Golf Course Spending Fell to 1.9399 Trillion KRW Last Year

Marked Decline from 2.0689 Trillion KRW in Previous Year

Rising Green Fees Drive MZ Generation to Tennis

Park Golf and Affordable Japan, Southeast Asia Destinations Gaining Popularity

Domestic golf courses are facing a crisis. The unprecedented boom during the COVID-19 pandemic has ended, causing difficulties. Golf courses outside the metropolitan area are struggling to the point where tee times remain unbooked. In short, the atmosphere is gloomy. CEO A, who operates a membership golf course in Jeju Island, said, "It is not easy to fill tee times on weekdays," adding, "There are talks that it might be better to host tournaments and collect usage fees."

The revenue of domestic golf courses, which enjoyed a boom due to COVID-19, is rapidly declining. This photo is not related to the article.

The revenue of domestic golf courses, which enjoyed a boom due to COVID-19, is rapidly declining. This photo is not related to the article.

According to the Korea Tourism Data Lab, consumer spending on domestic golf courses is decreasing. From 2018 to 2022, there was a steep upward trend, but it has been declining since 2023. Looking at the trend over the past three years, spending recorded 2.2202 trillion KRW in 2022, then dropped to 2.0689 trillion KRW in 2023, and further decreased to 1.9399 trillion KRW last year. Compared to the peak in 2022, last year saw a decrease of 280.3 billion KRW. The sharp drop in demand is worsening the financial difficulties of golf courses.

Domestic golf courses experienced a COVID-19 boom. According to the 2024 nationwide golf course usage report released by the Korea Golf Course Management Association, the number of golf course users nationwide increased over the past five years: 417.0992 million in 2019, 467.36741 million in 2020, 505.66536 million in 2021, and 505.83383 million in 2022. However, in 2023, the year the endemic era was declared, the number fell to 477.2266 million, a 5.7% decrease from the previous year.

Golf platform company XGOLF recently diagnosed a red light for the domestic golf industry. XGOLF stated, "Golf courses that recorded record-breaking performances and rapid growth during the COVID-19 period are now unable to avoid a downward trend," adding, "The prices for golf course acquisitions, which once soared to unprecedented heights, have plummeted, and although golf course sales are actively proceeding, it is difficult to find buyers." They further analyzed, "This is likely not a simple temporary slump but a structural problem that may prolong."

Korea holds the world's eighth-largest golf course area. As of 2023, there are 532 registered golf courses nationwide, accounting for 89.1% of the total sports facility area. As the number of golf courses increased, profitability has deteriorated, and the departure of MZ generation and female golfers who entered during the COVID-19 period is accelerating. Last year, domestic golf demand recorded a decline for the first time in 20 years. The operating performance of major golf courses decreased by 10-20% compared to 2022.

After COVID-19, golf courses that had been setting record highs in sales thanks to increased corporate card usage began to see their performance decline. The number of golf travelers going abroad has increased, and due to concerns about economic downturns, large corporations are competing to restrict corporate card usage at golf courses. Since golf courses rely on corporate cards for one-third of their sales, the spread of corporate card usage restraint by large companies directly leads to reduced golf course revenue.

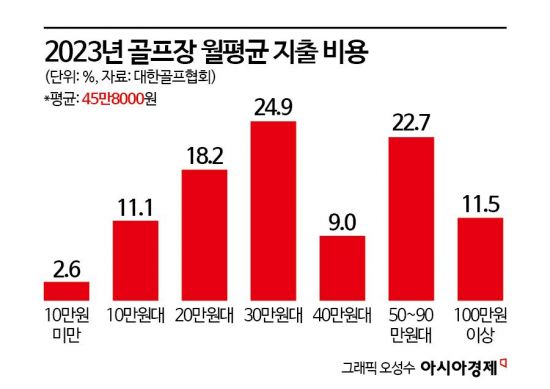

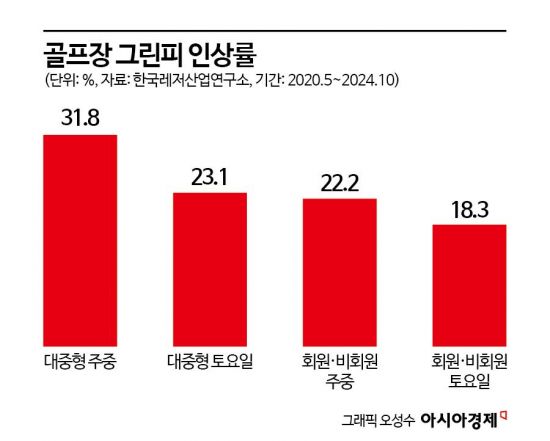

During the COVID-19 boom, domestic golf courses significantly raised green fees. According to the Korea Leisure Industry Research Institute, from May 2020 to October 2024, public golf courses raised weekday green fees by 31.8%, and membership and non-membership golf courses charged 22.2% more on weekdays. Still, customers were abundant. However, from 2023, it became difficult for local golf courses to fill tee times. Due to a caddy shortage, caddy fees have risen 52.5% over the past 14 years. The caddy fee per team, which was 95,000 KRW in 2010, increased by 49,000 KRW to 145,000 KRW as of 2024. The cost of playing golf once in the metropolitan area required about 300,000 to 400,000 KRW per person.

Domestic golf courses became a great source of vitality with the new participation of the MZ generation, but excessive cost increases are causing them to leave. They are moving to tennis and running instead of golf. The main customers of golf, the elderly, are also seeking new hobbies. Park golf, which costs less, is enjoying a boom. Existing golfers are traveling to countries like Japan, Thailand, Malaysia, and Singapore where golf is cheaper. They are also moving to screen golf, which is on the path of technological advancement.

Not only golf courses but also golf apparel continue to experience poor performance. Looking at the sales of the French golf apparel brand Castelbajac, sales fell from 61.8 billion KRW in 2022 to 48.4 billion KRW in 2023 and 40.7 billion KRW in 2024. Castelbajac held a regular shareholders' meeting and changed its company name to Hyungji Global. The equipment industry is also struggling. According to the Korea Customs Service in September last year, golf equipment imports peaked at 12,889 tons in 2022 but decreased by 3.71% in 2023 compared to the previous year. The domestic golf industry, facing a crisis, has entered a survival mode.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.