Number of Tradable Stocks Expands from 110 to 350 Starting on the 24th

Large-cap Stocks Like Samsung Electronics and SK Hynix Join

Key Issue: Addressing Liquidity Shortage in the Pre-market

Alternative Trading System (ATS) NextTrade is welcoming the 'big brothers' of the domestic stock market. With the addition of large-cap stocks such as Samsung Electronics and SK Hynix, expectations for active trading are growing. However, challenges such as price distortion caused by insufficient pre-market trading volume remain to be addressed.

According to NextTrade on the 24th, the number of tradable stocks within the alternative trading system will expand from the existing 110 to 350 starting today. Leading the way are semiconductor giants Samsung Electronics and SK Hynix, along with 145 stocks from the Korea Composite Stock Price Index (KOSPI) and 95 stocks from KOSDAQ newly joining. As a result, all constituent stocks of the KOSPI200 and KOSDAQ150 indices will be listed on the alternative trading system. The number of stocks is expected to increase to 800 by the 31st.

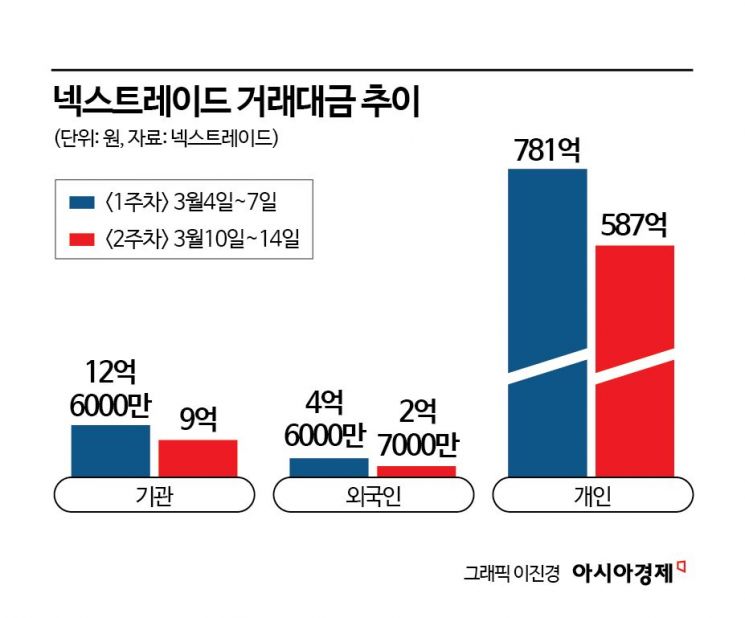

Attention is focused on whether the alternative trading system can successfully rebound its trading volume with the large-cap stocks joining in large numbers. NextTrade, which opened with 10 stocks on the 4th, seemed to be sailing smoothly with trading value surpassing 79.9 billion KRW over four days, but in the second week (10th to 14th), it sharply dropped by 25% to 59.9 billion KRW. Another issue is the low inflow of foreign and institutional investors, with individual investors accounting for nearly 98% of the trading value.

Baek Doosan, a researcher at Korea Investment & Securities, said, "Thanks to the automatic order transmission system and pre- and after-market, the alternative trading system is successfully settling in, but some trading volume from the existing Korea Exchange is simply being transferred to the alternative trading system," adding, "Excluding this substitution effect, the net increase in domestic stock trading volume due to the launch of the alternative trading system is estimated to be around 5%."

Recovery of trading volume is also necessary to prevent price distortion. Recently, on NextTrade, many stocks have been observed hitting upper or lower price limits immediately after opening, especially in the low-volume pre-market, before reversing. For example, on the 17th, DB Insurance hit the lower limit right after opening, and on the following day, Cheil Worldwide did the same. On the 19th, Webzen and NH Investment & Securities surged to the upper limit, while on the 20th, Kangwon Land, Lotte Holdings, and Hyundai Engineering & Construction hit the lower limit.

The root cause of this phenomenon is attributed to the absolute lack of liquidity in the pre-market. Since market orders are not supported in the pre-market, sufficient bids and offers from market participants are not filled, resulting in prices being set arbitrarily. On the 18th, when many stocks experienced sharp price changes, NextTrade recorded 117.9 billion KRW in trading volume for the day, but the pre-market accounted for only 7% (8.6 billion KRW) of that.

A NextTrade official explained the price distortion phenomenon by saying, "The biggest factor is the lack of trading volume," and added, "Legal systems are insufficient to provide securities firms, which act as market makers, with securities transaction tax exemptions to supply liquidity." Securities firms are reluctant to supply liquidity to the alternative trading system without tax exemption benefits because it would result in significant financial losses.

Generally, securities firms enter into market-making contracts with the Korea Exchange and continuously submit two-way bids and offers for allocated stocks to supply liquidity to the market. Currently, nine member firms including Mirae Asset, Meritz, and NH Investment & Securities have signed market-making contracts with the Korea Exchange as of the end of last year and are actively operating. Trading by these institutions for market making is exempt from securities transaction tax under the Restriction of Special Taxation Act.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)