Overseas Direct Investment Totals $63.95 Billion

U.S. Investment Drops 21.1% Due to Base Effect

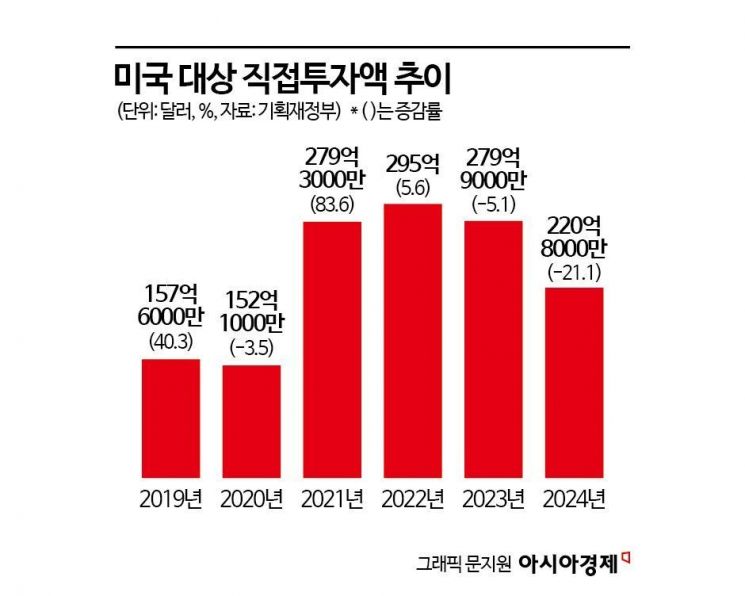

Adjustment Trend After Reaching $29.5 Billion in 2022

Last year, the United States accounted for 40.5% of South Korea's overseas direct investment (ODI). Although the proportion decreased compared to the previous year (48.5%) due to the base effect from a significant increase in U.S. investment, investments in manufacturing industries including semiconductors and batteries continued. Compared to five years ago, the investment amount growth rate reached 40.1%.

The Ministry of Economy and Finance announced on the 14th that last year's overseas direct investment amounted to a total of $63.95 billion, a 1.8% decrease from the previous year ($65.15 billion). Investment amounts continuously declined from the first to the third quarter but rebounded in the fourth quarter, easing the decline compared to the previous year (-20.3%). Net investment, which is total investment minus recovery amounts such as equity sales and liquidations, was $46.61 billion, down 10.3% from the previous year ($51.98 billion).

By country, the largest investment amounts were in the United States ($22.08 billion), the Cayman Islands ($6.63 billion), Luxembourg ($5.99 billion), and Canada ($3.79 billion). Although investments in other countries increased, U.S. investment decreased by 21.1%. Investment in China ($1.81 billion) also declined last year (-4.0%) following the 2023 decrease (-78.1%) due to the slowdown in the Chinese economy.

The decrease in U.S. overseas direct investment is largely due to the base effect. The U.S., which used to compete with China for the top spot, has maintained the number one position since 2010. Investment, which was $15.76 billion in 2019, surged to $27.93 billion in 2021 and reached a record high of $29.5 billion in 2022 since related statistics began. In fact, compared to five years ago, last year's investment growth rate was 40.1%.

Investment in advanced industries in the U.S. is also continuing. Last year, investment in manufacturing in the U.S., including semiconductors and batteries, was $3.92 billion, accounting for 24.2% of total manufacturing investment. Manufacturing accounted for 17.7% of total U.S. investment.

A Ministry of Economy and Finance official explained, "Since COVID-19, many local production facilities have been established in the U.S., especially in semiconductors and automobiles, leading to a significant increase in related investments until 2023. Although investment continued to increase last year, the base effect caused a decrease in (U.S. investment amounts)." The official added, "The decrease in manufacturing investment last year was also due to this effect."

By industry last year, the largest investment amounts were in finance and insurance ($27.39 billion), manufacturing ($16.17 billion), real estate ($5.6 billion), mining ($3.9 billion), and information and communications ($3.06 billion). Although investments in major industries increased, manufacturing investment decreased by 21.6% compared to the previous year, offsetting the increases in other industries.

By region, investments were highest in North America ($25.88 billion), Europe ($13.87 billion), Asia ($12.45 billion), and Latin America ($9.15 billion). Although North American investment decreased by 18.1%, European investment increased by 25.5%, raising Europe's share of total investment by 4.7 percentage points to 21.7%.

The Ministry of Economy and Finance evaluated that despite ongoing global high interest rates and persistent uncertainties such as geopolitical risks, the decline in investment narrowed, showing a solid trend. They viewed this as a result of complex investment demand, including the activation of alternative asset investments by pension funds in developed countries and continued investment by Korean companies in advanced U.S. industries (semiconductors, batteries, etc.).

The Ministry stated, "With the strengthening of global protectionism and the restructuring of supply chains, uncertainties in the trade environment are expanding. We plan to strengthen communication and cooperation with major investment destination countries in various ways to ensure that Korean companies expanding overseas can conduct stable business activities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)