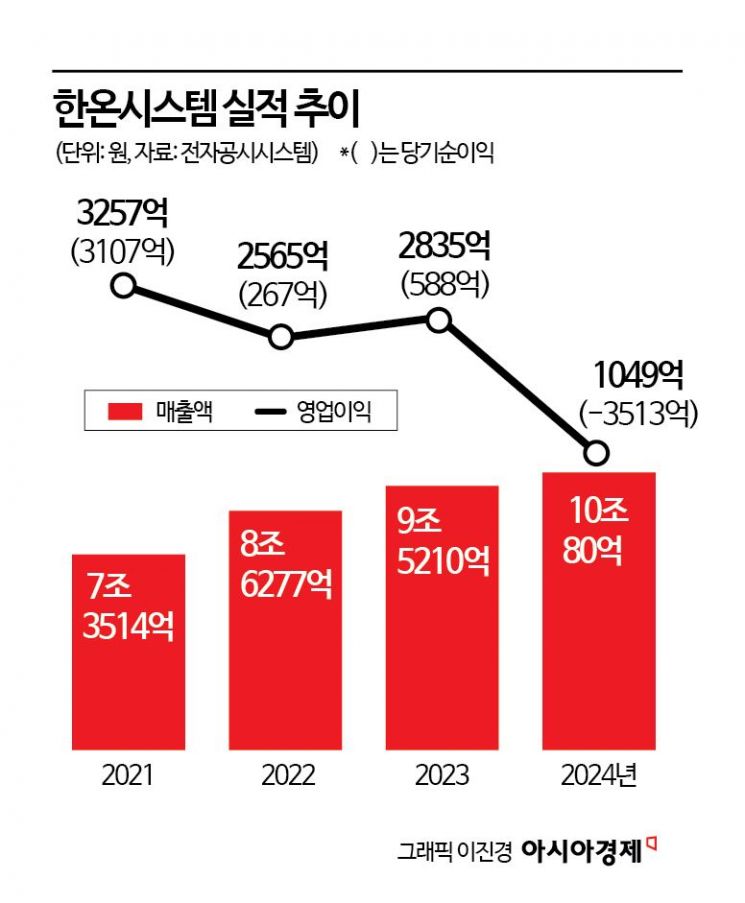

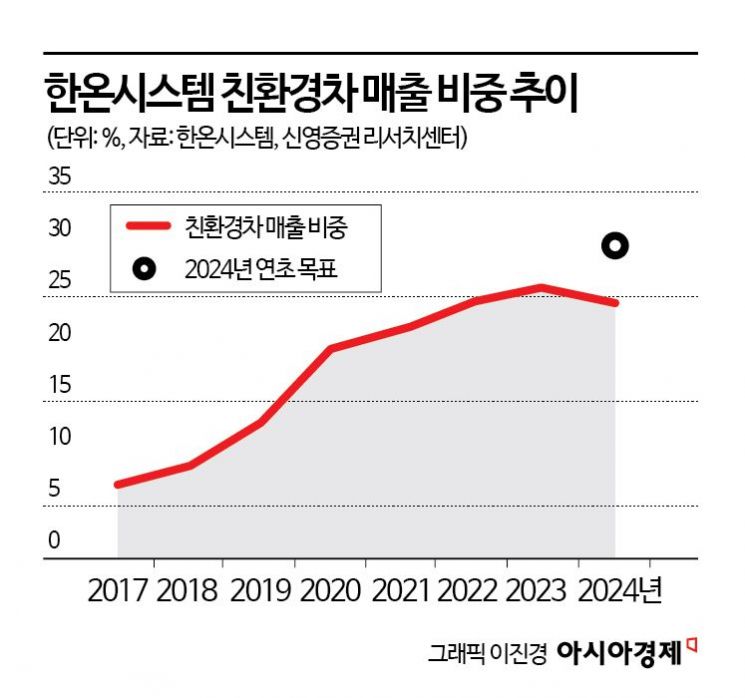

Concerns are also rising that Hanon Systems, which Korea & Company completed acquiring in January, will take a long time to return to normal management. Last year, Hanon Systems posted an operating profit of 105 billion KRW but recorded a net loss of 351 billion KRW. In the fourth quarter alone, it posted a net loss of 293.9 billion KRW, marking three consecutive quarters of losses.

Hanon Systems, the world’s second-largest thermal management system solution company, has not escaped the impact of the shrinking electrification market. Additionally, losses occurred due to increased depreciation expenses, impairment losses on intangible assets (accounting losses recognized when the value of intangible assets decreases), and restructuring costs.

Samsung Securities analyzed, "In 2025, there is a possibility of impairment losses on intangible assets due to restructuring costs and sluggish electric vehicle sales, and losses are expected due to interest expenses amounting to 200 billion KRW annually."

Chairman Cho Hyun-bum announced earlier this month plans to undertake restructuring, including the sale of non-profitable assets of Hanon Systems and workforce reductions in overseas subsidiaries. Despite presenting a goal to normalize Hanon Systems’ management through intensive innovation over the next three years, Hanon Systems’ stock price has fallen more than 7%, from 4,275 KRW to 3,990 KRW (closing price on the 21st) this month.

The sluggish business conditions are compounded by the burden of tariffs imposed by the United States on automotive parts. Hanon Systems’ subsidiaries for hydraulic control devices and thermal management businesses, acquired from Magna in 2019, have operations in both Mexico and Canada. Additionally, it is constructing an electric compressor plant, a key electric vehicle component, in Ontario, Canada, scheduled to start operations this year.

Korea Ratings recently predicted in a report, "(Hanon Systems) is unlikely to achieve the expected investment results for the time being, considering the tariff burden and the U.S. rollback of eco-friendly policies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)