1 Billion Australian Dollars (Approximately 924.64 Billion KRW)

The Export-Import Bank of Korea announced on the 21st that it has issued Kangaroo bonds worth 1 billion Australian dollars (approximately 924.64 billion KRW). Kangaroo bonds are Australian dollar-denominated bonds issued by foreign institutions in the Australian capital market.

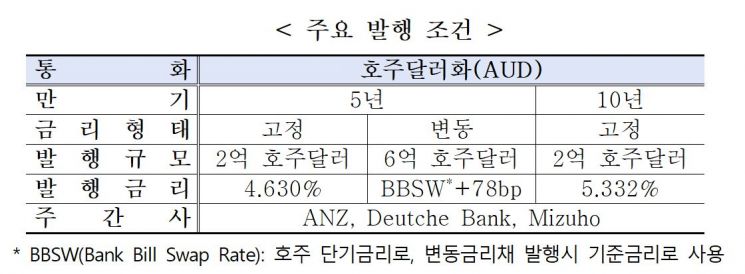

Despite uncertainties from the tariff war triggered by the Trump administration in the United States, the Export-Import Bank decided to raise funds in the Australian market, which maintains strong investment demand based on abundant liquidity. The maturities and issuance amounts are 5 years for 800 million Australian dollars and 10 years for 200 million Australian dollars, respectively. The 1 billion Australian dollars is the largest scale ever for Kangaroo bonds issued by a Korean issuer, matching the size of the Kangaroo bonds issued by the Export-Import Bank last year.

The Export-Import Bank explained that by making the 5-year maturity, which attracts concentrated investor demand, the main tranche, it set a new record for the largest single maturity among Korean Kangaroo bonds. Additionally, by adding the 10-year maturity, which is mainly issued by some ultra-high-grade SSA (Supranational, Sovereign, and Agency) issuers such as governments and international organizations in the Australian Kangaroo market, it satisfied the demand for long-term bonds from both regional and overseas investors, continuing its position as an SSA issuer.

Meanwhile, to alleviate overseas investors’ concerns about domestic political situations, the Export-Import Bank actively communicated with investors by holding one-on-one investor briefings in Australia and Singapore before issuance. In addition to major currencies such as the US dollar and euro, it closely monitors various cross-currency markets to secure high-quality foreign currency funds at competitive rates and plans to provide benchmarks for other domestic issuers.

An official from the Export-Import Bank stated, “Despite domestic and international uncertainties, not only new Australian investors but also global high-quality investors such as central banks and asset management companies participated, providing an opportunity to once again demonstrate the Export-Import Bank and the Republic of Korea’s external creditworthiness.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)