Jeximix Tops Sales,

Andar Leads in Profitability

Surging Demand for Running and Golf Wear Last Year

The competition for the top spot in the domestic athleisure market is fierce. The leading native athleisure brands, 'Jeximix' and 'Andar,' both recorded their highest-ever performances last year, with their company sizes and profitability closely matched.

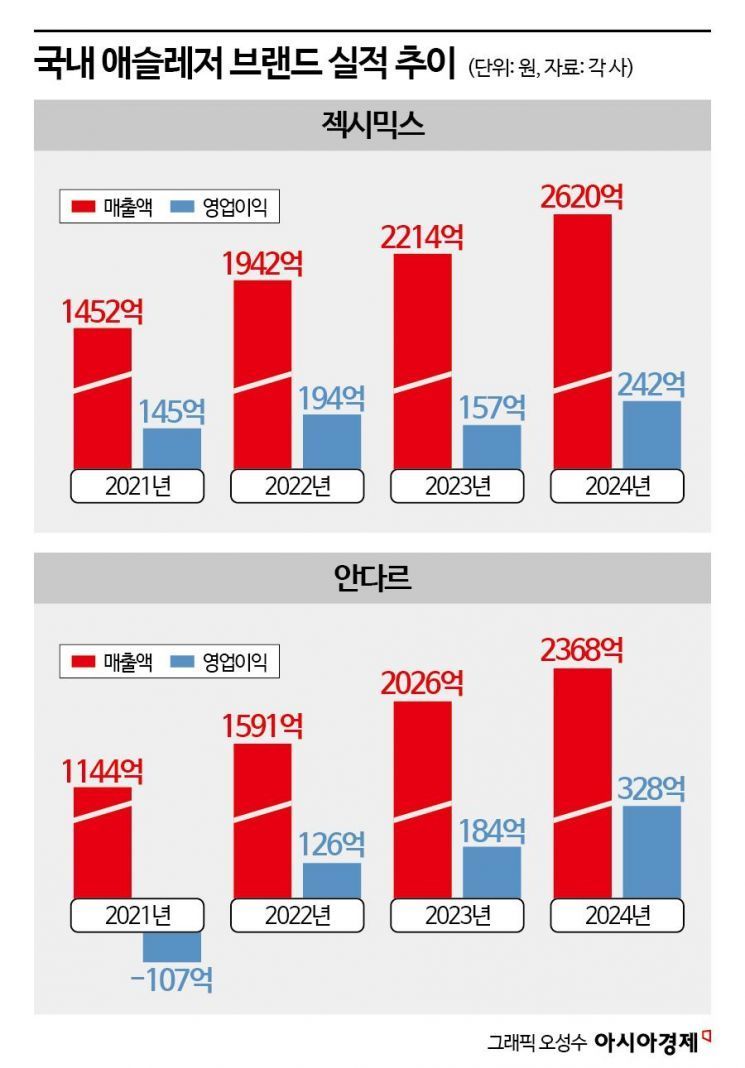

According to industry sources on the 12th, Jeximix, operated by Brand X Corporation, posted sales of 262 billion KRW last year, an 18% increase compared to the previous year. During the same period, Andar, an athleisure brand under Ecomarketing, recorded sales of 236.8 billion KRW, showing a 17% growth rate. The sales gap between the two companies widened from 18.8 billion KRW in 2023 to 25.2 billion KRW last year.

While Jeximix led in sales scale, Andar had the edge in profitability. Andar's operating profit surged 78% to 32.8 billion KRW last year. Jeximix, after officially entering the Chinese market in 2023, faced increased marketing expenses and a hit to profitability, resulting in an operating profit of only 24.2 billion KRW last year.

The domestic athleisure market was a three-way competition among Andar, Jeximix, and Mula Wear. However, after Mula Wear filed for corporate rehabilitation due to deteriorating performance in January, the remaining two companies are engaged in intense competition.

The overseas market was the deciding factor in the performance of the two companies last year. Jeximix actively pursued overseas expansion, which increased marketing costs and hampered profitability. Jeximix currently operates overseas subsidiaries in Japan, China, Taiwan, and runs a total of 14 stores. In 2023, to fully enter the Chinese market, Jeximix signed an exclusive supply contract with the local major distributor YY Sports, which increased selling and administrative expenses and temporarily lowered operating profit. Since last year, under the sole leadership of CEO Su-yeon Lee, the company has focused on management efficiency to improve profitability.

On the other hand, Andar is considered conservative in overseas expansion. It currently operates two global stores in Singapore. Following the opening at Marina Square in Singapore in July 2023, it entered the Takashimaya department store in October last year. Since Ecomarketing acquired Andar in 2021, which recorded an operating loss of 10.7 billion KRW, the company has emphasized management efficiency.

Nonetheless, these athleisure brands both recorded record-breaking performances last year despite the sluggish domestic fashion market. This was driven by growing demand for 'value-for-money' products centered on the running and golf markets since last year.

Jeximix's golf line, launched in May 2022, saw sales grow 92% from 13.3 billion KRW in 2023 to 25.4 billion KRW last year. The running wear released in April last year, featuring everyday designs such as boot-cut and jogger pants, saw a 64% increase in sales in the fourth quarter compared to the second quarter. Andar's flagship running wear line, the 'Air Moose Fleece Jogger Pants,' saw a 75% increase in sales from January 1 to 20 compared to the same period last year. Andar also explained that expanding its golf wear product line by 121% in the third quarter of last year contributed to its performance growth.

Furthermore, the outlook for the global athleisure market is positive. According to global market research firm Future Market Insights, the worldwide athleisure market is expected to grow at an average annual rate of 8.8% through 2034. The market size is projected to expand from $396.7 billion in 2024 to $920 billion in 2034.

For this reason, K-athleisure brands plan to accelerate their overseas market expansion this year. Jeximix will focus on Asian countries, while Andar will target high-income countries such as Australia. Jeximix plans to further expand its business in Malaysia, Mongolia, and other countries alongside its currently operating subsidiaries in Japan, China, and Taiwan. The goal is to achieve over 70% sales growth year-over-year at each subsidiary this year. Andar also plans to open an offline store at Westfield Mall in Australia this year. An Andar representative stated, "We plan to expand our influence in overseas markets, focusing on high-income countries."

Hae-ni Lee, a researcher at Eugene Investment & Securities, said, "Domestic athleisure brands are still small in scale and have plenty of room to grow. In the past, people did not often wear sportswear for indoor activities, but now more people wear it in daily life, making athleisure a new clothing category." She added, "Lululemon dominates the overseas athleisure market, but Andar and Jeximix are expected to be active in the market, especially in Asia."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)