National Assembly Seminar on the "K Duty-Free Industry"

Duty-Free Recession Driven by Changes in Tourist Shopping Behavior and Lower Average Spending

Experts: "Incheon Airport Rent Should Be Reduced and Collection Structure Overhauled"

Voices have emerged calling for improvements to the rent calculation structure of duty-free shops operating at Incheon International Airport. Although the number of departing passengers has surged since COVID-19, the duty-free industry continues to struggle, prompting calls for Incheon International Airport Corporation to devise drastic measures.

On the 11th, Professor Hong Gyuseon of the Department of Tourism at Dong Seoul University stated at the seminar titled "Diagnosing the Crisis and Seeking Solutions in the Aviation and Tourism Industry: Focusing on the K Duty-Free Industry," held at the National Assembly Members' Office Building in Seoul, "To restore the duty-free industry at Incheon Airport, the rent burden must be eased," adding, "If duty-free shops collapse and there are no people at the airport, both Incheon Airport and its users will suffer."

Changes in Foreigners' Shopping Behavior... Need to Revise Incheon Airport Duty-Free Rent Collection Structure

Currently, the rent structure at Incheon Airport is calculated by multiplying the total number of departing passengers at the airport by the rent per passenger. This means that even if the number of duty-free shoppers decreases, rent increases if the number of departing passengers rises. As a result, although the duty-free business conditions have worsened compared to before COVID-19, the total rent at Incheon Airport has rapidly soared. Last year, the total rent for duty-free shops at Incheon Airport was 644.5 billion KRW, an increase of about 500 billion KRW compared to 140.3 billion KRW in 2022, while the duty-free market sales dropped from 17 trillion KRW to 14 trillion KRW during the same period.

Professor Hong explained, "Duty-free shops at Incheon Airport are compensating for excessive rent burdens with downtown duty-free sales," adding, "The current rent collection structure based on the number of travelers is unsustainable and should be adjusted differentially by considering factors such as age, travel route, length of stay, and transfer status to alleviate rent burdens."

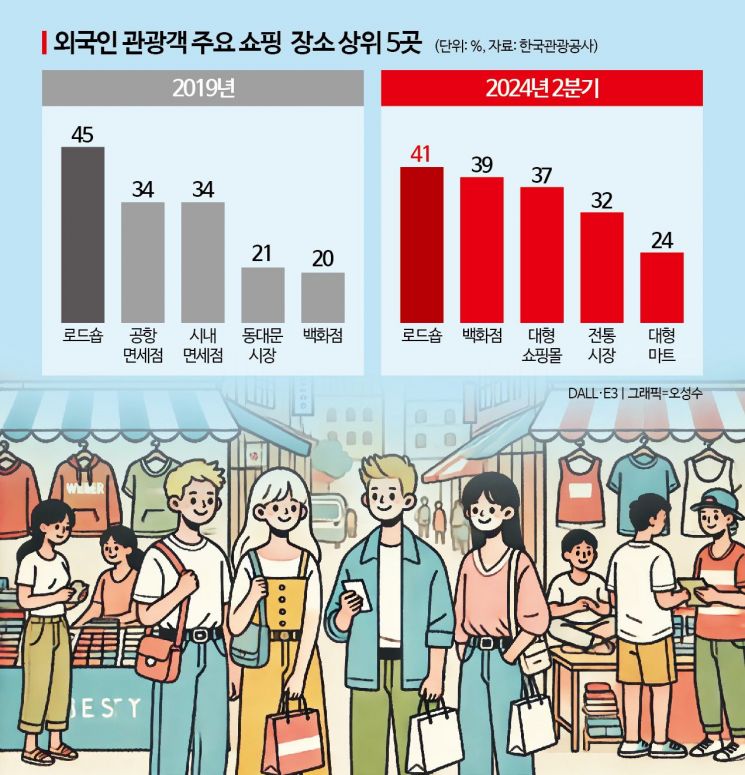

The stagnation in the duty-free industry is confirmed to be due to changes in foreign tourists' shopping tourism patterns, mainly among Chinese visitors, and a lowered average spending per customer. Senior Research Fellow Kim Sookkyung of the Korea Institute for Industrial Economics and Trade, who presented at the discussion, explained, "Between 2018 and 2019, the top five major shopping places for foreign tourists were road shops, airport duty-free shops, downtown duty-free shops, Dongdaemun Market, and department stores, but in 2024, duty-free shops are no longer included." Notably, among the top 10 industries for Chinese tourists, the share of duty-free shops was 63% in 2019 but dropped sharply to 13% last year.

In fact, while the number of foreign tourists visiting duty-free shops has increased, the number of tourists purchasing goods at duty-free shops has significantly decreased. The foreign tourist purchase conversion rate, which indicates the proportion of duty-free shoppers among duty-free tourists, was 114.4% in 2019 but halved to 54.6% in 2023 and 57% in 2024.

Research Fellow Kim said, "To reach the 2019 level of duty-free sales, total duty-free sales need to increase by 75%, and Incheon Airport duty-free sales need to grow by 39%," adding, "Since foreign tourists' shopping behaviors are unlikely to improve quickly, significant efforts and considerations are necessary."

"65% of Incheon Airport's Non-Aviation Revenue, Time to Implement Drastic Support Measures"

Participants in the seminar titled "Diagnosing the Crisis and Seeking Solutions in the Aviation and Tourism Industry: Focusing on the K Duty-Free Industry," held on the 11th at the National Assembly Members' Office Building in Seoul. From the left: Seongbin Lim, Deputy Manager of Commercial Services at Incheon International Airport Corporation; Sangdong Go, Professor of Tourism English at Youngjin Cyber University; Gangseok Lee, Professor of Aviation Traffic and Logistics at Hanseo University; Yungeun Shin, Director of Aviation Policy at the Ministry of Land, Infrastructure and Transport.

Participants in the seminar titled "Diagnosing the Crisis and Seeking Solutions in the Aviation and Tourism Industry: Focusing on the K Duty-Free Industry," held on the 11th at the National Assembly Members' Office Building in Seoul. From the left: Seongbin Lim, Deputy Manager of Commercial Services at Incheon International Airport Corporation; Sangdong Go, Professor of Tourism English at Youngjin Cyber University; Gangseok Lee, Professor of Aviation Traffic and Logistics at Hanseo University; Yungeun Shin, Director of Aviation Policy at the Ministry of Land, Infrastructure and Transport.

During the subsequent discussion, opinions were voiced that rent at Incheon Airport should be lowered due to the difficult situation of duty-free shops. Professor Ko Sangdong of the Department of Tourism English at Youngjin Cyber University argued, "The focus should be on alleviating the cries of duty-free shops at Incheon Airport, and drastic support measures such as rent reductions are necessary."

Professor Ko stated, "Incheon Airport was selected as the world's top one or two global best airports and achieved remarkable development largely due to the financial contributions of duty-free shops," emphasizing, "Even if self-help measures are left to the duty-free shops themselves, progressive actions regarding rent are necessary."

Professor Ko pointed out the revenue structure of Incheon International Airport Corporation and said that the proportion of non-aviation revenue should be gradually reduced in the long term. Currently, Incheon Airport's revenue structure consists of about 35% aviation revenue and 65% non-aviation revenue. Non-aviation revenue mainly comes from duty-free shop commissions and real estate rents. In comparison, the aviation revenue proportions at Heathrow Airport in the UK, Amsterdam Airport Schiphol in the Netherlands, and Frankfurt Airport in Germany are about 57-60%. He concluded by raising his voice, saying, "Leaving the operation of duty-free shops, which continue to run at a loss, as is will lead to the loss of momentum for Incheon Airport."

Professor Lee Gangseok of the Department of Air Traffic and Logistics at Hanseo University mentioned the concept of an "airport economic zone," arguing that a long-term ecosystem should be created where duty-free shops can benefit. The airport economic zone refers to an airport-centered industrial ecosystem that creates new economic value linked to the airport's air transport network. By establishing an airport economic zone and providing various benefits such as tax and fee reductions, duty-free operators could also enjoy these benefits.

Professor Lee said, "There is a way to form cooperative governance entities involving the central government, airport corporation, airlines, and private sector to receive legal support and collaborate," adding, "In the short term, adjusting rent (currently calculated per passenger) is necessary to resolve the accumulated deficits of airport duty-free shops."

Government discussants and representatives from Incheon International Airport Corporation expressed their intention to support improvements in the duty-free industry's conditions through ongoing discussions. Shin Yoongeun, Director of the Aviation Policy Division at the Ministry of Land, Infrastructure and Transport, said, "It is true that it is difficult to directly intervene in the duty-free industry," adding, "Since duty-free rent and real estate rental income constitute an important part of Incheon Airport's performance, discussions are necessary." Im Seongbin, Service Deputy General Manager at Incheon International Airport Corporation, explained, "We are aware of the need to explore solutions and provide assistance, but there are constraints, and new frameworks and legal amendments are also required."

Acceleration of Downtown Duty-Free Shop Withdrawals Amid Concerns Over Preferential Treatment for Some Operators

Some argue that lowering rent at Incheon Airport violates fairness. This is because it could appear as if only certain operators receive benefits rather than a comprehensive reform of the duty-free industry. During the 2023 bidding, Incheon Airport had announced that there would be no future rent adjustments. A duty-free industry insider stated, "For the development of the duty-free industry, institutional improvements or government support for the entire industry, including downtown duty-free shops, should come first, not just airport rent reductions."

Meanwhile, downtown duty-free shops, which have deepened deficits, are implementing strong measures to improve profitability. Lotte Duty Free became the first in the industry to completely halt transactions with Daigong (Chinese individual traders), who represent the largest transaction volume. This is a high-intensity structural reform aimed at increasing profits even if sales decline significantly.

Withdrawal news has also surfaced. In January, Shinsegae DF, which operates Shinsegae Duty Free, announced that it would return the operating license for its Busan branch after consulting with customs. Although it had a license to operate until 2026, it decided to withdraw early due to poor performance. At that time, Shinsegae Duty Free also expressed its intention to focus its capabilities on operating the Incheon Airport and Seoul Myeongdong flagship stores.

Hyundai Duty Free is reviewing various measures to enhance the efficiency of its downtown duty-free shops. Industry insiders expect Hyundai Duty Free to decide to withdraw from the Dongdaemun branch due to its severe accumulated losses. However, since operating an online duty-free shop requires holding a downtown duty-free business license, it is unlikely that all downtown duty-free shops will be withdrawn. A Hyundai Duty Free official said, "We are reviewing various measures to enhance duty-free shop efficiency," adding, "There has been no official discussion yet about withdrawing from either the Dongdaemun or Trade branches."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.