Korea Insurance Development Institute Conducts Survey

Post-Retirement Life: Current Workers Value "Financial Capability," Retirees Value "Health"

"2025 Retirement Market Report" to Be Published at Year-End

Images of retirement showed that current workers feel 'fear,' while retirees feel 'freedom.'

The Korea Insurance Development Institute announced on the 17th that it conducted a survey comparing the perceptions of current workers and retirees regarding post-retirement life. The survey was conducted by Gallup Korea in November last year, using proportional sampling of men and women aged 30 to 75 across 17 cities and provinces nationwide. Current workers aged 30 to 59 engaged in their professions participated in a web survey. Retirees aged 55 to 75 were interviewed individually.

When asked about the first word that comes to mind with 'retirement,' current workers chose 'fear,' while retirees selected 'freedom.' Regarding what is most important in post-retirement life, current workers answered 'independent financial capability,' whereas retirees answered 'health.'

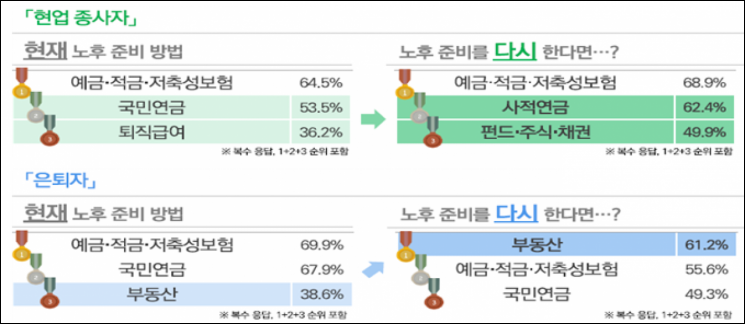

As for the main methods of preparing for old age, both current workers and retirees responded with savings/deposits, savings-type insurance, and the National Pension. When asked which method they would prefer if they were to start preparing for old age again, current workers favored private pensions, funds, stocks, and bonds. Retirees preferred preparing for old age through real estate management. It was found that current workers show high interest in financial products with high returns, while retirees show strong interest in real estate, which is considered a safe asset.

Regarding the health issue of greatest concern in old age, both current workers and retirees ranked dementia as the top concern. Women showed greater worry about dementia than men.

When asked about their willingness to enter specialized nursing facilities for elderly diseases such as dementia and stroke, 5 out of 10 current workers and 4 out of 10 retirees responded affirmatively. Among current workers, women and married individuals (compared to singles including unmarried, divorced, separated, or widowed) showed a significantly higher willingness to enter such facilities. Conversely, among retirees, singles showed a higher willingness than married individuals, and there was little difference by gender.

Survey on preferred methods for preparing for retirement again by current workers and retirees. Provided by the Korea Insurance Development Institute.

Survey on preferred methods for preparing for retirement again by current workers and retirees. Provided by the Korea Insurance Development Institute.

Regarding additional services they would most like to receive when subscribing to insurance products, current workers responded in order of 'regular health checkups,' 'connection to medical institutions,' and 'operation of a 24/7 medical support consultation line.' Retirees showed similar levels of demand for various services such as 'regular health checkups,' 'connection to medical institutions,' 'home care support,' and 'family discounts.'

About insurance services that use wearable devices like smartwatches to monitor health status and provide health management methods or premium discounts, 4 out of 10 current workers expressed willingness to subscribe. Retirees showed lower favorability toward such services. It appears that 'prevention-centered services' actively utilizing new technologies are needed for current workers, while 'customized services' that can meet diverse demands are necessary for retirees.

Huh Chang-eon, President of the Korea Insurance Development Institute, stated, “It is necessary to specifically understand the perceived levels of each consumer group regarding post-retirement life and provide customized insurance products and services that meet the demands of these groups.” He added, “The Institute will continue to provide useful data for the super-aged society by further analyzing various social statistics such as insurance information and data from Statistics Korea, and plans to publish the '2025 Retirement Market Report' within the year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)