Diverging Trends in Safe-Haven Assets

Dollar Deposits Drop 13% in a Month... Gold Banking Nears 1 Trillion Won

"Perception That Exchange Rate Has Peaked... Expectations for Further Rise in Gold Prices"

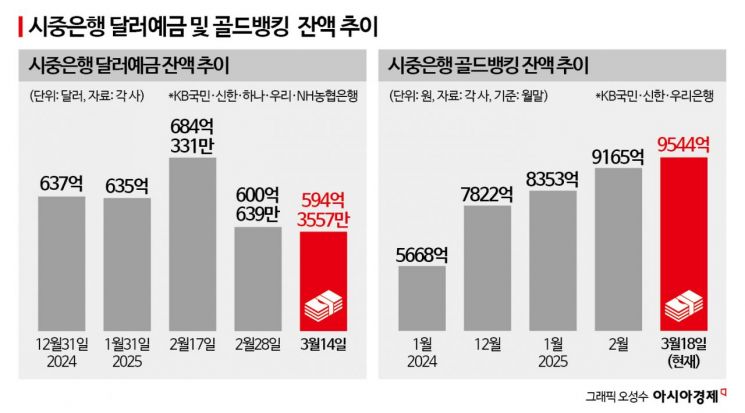

The dollar and gold, which are considered representative safe-haven assets, are showing divergent trends among domestic investors. While the balance of dollar deposits fell by 13% in a month, the balance of gold accounts has steadily increased, approaching 1 trillion won. This is analyzed as a result reflecting the limited expectations for further rise in the won-dollar exchange rate, whereas the perception that gold prices will continue to rise even after reaching an all-time high.

According to the banking sector on the 20th, the balance of dollar deposits at the five major domestic banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) was recorded at $60.02032 billion as of the 17th. On the previous business day, the 14th, it was $59.4 billion, falling below $60 billion.

The balance of dollar deposits rose from $63.5 billion at the end of January to $68.4 billion in mid-February but has since entered a clear downward trend. This month, it has remained between $60 billion and $61 billion. Based on the highest and lowest figures, it decreased by 13% in a month. This is $9 billion, which translates to about 13 trillion won.

On the other hand, the balance of gold banking at commercial banks (Kookmin, Shinhan, Woori) reached 954.4 billion won as of the 18th, approaching the first-ever breakthrough of 1 trillion won. Gold banking is a product that allows buying and selling gold through a bank account. Compared to 566 billion won at the end of March last year, it surged nearly 70% in a year. It has been rapidly increasing, with 782.2 billion won at the end of last year, 835.3 billion won at the end of January this year, and 916.5 billion won at the end of February.

Despite persistent domestic and international uncertainties, the balance of dollar deposits is decreasing, and gold prices have reached an all-time high, yet there is little movement toward realizing profits. The financial sector views this as reflecting differences in perceptions regarding the trends of the won-dollar exchange rate and gold prices, which are directly linked to profits.

In fact, except for hitting the 1460 won level for two days at the beginning of this month, the won-dollar exchange rate has been maintained in the 1440-1450 won range. A financial sector official said, "Since stability has been maintained for over a month, expectations for further rise are not high, so domestic investors may have realized profits."

Conversely, the international gold price rose to $2,835 per troy ounce (about 31.1g) at the end of January and surpassed $3,000 on the 14th, reaching an all-time high. Despite this, the increase in gold banking balances rather than profit realization is analyzed as a result of demand concentrating on gold banking due to expectations that gold prices will rise further and restrictions on gold bar sales.

Lee Young-hwa, an S&T economist at Shinhan Bank, said, "Although there is a possibility of a short-term reduction in the rate of increase or correction, due to preference demand for safe-haven assets, gold prices are likely to trend upward in the mid to long term," adding, "This expectation seems to be reflected in many investors maintaining their accounts."

The economist added, "Unlike gold prices, the strong dollar phenomenon is somewhat subdued," explaining, "This is because the previously sluggish Chinese and European economies are recovering, while the U.S. economy faces increasing uncertainties." He continued, "However, since the dollar is a key currency and also has the nature of a safe-haven asset, there is an offsetting aspect," and predicted, "We need to observe indicators through the first half of the year to see which factor will carry more weight."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)