"Finance: Shareholder Returns, IT: Capital Investment Drive Corporate Value"

Encouraging Stronger Shareholder Returns Through Corporate Governance Reform

Capital Expenditures in High-Growth Industries Like IT Must Also Be Evaluated

An analysis has shown that expanding shareholder returns is generally effective in increasing corporate value in South Korea, where shareholder protection is weak. However, it is diagnosed that when constructing the value-up index, industry characteristics should be considered, and not only shareholder returns but also capital investment plans should be evaluated. This is because factors that significantly affect corporate value vary by industry.

In the financial industry, shareholder returns had a relatively high impact on corporate value, whereas in the IT sector, centered on software and semiconductors, capital expenditures had a much greater impact than shareholder returns.On the 17th, the Bank of Korea emphasized this in its BOK Issue Note titled "The Impact of Shareholder Return Policies on Corporate Value." Using data from 3,560 companies in 16 G20 member countries from 2019 to 2023, it conducted an international comparison of shareholder protection and corporate management status in South Korea, followed by an empirical analysis of the impact of expanding shareholder returns on corporate value.

According to the report, South Korea's corporate value remains at a low level compared to growth and stability, and shareholder protection and shareholder return levels are also relatively insufficient. Kim, Senior Manager of the Bank of Korea's National Income General Team, stated, "Looking at the sales growth rate (average annual 2.5% from 2019 to 2023) and debt ratio (2.4), the growth and stability of Korean companies are at a good level, but corporate value evaluated based on price-to-book ratio (PBR) relative to capital and Tobin's Q, a corporate value measurement indicator, is at the lowest level among the comparison countries." He pointed out, "South Korea's PBR (1.4) is lower than high-growth countries (India 5.5) and advanced countries (USA 4.2, UK 3.3), and Tobin's Q (2.1) is also lower than major countries (India 6.2, USA 4.8, UK 3.9)."

Regarding corporate governance and government regulations protecting shareholder interests, South Korea is also lower compared to major analyzed countries. The average shareholder protection score of Korean companies was 6.8, ranking 12th. This is significantly lower than major advanced countries (UK 9.3, USA 8.9) and some emerging countries (Brazil 8.2, India 7.5). The Private Benefit Prevention Index, which measures the level of regulation restraining executives' pursuit of private benefits, was also lower than in major countries at 0.47.

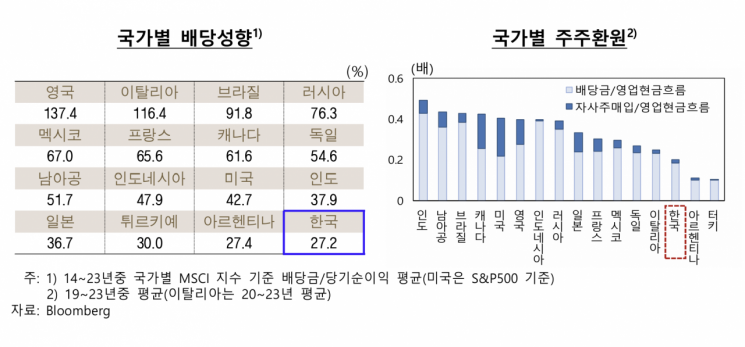

South Korean companies' shareholder return rates, including dividends and share buybacks, were among the lowest compared to the countries analyzed. The dividend payout ratio (27.2) was the lowest in South Korea, and the scale of shareholder returns relative to operating cash flow (0.2) was low, ranking just above T?rkiye (0.1) and Argentina (0.1). Shareholder return methods were concentrated on dividend payments, contrasting with major advanced countries where companies actively conduct share buybacks.

Despite weak shareholder protection and shareholder returns, cash assets were relatively low among the countries analyzed due to active capital expenditures. South Korea's capital expenditure ratio to operating cash flow (0.9) was the second highest among the countries compared. The proportion of cash assets to total assets (0.08) was also lower than major countries (UK 0.12, USA 0.11). Typically, when shareholder protection is weak, companies tend to hold large cash assets within the company because they are reluctant to use surplus funds for shareholder returns. Cash assets can increase corporate value when used for shareholder returns or capital expenditures, but if corporate governance is weak or shareholder protection is insufficient, executives may misuse them privately, negatively affecting corporate value.

The Bank of Korea investigated the impact of shareholder protection levels on companies' cash utilization decisions and whether shareholder returns and cash holding behaviors have a significant relationship with corporate value through panel regression analysis controlling for year, industry, and country effects. The results showed that the higher the shareholder protection level, the more shareholder returns increased and the smaller the cash asset holdings. This means that when shareholder protection is insufficient, the incentive to hold cash that can be used at the discretion of controlling shareholders and executives increases.

Also, the larger the shareholder return scale, the higher the corporate value, and cash assets positively affected corporate value only in companies with sufficiently high shareholder protection levels. Generally, cash assets positively impact corporate value as they are used for capital expenditures, dividends, and precautionary funds. However, when analyzing including the interaction term between shareholder protection level and cash assets, it was found that if the shareholder protection score does not reach a certain level (6-7 points) and the problem of executives' private misuse is significant, it negatively affects corporate value.

The effect of increasing shareholder returns on corporate value was found to be greater in companies with weak shareholder protection. This was based on estimating the relationship between shareholder return scale and corporate value by dividing the sample into groups with high shareholder protection scores (above median) and low groups (below median). Conversely, cash assets positively influenced corporate value expansion in groups with good shareholder protection levels.

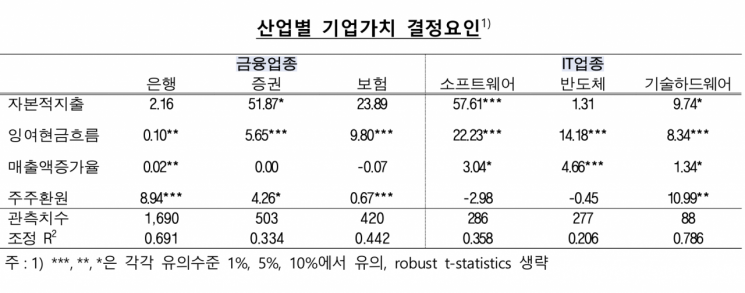

Empirical analysis by industry showed that in high-growth industries like the IT sector, which require large capital expenditures, the impact of shareholder returns on corporate value was limited. Kim said, "In industries requiring large capital expenditures, the effect of enhancing corporate value through capital investment is considered greater." Conversely, industries such as finance, where the need for capital expenditures is low, saw shareholder return expansion have a relatively large impact on increasing corporate value. Capital expenditures were found to have a positive effect on corporate value regardless of shareholder protection and returns, indicating that investment activities are a key factor in enhancing corporate value.

Kim emphasized, "In South Korea, where shareholder protection is weak, expanding shareholder returns is effective in enhancing corporate value," and added, "It is necessary to continuously pursue corporate governance improvements to protect common shareholders in the mid to long term and to enhance investor confidence during corporate splits and mergers."

However, it is analyzed that care must be taken so that shareholder returns do not constrain capital expenditures in the process of promoting disclosure of shareholder return expansion and investment plans that affect corporate value to ensure appropriate market evaluation of companies. Since capital expenditures are an important factor for corporate value in high-growth industries, industry characteristics should be considered when constructing value indices, and capital investment plans as well as shareholder returns should be properly evaluated and reflected. Kim said, "While continuing efforts to improve corporate governance and encouraging stronger shareholder returns, it is necessary to establish a structure where shareholder interest growth and corporate value enhancement through expanded capital expenditures in fast-growing industries proceed simultaneously."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)