Operating Loss of 167.6 Billion KRW Last Year

Deficit Widens Despite Parent Company Support

Accumulated Deficit Grows to 529 Billion KRW

Another Challenging Year Ahead Amid Market Slowdown

SK Nexilis, the global No. 1 company in the secondary battery copper foil market, recorded a large-scale operating loss and negative growth last year due to the prolonged chasm (temporary demand stagnation) in the electric vehicle market. Despite substantial support such as capital injection from its parent company SKC, which has positioned secondary battery materials as a new growth engine, it is analyzed that the fallout from the sluggish market conditions could not be avoided.

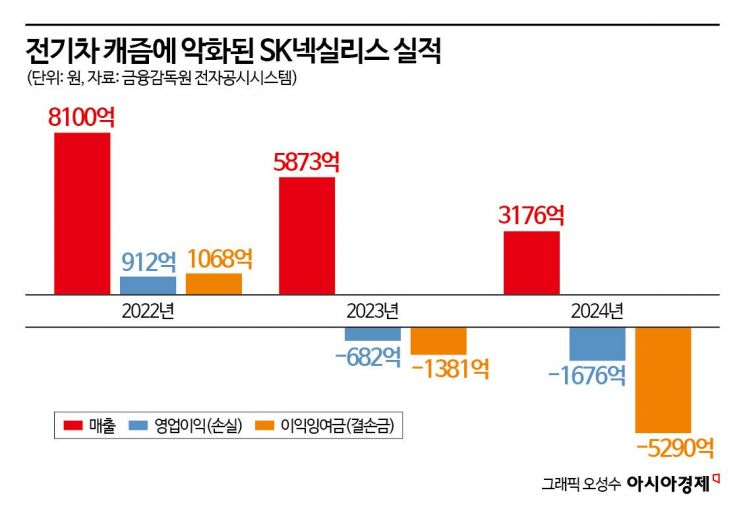

According to the Financial Supervisory Service's electronic disclosure system on the 19th, SK Nexilis posted an operating loss of 167.6 billion KRW on a consolidated basis last year. This represents a 145.7% increase in the deficit compared to the previous year (68.2 billion KRW operating loss). The slowdown in the electric vehicle market, coupled with difficulties in the copper foil market for secondary batteries, was reflected in the valuation of goodwill and intangible assets, resulting in impairment losses of about 90 billion KRW.

Sales also declined. SK Nexilis' sales last year were 315.7 billion KRW, down 46.2% from 587.3 billion KRW the previous year. Although this was a result of the market slowdown, it contrasted with competitor Lotte Energy Materials, which, despite posting an operating loss of 66.4 billion KRW last year, achieved sales growth from 809 billion KRW to 902.3 billion KRW compared to the previous year.

SK Nexilis is regarded as a global leader in the copper foil sector, a core material for electric vehicle batteries. Leveraging its technology to produce thin copper foils of 4㎛ and 6㎛, it has maintained a market share exceeding 20% globally. After being acquired by SKC in 2020, it expanded production capacity and actively entered overseas markets, showing significant growth. In 2022, it recorded sales of 810 billion KRW and an operating profit of 91.2 billion KRW.

However, SK Nexilis' growth and profitability both deteriorated following the slowdown in the electric vehicle market. In 2023, it experienced negative growth for the first time since the SKC acquisition, and operating profit turned into a loss. Last year, the operating loss widened, and accumulated deficit grew to 529 billion KRW. The accumulated deficit is the opposite of retained earnings, representing the cumulative losses incurred during business operations. As a result, capital decreases, adversely affecting the company's financial soundness.

The deterioration in SK Nexilis' performance also impacts SKC. Previously, SKC sold its core film business and restructured its business by adopting secondary battery materials as a new growth engine. Last year, to improve management efficiency, SKC made SK Nexilis a wholly owned subsidiary and injected 700 billion KRW through a paid-in capital increase. Thanks to this, SK Nexilis was able to partially repay over one trillion KRW in increased borrowings, easing its financial strain; however, SKC's financial condition worsened. SKC's net working capital last year was -724.5 billion KRW, turning negative from 235.6 billion KRW the previous year.

The problem is that market prospects this year are also not bright. In the U.S., discussions are underway to abolish electric vehicle subsidies following the inauguration of the Trump administration's second term, and Europe is showing signs of changes in eco-friendly policies such as carbon dioxide emission regulations. Additionally, Chinese companies are strengthening their position based on the domestic market, threatening the standing of domestic companies.

SKC and SK Nexilis plan to improve plant operating rates and expand new supply contracts to escape losses and reignite growth engines. However, with the electric vehicle chasm expected to continue, the possibility of a rebound remains uncertain. An SKC official said, "With the completion of the Malaysia plant, the plant operating rate is expected to double compared to last year," adding, "We are expecting performance improvement."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)