Bank of Korea Releases Monetary and Credit Policy Report

Household Loans Unlikely to Expand Significantly in the Short Term

Eased Bank Loan Management and Lifting of Land Transaction Permit Zones May Spur Growth

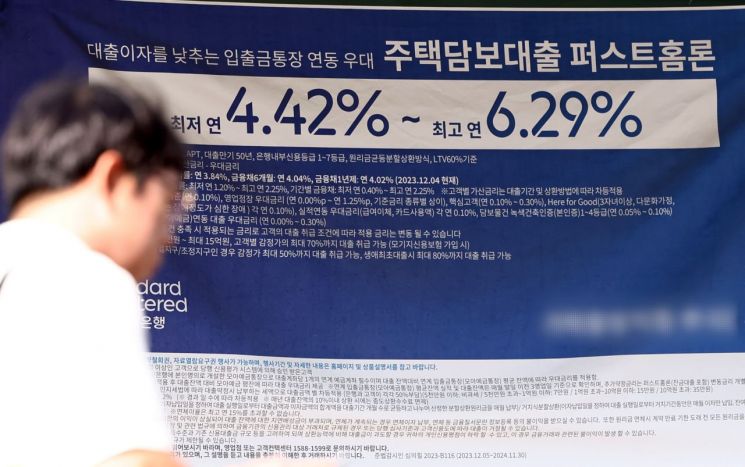

Amid a renewed increase in household loans at the beginning of the year, there is an assessment that the easing of banks' management policies and the lifting of land transaction permit zones in the Gangnam area of Seoul could stimulate the growth of household loans again.

On the 12th, the Bank of Korea forecasted in its Monetary and Credit Policy Report that the flow of household loans this year is highly uncertain due to mixed upward and downward factors in the housing market.

Considering the recent adjustment trend in the housing market, it is expected that household loans will not expand significantly in the short term. However, ▲easing financial conditions ▲demand for jeonse (long-term deposit rental) funds due to the resolution of reverse jeonse situations are seen as upward factors, while ▲a decrease in pre-sale and move-in volumes ▲a decline in investment demand due to economic slowdown are considered downward factors.

From the supply side, banks are expected to manage household debt growth on a monthly and quarterly basis in line with government policies to keep the growth rate within the nominal Gross Domestic Product (GDP) growth rate. However, the scale of policy loan supply is unlikely to decrease significantly compared to last year. The household debt-to-nominal GDP ratio fell from 97.3% at the end of 2022 to 90.5% last year. The Bank of Korea considers an appropriate household debt ratio to be around 80%.

The head of the Market General Team at the Financial Market Department, who authored the report, stated, "It is particularly necessary to pay attention to the possibility that the easing of banks' household loan management measures due to relaxed financial conditions and the lifting of land transaction permit zones in some areas of Seoul could stimulate expectations of housing price increases as well as the growth of household debt." He added, "If the household loan growth is expected to expand again, it is necessary to respond by strengthening additional macroprudential regulations, such as expanding the scope of the Debt Service Ratio (DSR) application."

Meanwhile, the flow of household loans last year was analyzed to have clearly slowed down following the contraction of housing price increases in the metropolitan area after September. The increase in household loans, which approached 10 trillion won in August last year, shrank to between 4 trillion and 5 trillion won from September to December. This year, it decreased due to seasonal factors in January but turned to an increase of around 4 trillion won last month.

The team leader explained, "The reduction in the increase of housing-related loans within the banking sector led the slowdown in household loan growth," and analyzed, "In the case of policy loans, demand from low-income and real users continued steadily due to relatively favorable loan conditions, maintaining an increase of 2 to 3 trillion won per month."

By purpose, not only loans for housing purchases but also housing loans for purposes other than home purchase, such as living stabilization funds and refinancing, decreased. Although loan demand shifted from banks to non-bank sectors, the Bank of Korea evaluated that it did not expand to a level that would increase the total volume of household loans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)