European Funds Record Outstanding Returns This Year

Emerging Europe Funds Lead with 20.91% Return

U.S. Funds, Last Year's High Performers, Post Negative Returns

Despite Weak Performance, Most Capital Still Flows into U.S. Funds

So far this year, the fund returns by major countries are showing a different pattern compared to last year. Countries that recorded high returns last year are struggling with negative returns this year, while countries that underperformed last year have escaped their slump and are showing favorable returns. Despite North American funds showing negative returns this year, capital continues to flow into North American funds.

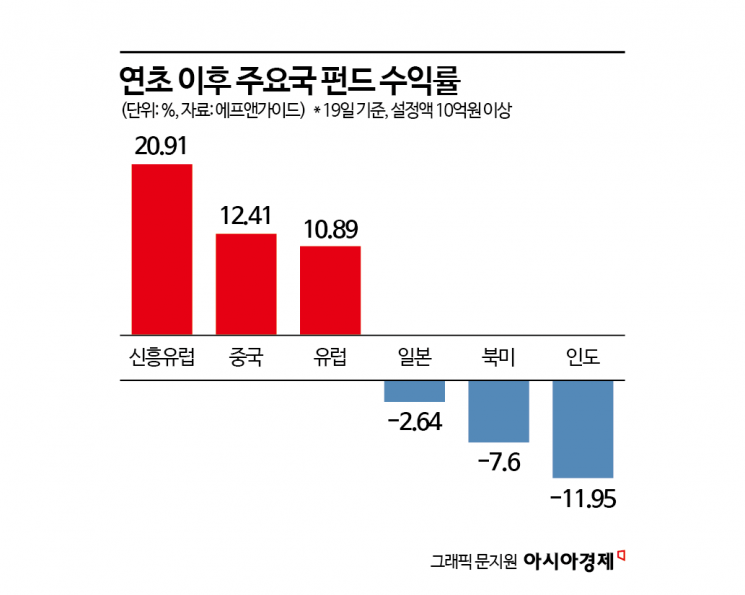

According to financial information provider FnGuide on the 21st, among major regional funds, the highest return so far this year was recorded by emerging Europe funds. Emerging Europe funds posted a 20.91% return since the beginning of the year. Among the regional funds classified by FnGuide, emerging Europe is the only region with returns exceeding 20% year-to-date. European funds also showed favorable returns, recording a 10.89% return since the start of the year. Additionally, China (12.41%), Brazil (12.52%), and Russia (12.20%) funds posted returns in the 12% range.

Seonghwan Kim, a researcher at Shinhan Investment Corp., said, "Although the European stock market does not yet have the fundamentals to sustain a broad upward trend, it has recently been spotlighted as part of a rotation between leading and lagging stocks. The narrative that fiscal policy and the end of the Russia-Ukraine conflict will improve Europe's fundamentals is forming, and I believe this can sufficiently act as a short-term outperformance driver amid supply-demand gaps and undervaluation."

China funds, which have been showing a full-fledged recovery since last year, continue to maintain a favorable trend this year. Seolhwa Choi, a researcher at Meritz Securities, said, "The strong rally centered on Chinese tech stocks at the beginning of the year has normalized China's previously excessively undervalued valuation to about 95%. Although there are concerns about further rises, Chinese tech companies are showing earnings improvements, big tech firms are rapidly investing in artificial intelligence (AI), which is expected to lead to the blossoming of China's AI industry, and the Chinese government is prioritizing domestic demand stimulation this year, making moderate additional gains possible."

On the other hand, North American funds, which recorded an outstanding return close to 40% last year, are posting a -7.6% return this year as the U.S. stock market undergoes a correction. Indian funds, which showed favorable returns last year, also showed the weakest performance among major regional funds with a -11.95% return year-to-date. Chankyu Baek, a researcher at NH Investment & Securities, explained, "The Indian stock market has been sluggish for the past six months. The valuation multiples of the Indian stock market, which were higher than the U.S. at the peak in September last year, concerns about reduced investment by the new government after the general election, and uncertainty over tariff policies under a potential second Trump administration negatively affected the market. Currently, the Indian stock market is passing through a bottom phase, having resolved valuation burdens through six months of time and price adjustments. From a mid- to long-term perspective, the structural growth rationale remains valid."

Despite the continued sluggishness of the U.S. stock market this year, capital is still flowing into North American funds. Since the beginning of the year, 3.9601 trillion KRW has flowed into North American funds, followed by 138.1 billion KRW into Chinese funds.

Bowon Choi, a researcher at Korea Investment & Securities, commented on the U.S. stock market, saying, "The U.S. S&P 500 index has fallen more than 10% from its peak, raising concerns about entering a correction phase, and conservative responses are needed at least until early April rather than aggressive overweighting. In the short term, uncertainties regarding tariffs, the economy, and earnings will increase downward pressure on the index, but it still retains potential for a mid- to long-term rebound."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)