Transactions of 5 Billion KRW Apartments Surge 1.56 Times

2.51 Times Increase Compared to Last Year

Luxury Home Demand Rises as Number of Wealthy Individuals Grows

The number of transactions for ultra-high-priced apartments with actual transaction prices exceeding 5 billion KRW increased by 2.51 times last year. The number of transactions and prices also rose in January and February of this year compared to last year. As the number of 'super-rich' (ultra-high net worth individuals) increased, demand for luxury housing grew, and with various regulations breaking the traditional investment formula of wealthy individuals being multi-homeowners, preference for luxury homes has risen. However, experts predict that this increase in high-priced housing transactions is unlikely to spread to the general apartment market.

Transactions of 5 Billion KRW Apartments Increased 2.51 Times

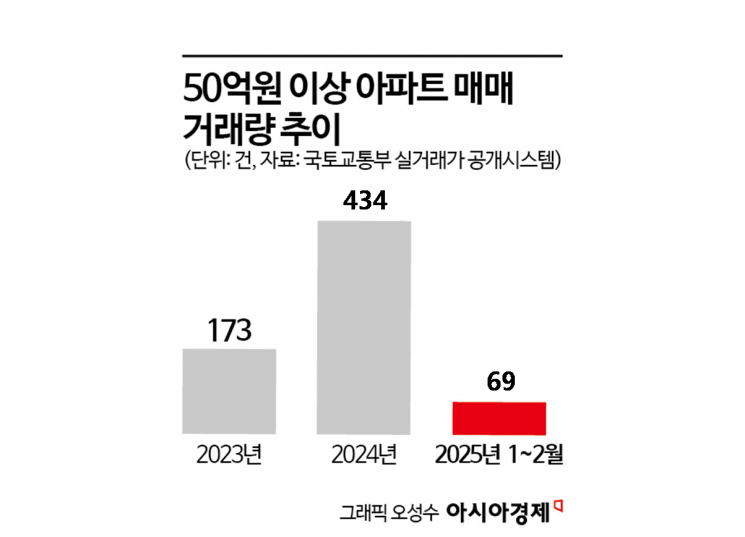

According to the Ministry of Land, Infrastructure and Transport's actual transaction price disclosure system on the 12th, the number of apartment sales nationwide priced at 5 billion KRW or more last year was 434, which is 2.51 times higher compared to 173 transactions the previous year. The number of luxury apartment transactions has continued to increase this year following last year. The transaction volume for January and February totaled 69, which is 1.56 times more than the 44 transactions in the same period last year.

Transactions frequently occurred in areas lined with ultra-high-priced homes. Deals took place in Gangnam-gu, Seocho-gu, Yongsan-gu, as well as Seongdong-gu and Yeouido. The highest-priced transaction last month was at Acro Seoul Forest in Seongsu-dong 1-ga. A unit with a net floor area of 159.6㎡ was sold for 13.5 billion KRW to a new owner. A 244.3㎡ unit at Nine One Hannam in Hannam-dong, Yongsan-gu, was traded for 10.2 billion KRW.

The increase in transaction volume led to price rises. A 116.92㎡ unit at Raemian One Bailey in Banpo-dong, which previously had a highest price of 6.2 billion KRW, was sold for 7.1 billion KRW last month. A 165㎡ unit at Banpo Xi in Banpo-dong was traded for 5.25 billion KRW in June last year, but last month the price rose to 5.8 billion KRW. A 235㎡ unit at Hannam The Hill in Hannam-dong, Yongsan-gu, increased from 9.45 billion KRW in January last year to 10.9 billion KRW within one year.

Wealthy Individuals Purchase One Home for Actual Residence

The recent increase in transactions is analyzed to be due to rising demand. According to Hyundai Motor Securities, the number of people with total assets exceeding 1 billion KRW increased from 296,000 in 2018 to 422,000 in 2023. During the same period, those with assets over 10 billion KRW rose from 22,000 to 29,000, and ultra-high net worth individuals with assets exceeding 30 billion KRW increased from 5,700 to about 10,000. Hyundai Motor Securities stated, "While there are few newly built luxury homes currently available for move-in, the number of wealthy individuals capable of purchasing such properties is increasing," and predicted, "The luxury housing market is expected to maintain a supply-demand imbalance favoring demand for some time."

There is also an analysis that the formula 'wealthy individuals = multi-homeowners' has been broken. Instead of buying multiple luxury homes, more wealthy individuals are purchasing one top-tier home for residence and investing funds in other assets. This differs from those who buy a 'smart one home' by 'Yeongkkeul' (borrowing to the limit), as many now own only one home. Park Won-gap, Senior Real Estate Specialist at KB Kookmin Bank, said, "Investment trends have changed compared to the past," adding, "The recent trend is to own one home for actual residence and manage other financial assets such as securities and virtual assets."

This year’s lifting of land transaction permission zones (Toheoguyeok) and the reduction of the comprehensive real estate tax’s fair market value ratio from 100% to 60% also seem to have had an impact. However, luxury home transactions were already on the rise before Seoul City’s decision to lift the Toheoguyeok last month, and transactions were active not only in the areas benefiting from the lifting but also in Yongsan-gu, Seongdong-gu, and Yeouido.

Experts predict that the increase in ultra-high-priced home transactions will not have a significant impact on the general real estate market. Yoon Soo-min, Real Estate Specialist at NH Nonghyup Bank, explained, "The demand base for luxury homes, which are given rarity, is completely different from the general market," adding, "Unless the boundary of luxury homes is broken down and prices decrease, these two markets should be viewed separately."

Kim Je-gyeong, Director of Toomi Real Estate Consulting, said, "Because there is continuous demand for luxury homes in prime areas, transaction volume and prices are rising," but added, "In the general apartment market, due to reasons such as real estate stagnation, sellers outnumber buyers, so the warmth from the increase in luxury home transactions is not spreading to other areas."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)