Expansion of Health-Conscious Consumers in Their 20s and 30s

Pharmaceutical Companies Enter the Market, Emphasizing Expertise

#Mr. A, a mid-40s office worker, takes a handful of health supplements arranged on one side of his desk as soon as he arrives at work. In the morning, he takes probiotics, multivitamins, vitamin D, omega-3, milk thistle, and lutein. When he feels a bit drowsy in the afternoon, he takes out a red ginseng stick and chews it, and before going to bed at night, he also takes magnesium and collagen. Mr. A said, "At an age when I am extremely busy both at work and at home, I feel my stamina declining year by year, so I take everything that is good for my body," adding, "Although it costs a considerable amount every month, if the effects are good, I am willing to buy even slightly expensive products."

As interest in health and well-being has increased, it has become an era where anyone can easily purchase health functional foods (HFF) and take one or more types regularly. The recent controversy surrounding the 'Daiso' brand HFF, which attracted attention due to its low price, even led to conflicts between some pharmaceutical companies and pharmacist groups and intervention by the Fair Trade Commission, reflecting the high interest in HFF.

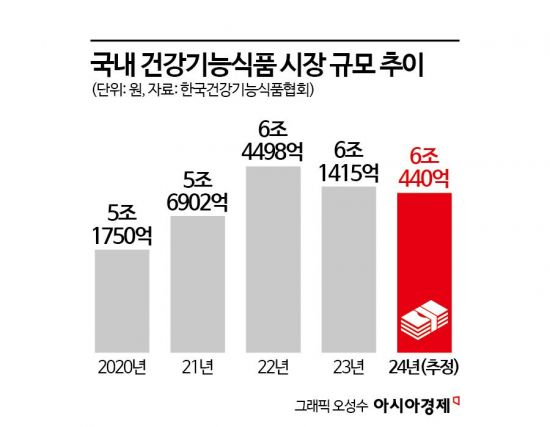

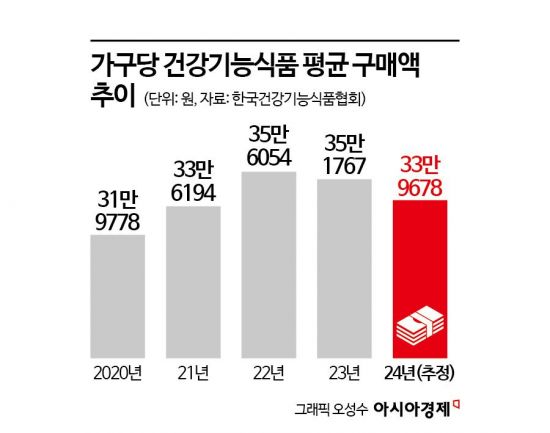

Health functional foods refer to foods manufactured or processed using ingredients or components recognized by the Ministry of Food and Drug Safety (MFDS) based on scientific evidence to have beneficial functions for the human body. However, as the name implies, they are simply 'foods' and are distinguished from 'medicines' taken to treat or prevent diseases. According to the Korea Health Supplements Association on the 19th, the domestic HFF market size, which was around 5 trillion won in 2020, grew to 6.044 trillion won last year. The purchase experience rate of HFF was 82.1%, meaning 8 out of 10 households in Korea purchased HFF at least once a year, and the average purchase amount per household was about 340,000 won annually.

Although the HFF market, which grew rapidly during the COVID-19 period, has shown some stagnation over the past 2-3 years, the aging society with an increasing population of elderly consumers with purchasing power, along with a growing trend among people in their 20s to 40s to prioritize health, are reasons why companies are newly entering or strengthening their businesses in the HFF market.

Lee Jung-min, CEO of Trend Lab 506, analyzed, "The HFF market has entered an era of a 'market for everyone,' expanding beyond specific age or gender limits to all age groups," adding, "The younger generation is rapidly emerging as a major consumer group by showing interest in issues such as 'premature aging,' 'obesity prevention,' and 'stress management.'" As of 2023, there are about 127,400 domestic health functional food manufacturers registered with the MFDS, producing more than 37,000 product types.

While there are 'steady sellers' that consumers trust and purchase over a long period, such as red ginseng or vitamin products, the popularity of HFF tends to be heavily influenced by trends in specific ingredients, advertising, and word-of-mouth marketing. For example, probiotics were once essential due to the importance of gut health, followed by a flood of milk thistle products claiming liver protection effects, and collagen products gaining popularity for skin improvement.

Some products see a surge in sales after being mentioned by popular celebrities on broadcasts, while YouTubers and influencers conduct viral marketing through social media and even organize group purchases, exerting absolute influence on sales. Since these items can become huge hits if they catch the trend well, many small companies flood the market with hundreds of similar products, according to industry insiders.

Professor Lee Eun-hee of Inha University's Department of Consumer Studies pointed out, "HFF is more sensitive to trends than any other food and consumers have free choice, so from the perspective of sellers and manufacturers, it has long been a fiercely competitive market," adding, "Because continuous advertising and marketing are necessary, costs are incurred, which inevitably reflect in product prices."

The national interest and controversy over Daiso's low-priced HFF are analyzed to stem from its differentiation from existing HFF in terms of price and distribution channels. The domestic HFF market is heavily skewed toward online sales, accounting for over 70%, and pricing policies encourage bulk purchases such as 'buy one get one free' or 3- or 6-month supplies, whereas Daiso emphasizes the advantage of offline purchase where consumers can directly see the products and buy small quantities (one month) at a time.

As the HFF market grows like this, competition among pharmaceutical companies around HFF is also heating up. Pharmaceutical companies can easily develop and produce HFF using their existing pharmaceutical manufacturing facilities, and thanks to the increased popularity of HFF, they can relatively easily increase sales.

There are even cases where existing representative medicines have been converted into HFF. Dong-A Pharmaceutical re-launched 'Circulan,' originally approved as an over-the-counter blood circulation enhancer, as an HFF. Similar cases include Huons' 'Salsarajin,' initially launched as an abdominal obesity treatment, and Anguk Pharmaceutical's eye disease medicine 'Tobicom.'

An official from the distribution industry said, "Although it is still early, as Daiso's HFF sales are coming out smoothly, companies have confirmed the possibility of offline sales of HFF, and consumers have reconsidered the reasonable prices of HFF," adding, "Even if some pharmaceutical companies give up entering Daiso due to opposition from pharmacies, it is highly likely that other companies will enter soon."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.