Unlike Other Commercial Banks, KB Kookmin Bank Sees Surge in Demand Deposits and New Account Openings Amid Low Interest Rates

As the benchmark interest rate was lowered and deposit interest rates fell to the 2% range, causing funds to flow out of banks, KB Kookmin Bank has attracted funds instead, drawing attention. This is attributed to the effect of Bithumb, a virtual asset exchange, ending its partnership with NH Nonghyup Bank in January and joining hands with Kookmin Bank, leading coin investors trading virtual assets through Bithumb to move to Kookmin Bank. Over the past month (January to February), Kookmin Bank saw more than 1 trillion KRW in demand deposits inflow, and the number of accounts increased by 3 to 4 times compared to usual.

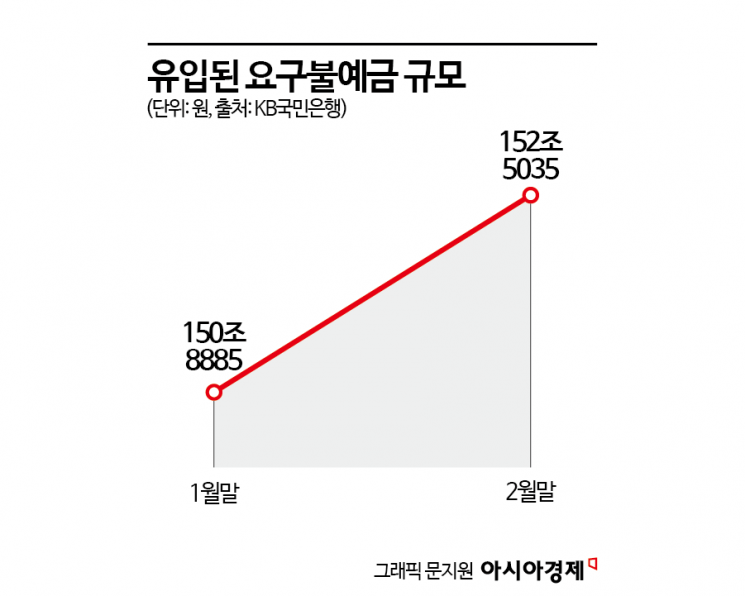

According to the banking sector on the 10th, as of the end of February, Kookmin Bank's demand deposits stood at 152.5035 trillion KRW, an increase of 1.615 trillion KRW from the previous month (150.8885 trillion KRW). This contrasts with other commercial banks, where demand deposits decreased. During the same period, Woori Bank saw a decrease of 5.0173 trillion KRW, and Hana Bank saw a decrease of 1.5696 trillion KRW, with outflows ranging from 1 trillion to as much as 5 trillion KRW. Demand deposits are deposits that can be withdrawn from banks at any time and are classified as funds waiting for investment. With the low-interest-rate trend pushing deposit and savings interest rates down to the 2% range, money movement is occurring as investors seek better investment destinations.

The inflow of more than 1 trillion KRW in demand deposits to Kookmin Bank is analyzed as the effect of the partnership with Bithumb, which competes for first and second place among domestic virtual asset exchanges. Until now, Bithumb customers could only trade virtual assets using Nonghyup Bank accounts, but from the 24th, Bithumb transactions will only be possible through Kookmin Bank accounts. Accordingly, Kookmin Bank has been conducting a 'pre-open service' since January 20, allowing customers to pre-register Kookmin Bank accounts.

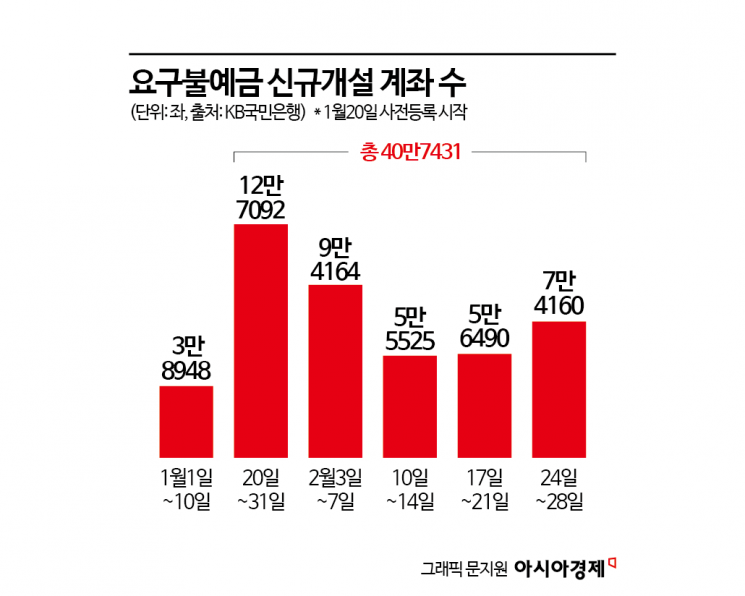

In fact, the number of newly opened accounts at Kookmin Bank increased significantly after the 'pre-open service' for Bithumb trading began on January 20. From January 1 to 10, before the pre-open service started, a total of 38,948 demand deposit accounts (an average of 5,564 accounts per day) were opened. From January 20 to 31, after the pre-open service began, the number of newly opened demand deposit accounts totaled 127,092 (an average of 21,182 accounts per day), nearly a fourfold increase.

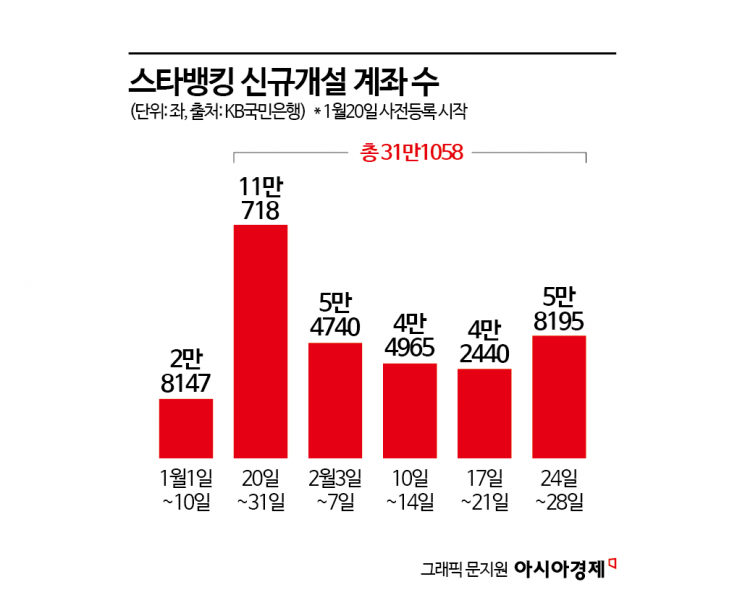

The number of new accounts opened via Kookmin Bank's mobile application (app) also increased. During the same period, it rose from 28,147 accounts (an average of 4,021 accounts per day) to 110,718 accounts (an average of 18,453 accounts per day), about a fivefold increase. Since then, new account openings have continued steadily at about three times the usual rate.

A Kookmin Bank official said, "Since the partnership with Bithumb, the scale of account openings has increased by 3 to 4 times compared to usual," adding, "There are no other seasonal factors internally that could have influenced this, so we see it as the 'Bithumb effect.'"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)