Vice President of U.S. Asset Management Firm Highlights 'Seohak Gaemi' Investment Patterns in Newsletter

"No" to K-Stock Culture

Points Out Volatility and High-Risk Investment Tendencies

"Where many Koreans gather, that place is the Gukjang (domestic stock market)." This is a popular phrase used by domestic stock investors in online stock communities. It means that even in overseas stock markets, if there are many Korean investors, the flow changes just like the KOSPI and KOSDAQ. It also contains a sarcastic meaning toward the so-called 'Seohak Gaemi' (Korean investors in overseas stocks) who pursue excessive risk.

The American asset management firm 'Acadian' pointed out that some stocks in the U.S. stock market are becoming Korean-ized, identifying the recently inflowing Seohak Gaemi as the cause.

The 'Squid Game' Koreans Play in the U.S. Stock Market

Owen A. Lamont, Senior Vice President of Acadian, posted a newsletter titled 'Squid Game Stock Market' on the official website earlier this month. Lamont publishes a newsletter called Owenomics every month, mainly analyzing overheated stocks where speculative forces gather. In this newsletter, he likened some Seohak Gaemi investing in U.S. stocks to participants in the 'Squid Game.'

He explained, "As of last year, the amount of U.S. stocks held by Korean individual investors was $112.1 billion (about 162 trillion KRW), which is only 0.2% of the total market capitalization of the U.S. stock market," but added that they exert considerable influence on certain small-cap stocks. The representative stocks he pointed out include quantum computing companies.

According to the Korea Securities Depository's data on U.S. stock purchase settlements (based on February-March), IonQ ranks 10th and Rigetti Computing ranks 15th. Both are quantum computing startups listed on the U.S. Nasdaq, and IonQ has drawn domestic attention because one of its early founders is a Korean researcher.

Lamont said that at a certain point, Korean investors held 31% of the total shares of these quantum computing companies, describing this as "bizarre and violent." He also pointed out that "(Seohak Gaemi) take tremendous risks to get rich quickly" and "seem to have an amazing ability to pick only stocks that will soon crash."

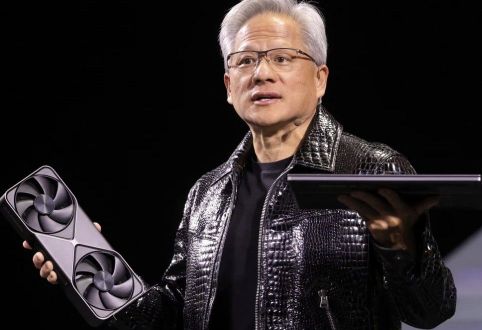

In fact, both IonQ and Rigetti hit their highest prices between the end of last year and early this year but have since dropped by nearly half. This was a result of a panic sell-off triggered after Jensen Huang, CEO of Nvidia, made negative remarks about the commercialization of quantum computing on January 8 (local time).

"The U.S. is also 'Korean-izing'... The Cause is Market Nihilism"

Quantum computing companies favored by foreign retail investors experienced a sharp decline in stock prices after Jensen Huang, CEO of Nvidia, stated at CES 2025 in January that "commercialization will take 20 years." Photo by Reuters Yonhap News

Quantum computing companies favored by foreign retail investors experienced a sharp decline in stock prices after Jensen Huang, CEO of Nvidia, stated at CES 2025 in January that "commercialization will take 20 years." Photo by Reuters Yonhap News

This is not the first time Lamont has focused on the investment patterns of Seohak Gaemi. In a newsletter published in June last year, he expressed concern that "the U.S. stock market is becoming Korean-ized." The Koreanization of the stock market, as he defined it, refers to phenomena such as sudden inflows of funds into popular stocks treated as 'theme stocks' and an obsession with high-risk products like leveraged ETFs.

At that time, Lamont closely analyzed the excessive risk-seeking culture seen in Korean securities markets such as KOSPI and KOSDAQ and explained why the 'Koreanization of capital markets' is dangerous. He identified the biggest characteristic of Korean individual investors, or ants, as 'market nihilism.' He defined ants as "a community that believes the market system is rigged against individuals from the start," explaining that "because of this, they see the market as a 'speculative tool to make quick money' and pursue high volatility."

He also viewed the strong opposition some Korean investors have toward short-selling systems as stemming from this nihilistic perspective. Furthermore, he argued that markets dominated by nihilism focus only on volatility for short-term profits rather than corporate value, which ultimately leads to widespread manipulation and fraud. Lamont emphasized repeatedly, "American individual investors are not yet as nihilistic as Koreans," but added, "I enjoy Korean food, music, TV, and movies, but not Korean stock culture. Please say 'No' to K-stock culture."

"After COVID-19, Seohak Gaemi Prefer High-Growth U.S. Tech Stocks"

Some individual investors prefer high-risk investments regardless of nationality, and this is a repeated phenomenon. In Japan, speculative investments were popular until just before the end of the bubble boom in 1989. Photo by AFP Yonhap News

Some individual investors prefer high-risk investments regardless of nationality, and this is a repeated phenomenon. In Japan, speculative investments were popular until just before the end of the bubble boom in 1989. Photo by AFP Yonhap News

In fact, domestic investors holding U.S. stocks seem to prefer high volatility. A securities firm official who requested anonymity said, "After the COVID-19 pandemic, as the U.S. stock market rebounded, Korean investors began to take active interest in U.S. stocks, and the companies favored by Seohak Gaemi at that time were high-growth tech stocks like Tesla." He added, "Since then, Seohak Gaemi have shown a tendency to pursue higher returns rather than safe assets. The recent popularity of 3x Tesla (a 3x leveraged product on Tesla stock) or SOXL (a 3x leveraged product on semiconductor company indices) is an extension of that phenomenon."

However, Lamont points out that individual investors obsessed with high-risk investments have existed regardless of nationality in the past. He said, "Just before the Great Depression in 1929, there was a high-leverage investment craze in New York. In 1989, Japanese 'salarymen' were the main speculative forces. In 2021, it was U.S. meme stock investors, and now it's Korea's turn." He advised, "If you are an individual investor, invest in boring assets. When offered to join the 'Squid Game,' the wisest decision is not to participate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.