Domestic Milk Faces Double Whammy: Declining Consumption and FTA Tariff Elimination

Product Diversification Strategies to Maintain Market Share

The domestic dairy industry in South Korea has begun devising countermeasures in response to the decline in milk consumption and the elimination of import tariffs on milk due to Free Trade Agreements (FTAs). Starting next year, milk from the United States and Europe will be imported tariff-free, which is expected to reduce the price competitiveness of domestic products.

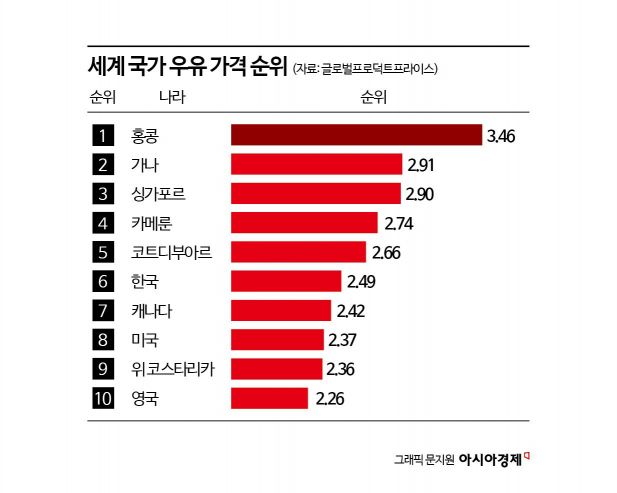

According to the global price comparison site GlobalProductPrice on the 18th, the price of milk per 1 liter in South Korea is $2.49, ranking 6th in the world. The price of milk in South Korea is higher than the global average ($1.62) and is more expensive than in major countries such as Canada ($2.42), the United States ($2.37), Switzerland ($2.20), and Japan ($1.51).

Dairy products are displayed at a large supermarket in Yangjae-dong, Seoul, on the 30th, as the raw milk price for this year, which has been under negotiation for over a month, is expected to be frozen. Photo by Jo Yongjun jun21@

Dairy products are displayed at a large supermarket in Yangjae-dong, Seoul, on the 30th, as the raw milk price for this year, which has been under negotiation for over a month, is expected to be frozen. Photo by Jo Yongjun jun21@

Domestic Milk Competitiveness Declines... The Problem is High Prices

The reason for the high price of domestic milk is the increase in raw milk prices. The price of raw milk for drinking, which was 910 KRW per liter in 2014, rose by 19% to 1,084 KRW last year. This is largely due to the raw milk price linkage system introduced in 2013. The raw milk price linkage system reflects changes in the price of raw milk produced by dairy farms in the prices of dairy products, applying a production cost linkage method.

Since the implementation of the raw milk price linkage system, raw milk prices have continuously increased for over 10 years. The main factor driving the rise in raw milk production costs is feed costs. Dairy farms rely mostly on imported feed, and currently, feed costs account for more than 50% of raw milk production costs.

Exchange Rate Effects Cause Imported UHT Milk Prices to Soar

Due to the rise in domestic raw milk prices, consumption of imported UHT (ultra-high temperature) milk surged last year. According to the Korea Customs Service, the import volume of UHT milk last year was 48,671 tons, a 30% increase from the previous year. It more than doubled from 23,198 tons in 2021 over three years.

However, due to the recent rise in exchange rates, the price of imported UHT milk has increased to between 2,000 and 4,500 KRW, making it less price-competitive than domestic milk. Prices that were only 1,300 to 1,500 KRW until last year have risen significantly.

According to the United Nations Food and Agriculture Organization (FAO), the global dairy price index last month was 148.7, the highest in 2 years and 4 months since October 2022 (149.2). The prices of German Oldenburger UHT milk (1 liter) and French ?chir? UHT milk (1 liter) sold at Homeplus are 2,590 KRW and 4,590 KRW, respectively. The price of Polish Mlekovita (1 liter) sold online is around 2,000 KRW, exceeding the price of Seoul Milk's 'Na 100' (1 liter) at 2,980 KRW.

Because of this, the import volume of UHT milk in January and February this year was 4,687 tons, a 20% decrease compared to 5,851 tons in the same period last year.

US and European Milk to be Imported Tariff-Free Starting Next Year

However, starting next year, milk from the United States and Europe will be imported tariff-free under FTAs, which is likely to increase price competitiveness again. Currently, import tariffs on milk from the US and Europe are 2.4% and 4.8%, respectively. But these tariffs will be abolished next year, which is expected to offset the effects of exchange rate increases.

In particular, with the increase of low-cost coffee shops, the use of imported milk in the B2B (business-to-business) market is expected to expand. A dairy industry official said, "Although the price of imported UHT milk temporarily rose this year due to exchange rate effects, the situation could change next year," adding, "If US and European milk are imported tariff-free, the price competitiveness of UHT milk will improve." He continued, "There is a trend of using imported UHT milk as a substitute to reduce costs in cafes," and "Although the share of imported UHT milk used in cafes is less than 10%, it is expected to increase if high inflation continues."

Low Birthrate Problem Accelerates Decline in Milk Consumption South Korea's low birthrate is also one of the main factors causing the decline in milk consumption. According to the National Assembly Budget Office, if the total fertility rate remains at 0.70 until 2040, the youth population is expected to sharply decrease from 6.32 million in 2020 to 3.18 million in 2040. The infant and toddler population is expected to drop nearly by half, from 2.63 million to 1.3 million.

Due to these demographic changes, domestic raw milk consumption has been steadily decreasing. According to the Korea Rural Economic Institute, domestic raw milk consumption last year was 4.153 million tons, a 3.6% decrease from the previous year, and the per capita raw milk consumption capacity also decreased by 3.7% to 80.8 kg compared to the previous year.

Companies Seeking New Revenue Models

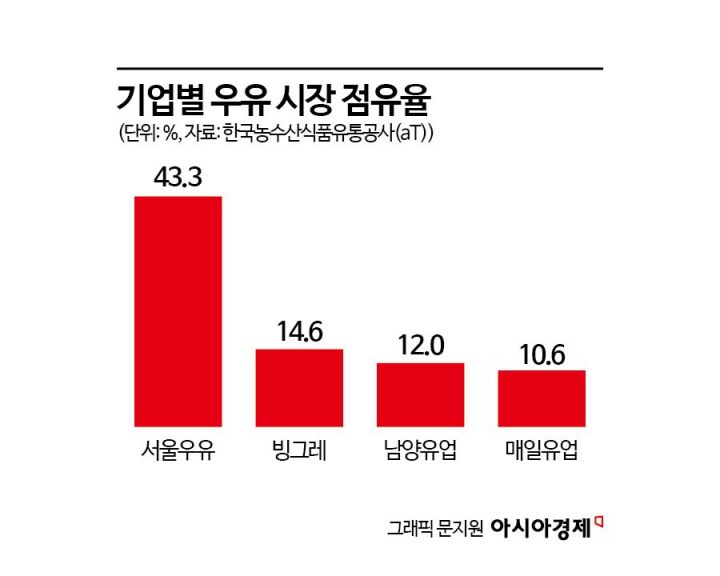

Companies are seeking new revenue models through business diversification. According to the Korea Agro-Fisheries & Food Trade Corporation (aT) Food Industry Statistics Information, Seoul Milk holds the largest market share at 43.3%, followed by Binggrae (14.6%), Namyang Dairy Products (12.0%), and Maeil Dairies (10.6%).

Seoul Milk has strengthened its product line based on high-quality raw milk. The 'A2+ Milk' launched in April last year is made exclusively from cows with the A2 protein genotype, using high-quality raw milk graded as somatic cell count grade 1 and bacterial count grade 1A, containing only A2 protein. The company plans to replace all its products with A2 milk by 2030.

Namyang Dairy Products is pursuing a strategy to expand its B2B market. In January this year, Namyang secured a contract to supply milk to Starbucks Korea. It has also obtained product approval from the Ministry of Food and Drug Safety to produce milk exclusively for cafes. Additionally, it plans to diversify its products by leveraging long-selling products such as 'Delicious Milk GT' and fermented milk 'Bulgari,' and is considering launching new health-focused products. Last year, Namyang released the plant-based beverage 'Floralab,' the protein drink 'Takefit Pro,' and the health functional fermented milk 'Innercare Bone & Joint Protect.'

Maeil Dairies is diversifying its plant-based beverages while focusing on expanding the ready-to-eat meal market. Maeil sells Amazing Oat, Almond Breeze, and Selex Protein. Since entering the ready-to-eat meal market in 2018 with the brand Sangha Farm, Maeil's subsidiary M Seed operates Crystal Jade, Sangha Kitchen, and Il Porno, offering their menus as convenient meals.

A dairy industry official said, "Competition with imported milk is expected to become more intense in the future," adding, "We need to find breakthroughs through cost reduction, product diversification, and targeting the premium market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.