Receive Death Benefits in Advance as Annuity or In-Kind Payments

Customers Can Choose Annuity Payout Period and Ratio

In-Kind Services Linked to Nursing and Care Facilities

The financial authorities' plan to introduce 'death benefit securitization' as a measure against low birth rates and aging is expected to be implemented as early as the third quarter of this year. It will allow whole life insurance policyholders to receive their death benefits in the form of annuities or in-kind payments before death.

The Financial Services Commission announced on the 11th that death benefit securitization products are planned to be launched in the third to fourth quarter of this year. Insurance companies will sequentially release the products as they prepare them.

Death benefit securitization is a system that supports the use of death benefits, which are post-mortem income, during the policyholder's lifetime. The major assets of many elderly people are housing and whole life insurance. While housing can be securitized through a housing pension system, whole life insurance has been difficult to utilize during the insured's lifetime.

The insurance contracts eligible for securitization are death benefits of fixed interest whole life insurance. The policyholder must have completed premium payments, and the contract must have the same policyholder and insured. There must be no outstanding policy loans at the time of application. The system will uniformly apply institutional riders to whole life insurance contracts without annuity conversion riders that were purchased in the past. However, some whole life insurance policies that are difficult to securitize (variable whole life insurance, interest-linked whole life insurance, short-term payment whole life insurance) and ultra-high death benefits will be excluded from the first phase of securitization. Fixed interest whole life insurance contracts purchased from the mid-1990s to the early 2010s will mostly be eligible if there are no policy loans.

Securitization will be operated as partial securitization (up to 90%) rather than full securitization, considering the unique characteristics of whole life insurance, and will be structured as a fixed term (e.g., 20 years). There are no separate income or asset requirements for eligibility. Any policyholder aged 65 or older at the time of application can apply. As of December last year, about 339,000 contracts were eligible for immediate securitization. The securitization target amounts to approximately 11.9 trillion KRW. As the number of policyholders reaching age 65 and those who have completed premium payments increase, the number of contracts eligible for securitization is expected to grow.

The death benefit securitization plan will be launched in two types: 'annuity type' and 'service type,' and combinations between the two types will be possible. The annuity type allows the policyholder to securitize part of their death benefit and receive it monthly as an annuity. Through securitization, the monthly annuity will be structured to pay an amount at least exceeding the monthly premium paid by the policyholder (approximately 100-200% of the total premiums paid). Since a portion of the reserve funds prepared annually to fulfill the insurance contract is automatically reduced and paid out, the time value (present value) of the death benefit is reflected, but no additional costs are added as business expenses. However, because a certain percentage of the reserve funds is paid annually, the amount received varies depending on the expected interest rate of the insurance contract and the timing of securitization. Older policyholders who have accumulated more reserve funds can receive larger amounts.

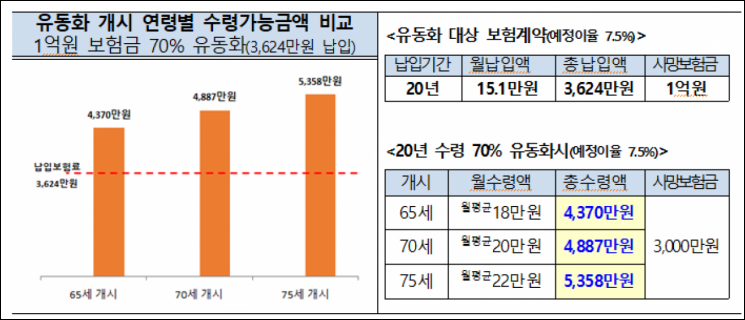

Comparison of Death Benefit Amounts Received by Age When Securitized. Provided by the Financial Services Commission

Comparison of Death Benefit Amounts Received by Age When Securitized. Provided by the Financial Services Commission

For example, suppose Mr. A purchased a death benefit insurance contract at age 40 with a monthly premium of 151,000 KRW for 20 years, paying a total of 36.24 million KRW, with a death benefit of 100 million KRW. If Mr. A chooses to securitize 70% of the death benefit over 20 years, he can receive an annuity ranging from 121% (43.7 million KRW total, approximately 180,000 KRW monthly starting at age 65) to 159% (57.63 million KRW total, approximately 240,000 KRW monthly starting at age 80) of the premiums paid. He can also receive the remaining 30 million KRW of the death benefit. The payout period and ratio can be customized according to the consumer's situation.

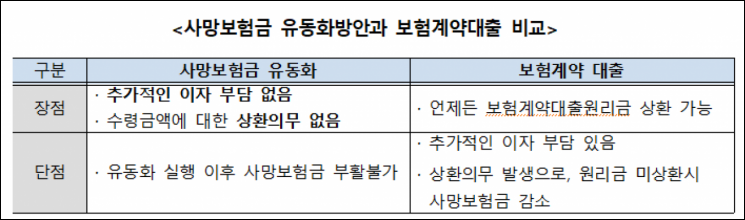

Death benefit securitization has advantages compared to policy loans. Unlike policy loans, death benefit securitization does not involve increasing interest costs or repayment obligations. The policyholder can leave as much death benefit as planned. However, policy loans can be repaid at any time, allowing the policyholder to maintain the death benefit upon repayment of principal and interest.

For example, suppose Mr. B receives a total of 44.87 million KRW by securitizing his death benefit with an average monthly payment of 200,000 KRW. Under the same conditions, if he uses a policy loan with a 9% interest rate for 20 years, the interest cost would be 44.16 million KRW, and the remaining death benefit would be 6.97 million KRW. In the case of death benefit securitization, there is no interest cost after 20 years, and the remaining death benefit is 30 million KRW.

Comparison of Life Insurance Death Benefit Securitization and Policy Loan. Provided by the Financial Services Commission

Comparison of Life Insurance Death Benefit Securitization and Policy Loan. Provided by the Financial Services Commission

The annuity conversion rider added to existing whole life insurance applies only to some new products from certain insurers. However, death benefit securitization can be applied to all whole life insurance policies that meet the requirements across all insurers. For contracts with annuity conversion riders, the whole life type can be selected, but securitization contracts are only available in fixed term types.

The financial authorities are also promoting products that securitize death benefits not in cash annuity form but as in-kind and service types. Various products linked to nursing facilities, healthcare, and caregiving services are expected to be launched. The service-type products are an initial form of 'insurance service' that combines nursing, caregiving, housing, and health management services with insurance products, and will be used as pilot projects for future institutional improvements. The financial authorities will actively support the insurance industry to become a comprehensive service throughout the life cycle through innovative financial services promotion and related institutional improvements.

Regarding death benefit securitization, the financial authorities and the industry will form a practical task force (TF) to finalize detailed operational matters such as consumer protection measures before the product launch. The products will be launched only after sufficient consumer protection measures are established at all stages before and after securitization enrollment.

Kim So-young, Vice Chairman of the Financial Services Commission, said, "The death benefit securitization plan is a task that can mutually benefit both consumers and insurers," adding, "Since a new product structure is being introduced, we will prepare detailed consumer protection measures to prevent consumer harm."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)