Focus on AIDC-Centered Monetization Strategy

Mirae Asset Securities: "Performance to Be Impacted from the Second Half"

Domestic securities firms have analyzed that SK Telecom's (SKT) revenue strategy centered on AI Data Centers (AIDC) this year will have a positive impact on its performance.

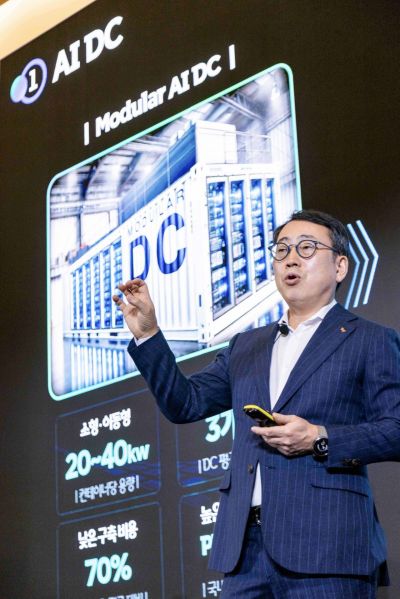

According to the industry on the 20th, major securities firms are continuously releasing forecasts on SKT's AI business performance this year. Earlier this month, SKT announced its ‘AI Pyramid 2.0’ strategy at the 'Mobile World Congress 2025 (MWC25)' held in Barcelona, Spain, which includes plans to expand AI data centers and AI businesses targeting both corporate and individual customers.

KB Securities mentioned the growth potential of SKT's AI Contact Center (AICC) and AI assistant businesses in a report on the 13th. Researcher Kim Junseop of KB Securities stated, "As a founding member of the global telco AI alliance, SKT holds the initiative in AI development," and gave a buy recommendation.

DB Financial Investment identified AIDC as SKT's main AI revenue-generating strategy. It also mentioned that, in the long term, SKT is reviewing plans to build a 100-megawatt (MW) class AI data center in non-metropolitan areas, including about 60,000 graphics processing units (GPUs), in collaboration with big tech companies. Additionally, referring to SKT's launch of the ‘GPU as a Service’ business in December last year, which allows subscribing to GPUs in a cloud environment with Lambda, DB Financial Investment analyzed the possibility of additional revenue generation this year. Researcher Shin Eunjeong of DB Financial Investment explained, "SKT has plans to expand its AI cloud, AICC, and AI assistant businesses in the North American market," adding, "It offers a dividend yield of about 6.4%."

Researcher Kim Sujin of Mirae Asset Securities evaluated in a report on the 10th that "As efforts to monetize AI investments and improve business cost efficiency continue, it will have a positive impact on performance from the second half of the year."

NH Investment & Securities analyzed that SKT "is building infrastructure centered on data centers that can generate immediate revenue and will expand into the AI assistant business based on this." Researcher Ahn Jaemin of Mirae Asset Securities mentioned, "It is necessary to pay attention to SKT's AI business performance, which aims to be a ‘money-making AI.’"

Meanwhile, SKT decided on a dividend of 1,050 KRW per share for the fourth quarter of last year, confirming an annual dividend of 3,540 KRW per share.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)