"Significant Increase in Allowance for Loan Losses"

Both Delinquency Rate and Non-Performing Loan Ratio Rise

Ministry of the Interior and Safety: "Active Efforts to Manage Soundness"

A total of 1,276 Saemaeul Geumgo nationwide recorded a net loss approaching 2 trillion won last year. This is the largest loss in the history of Saemaeul Geumgo. The Ministry of the Interior and Safety explained that this was due to an increase in the allowance for loan losses, which is set aside in advance to prepare for loans that are difficult to recover. Asset soundness-related figures also deteriorated compared to the previous year. The Ministry of the Interior and Safety stated that although the related indicators remain within the predicted range and show stability, efforts will be made to manage soundness.

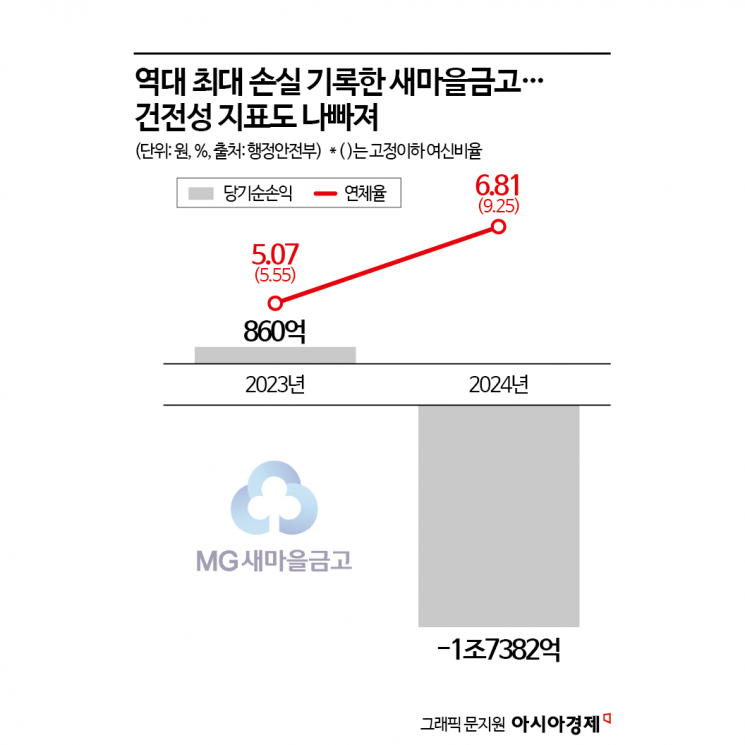

On the 21st, the Ministry of the Interior and Safety announced the business performance of Saemaeul Geumgo for last year. The net loss of Saemaeul Geumgo last year was 1.7392 trillion won. Although a net profit of 86 billion won was recorded in 2023, the Ministry explained that it turned to a deficit due to a sharp increase in the cost of setting aside allowances for loan losses to enhance loss absorption capacity last year. The amount of allowance for loan losses increased by 1.5647 trillion won from 5.4558 trillion won at the end of 2023 to 7.0205 trillion won at the end of last year. However, the reserve ratio fell by 2.4 percentage points from the previous year to 103.73% last year. Regarding this, the Ministry explained, “The increase in the allowance ratio for real estate and construction loans is reflected in the required reserve amount (denominator), so the allowance ratio based on the same standard as of the end of June last year is 110.27%.”

Asset soundness indicators such as delinquency rate and non-performing loan ratio also worsened. The overall delinquency rate of Saemaeul Geumgo was 6.81%, up 1.74 percentage points from 5.07% in 2023. The corporate loan delinquency rate increased by 2.67 percentage points from the previous year to 10.41%, and the household loan delinquency rate rose by 0.23 percentage points from the previous year to 1.75%. The non-performing loan ratio was 9.25%, up 3.7 percentage points from the previous year. Loan receivables are broadly classified by soundness into normal, precautionary, fixed, doubtful, and estimated loss categories. Among these, fixed, doubtful, and estimated loss are collectively called non-performing loans. The net capital ratio, an indicator of capital adequacy, was 8.25%, down 0.35 percentage points from the previous year but maintained a level higher than the minimum regulatory ratio of 4%, the Ministry explained.

The total assets of over 1,200 Saemaeul Geumgo reached 288.6 trillion won last year, an increase of 1.6 trillion won (0.6%) compared to 2023. Total deposits increased by 1.4% from the previous year to 258.4 trillion won. Total loans recorded 183.7 trillion won, combining corporate loans of 107.2 trillion won and household loans of 76.5 trillion won.

The Ministry of the Interior and Safety said that although domestic and international economic uncertainties expanded last year, downside risks to the economy increased, and delays in real estate market recovery continued, “the soundness indicators of Saemaeul Geumgo did not exceed the predicted range and, as a result of continuous efforts to manage soundness, overall stability was observed.” Specifically, the Ministry stated, “Although the delinquency rate of Saemaeul Geumgo, along with the entire financial sector, rose at the beginning of the year, due to active and focused soundness management such as target management and sale of delinquent loans, the delinquency rate at the end of the year decreased compared to the end of June, showing gradual stabilization.”

The Ministry emphasized that although difficult management conditions are expected this year due to increased downside risks to the economy, active efforts to manage the soundness of Saemaeul Geumgo will continue, stating, “Soundness management through close cooperation with financial authorities, including disposal of non-performing loans through asset managers, mergers of financially troubled Geumgo, and joint audits of individual Geumgo, will also be sustained.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.