Additional Measures Announced to Improve Foreign Exchange Supply and Demand

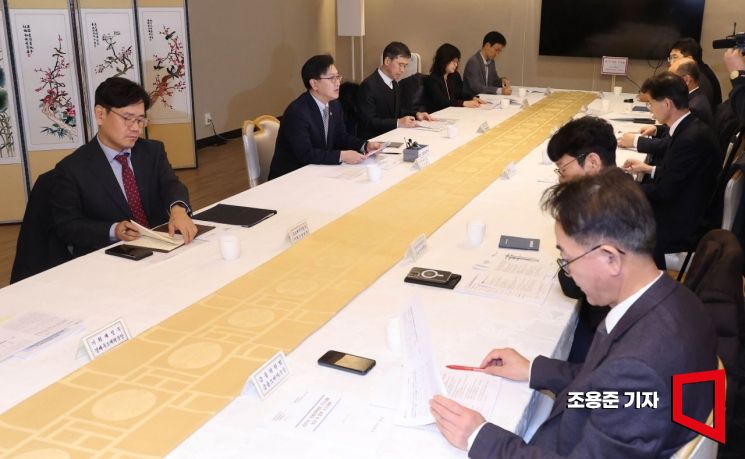

Kim Beom-seok, First Vice Minister of the Ministry of Economy and Finance, is speaking about recent economic issues at the Economic Vice Ministers' Meeting and Price-Related Vice Ministers' Meeting held at the Government Seoul Office in Jongno-gu, Seoul on the 12th. 2025.2.12 Photo by Jo Yong-jun

Kim Beom-seok, First Vice Minister of the Ministry of Economy and Finance, is speaking about recent economic issues at the Economic Vice Ministers' Meeting and Price-Related Vice Ministers' Meeting held at the Government Seoul Office in Jongno-gu, Seoul on the 12th. 2025.2.12 Photo by Jo Yong-jun

The government will raise the risk hedge ratio for foreign exchange derivative transactions, which have been restricted to prevent excessive foreign exchange hedging by companies, to 120%. To encourage domestic asset investment by Seohak Gaemi (Korean investors investing in U.S. stocks), the mandatory investment ratio in domestic stocks for the Domestic Investment-type Individual Savings Account (ISA) will be increased.

On the 9th, the Ministry of Economy and Finance, Financial Services Commission, Bank of Korea, and Financial Supervisory Service announced these measures as part of the "Additional Measures to Improve Foreign Exchange Supply and Demand." This response comes as the demand for dollars surged significantly due to Seohak Gaemi's purchases of overseas stocks, putting upward pressure on the won-dollar exchange rate.

First, the risk hedge ratio limit for professional investor companies will be raised to 125%, easing restrictions on foreign exchange derivative transactions. Additionally, foreign currency borrowing for won purposes through domestic banks' overseas branches will be allowed for export companies' domestic facility funds.

Current regulations limit the risk hedge ratio for foreign exchange derivative transactions (such as forward contracts) by financial institutions with large corporations to 100% to prevent excessive foreign exchange hedging by companies.

The Ministry of Economy and Finance stated, "We plan to ease the accumulated foreign exchange market supply-demand imbalance by adjusting the strict foreign exchange inflow regulations that have been maintained so far," adding, "We will revise the enforcement rules of banking and financial investment supervision regulations to expand the risk hedge ratio limit for professional investor companies to 125%, reflecting actual demand."

The restriction on purchasing Kimchi Bonds issued for won purposes will also be lifted. Originally, this regulation was intended to prevent Kimchi Bonds from being used as a means to circumvent foreign currency loan regulations for won purposes, but due to the recent pronounced foreign exchange supply-demand imbalance, it has been judged necessary to ease the regulation instead.

To encourage domestic investment by Seohak Gaemi, a Domestic Investment-type ISA, which has a tax-exempt limit twice that of the general investment type, will be newly established. At the same time, the mandatory investment ratio in domestic stocks for domestic stock-type funds included in the related ISA will be raised above the statutory minimum of 40%. The specific limit will be decided after further inter-agency consultations.

A tax support package to promote value-up of the domestic stock market will also be reintroduced. This includes providing a 5% corporate tax credit on increased shareholder returns, applying a low-rate separate taxation on increased dividends, and expanding ISA contribution limits and tax-exempt limits.

Additionally, the procedure for foreign investors to apply for tax exemption on government bond investments will be simplified, and if certain conditions are met, actual owner verification will be exempted when opening and trading through integrated government bond trading accounts.

Safety measures such as prior education and simulated trading will be established for overseas leveraged Exchange Traded Products (ETPs) and on-exchange derivatives investments, similar to domestic products.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)