The government will announce next week a plan to reform the inheritance tax system from the current 'estate tax' to an 'inheritance acquisition tax.' The inheritance acquisition tax does not levy tax on the entire estate left by the decedent but taxes each heir based on the amount they inherit. With the catchphrase of revitalizing the people's economy through tax cuts and reforms, the government has been discussing inheritance tax taxation methods for several years. Initially, the plan was to submit the inheritance acquisition tax bill to the National Assembly in the first half of this year, but considering the possibility of an early presidential election due to the impeachment of President Yoon Suk-yeol, the submission timing has been moved up. As the early election phase begins, both ruling and opposition parties are proposing tax cut plans including inheritance tax reform, so the push for inheritance acquisition tax reform is expected to gain momentum.

Q. Why is there competition over inheritance tax among ruling and opposition parties?

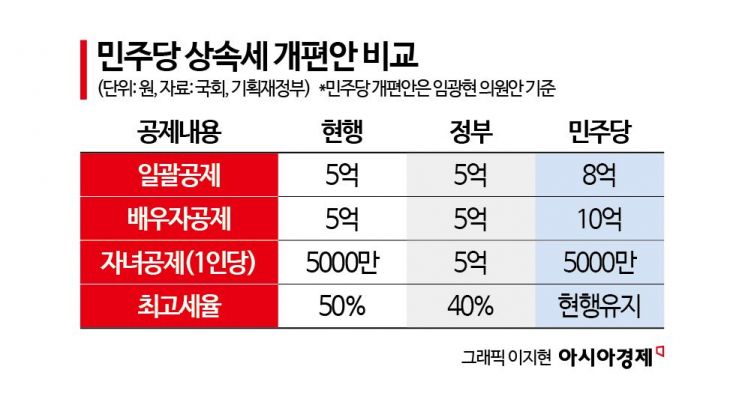

The ruling and opposition parties have been competing to propose inheritance tax reform plans. The ruling party emphasizes the complete abolition of spousal inheritance tax, while the opposition's reform plan focuses on raising deduction amounts. The current standard of a blanket deduction of 500 million KRW and a minimum spousal deduction of 500 million KRW would be raised to 800 million KRW and a minimum of 1 billion KRW, respectively. The ruling party and government also intend to introduce inheritance acquisition tax instead of the outdated 75-year-old estate tax. A Ministry of Economy and Finance official said, "All major tasks for the transition to inheritance acquisition tax have been reviewed," and "a detailed reform plan will be announced next week."

The inheritance tax has become a contentious issue because it has shifted from being a tax on the ultra-rich to one that middle-class citizens must also bear. The inheritance tax has failed to properly reflect economic changes such as soaring inflation and skyrocketing housing prices, leading to a significant increase in taxpayers. Domestic small and medium-sized enterprise (SME) owners have reached a point where they must forgo business succession due to the heavy inheritance tax burden. According to the National Tax Statistics Portal, the number of inheritance tax taxpayers was 19,944 as of the end of 2023, a 150% increase compared to 8,002 in 2018.

A representative of a domestic mid-sized company pointed out, "As business owners age and their inheritance tax preparations intensify, there is a need to efficiently improve the inheritance tax system, which has been frozen for 25 years since the 1999 reform." The ruling and opposition parties' active stance on inheritance tax reform is interpreted as an effort to target the middle-class vote. With the possibility of an early presidential election due to the president's impeachment ruling, tax cut competition targeting the middle-class vote in the metropolitan area has intensified among both parties.

Q. What are the tax cut effects of the government and party proposals?

Switching from an estate tax levied on the entire inherited property to an inheritance acquisition tax levied on the property each heir receives reduces the tax burden. For example, assuming a parent leaves 2 billion KRW equally to four children, under the estate tax system, a 40% inheritance tax rate applies, but under the inheritance acquisition tax system, each child's actual inherited 500 million KRW becomes the taxable base, and the inheritance tax rate drops to 20%. Based on the current taxable base, the total tax burden for the children is 800 million KRW under the estate tax method but reduces to 100 million KRW per child, totaling 400 million KRW, under the inheritance acquisition tax method. However, the tax burden could be further reduced depending on how the government sets the taxable base calculation and deductions per heir.

The tax revenue reduction from the ruling party's proposal to abolish spousal inheritance tax is difficult to estimate accurately under the estate tax system. Since the current law taxes the entire inheritance amount rather than the individual heirs, there is no data on how much of the inheritance amount belongs to the spouse heir. Currently, the spousal inheritance deduction limit applies up to 3 billion KRW, so the actual tax revenue loss would occur from the deduction amount exceeding 3 billion KRW. Although the taxable inheritance amount is large, the number of taxpayers is small, making it difficult for the government to estimate the overall impact on tax revenue.

Q. The world's highest inheritance tax rates... Is there discussion about lowering them?

The opposition party has expressed willingness to accept the ruling party's proposal to abolish spousal inheritance tax but opposes lowering the top tax rate and introducing inheritance acquisition tax rates, framing them as 'tax cuts for the ultra-rich,' making it uncertain whether inheritance tax reform discussions will yield clear results. Lee Jae-myung, leader of the Democratic Party of Korea, announced yesterday that he would accept the abolition of spousal inheritance tax but firmly stated that the top tax rate should not be touched and only deduction limits should be adjusted to reflect reality.

Calls to lower the world's highest inheritance tax rates have been ongoing. The current top tax rate of 50% ranks second among OECD countries after Japan (55%) and is about twice the average top rate of member countries (26%). Including the surcharge applied to major shareholders of large corporations, the effective top tax rate rises to as high as 60%. This means Korea has the highest inheritance tax rate.

Last year, the government attempted to reform inheritance tax by lowering the top rate to 40% and raising child deduction amounts, but the plan failed due to strong opposition from the major opposition party. At that time, the government stated that lowering the top rate to 40% was expected to reduce tax revenue by 1.8 trillion KRW.

Q. Should the burden of business succession be eased... What are the differences between parties?

The People Power Party and the business community argue that the top inheritance tax rate must be lowered to ease the burden of business succession. Including the 20% surcharge on major shareholders, the tax rate on business inheritance reaches up to 60%. The Korea Federation of Mid-sized Enterprises claims that the scope of industries eligible for business succession deductions is limited and the deduction limits are low, making utilization minimal.

On the other hand, the Democratic Party holds the opposite view, stating that the benefits of business succession deductions have rapidly increased. The deduction limit for business succession increased from 100 million KRW in 2007 to a maximum of 60 billion KRW currently. Although the top tax rate is high, using the special gift tax taxation system, taxes are 10% up to 12 billion KRW and 20% up to 60 billion KRW, so the actual burden is not significant.

Q. Problematic Korean inheritance tax... How about overseas?

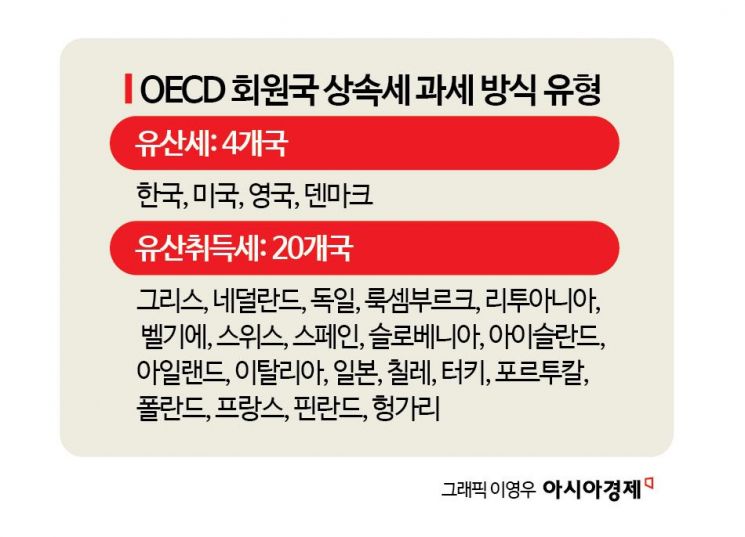

Major foreign countries operate inheritance acquisition tax systems. According to the National Assembly Budget Office, among the 24 OECD member countries that impose inheritance tax, 20 countries including Japan, France, Germany, Belgium, and Switzerland adopt the inheritance acquisition tax system. The estate tax system is used only in Korea, the United States, the United Kingdom, and Denmark.

In the United States, the top tax rate has been continuously lowered from 55% in 2001 to 50% in 2002, 45% in 2007, and 35% since 2010, so despite using the estate tax system, the tax burden is lighter. Denmark also has a low top tax rate of 15%. The United Kingdom, with a high top tax rate of 40%, has labeled inheritance tax as the most hated tax and has pursued phased abolition of inheritance tax.

Q. Wealth polarization... Is there controversy over tax fairness?

The ruling party focuses on tax fairness. The abolition of spousal inheritance tax is intended to rationally improve the issue of property transfer between spouses. For example, when a couple divorces, the state recognizes their economic community and divides property without taxing it. However, if inheritance occurs due to death, even spouses must pay tax. Taxing property differently depending on the manner of separation is considered unfair.

On the other hand, civic groups worry that abolishing spousal inheritance tax could worsen wealth polarization. The Tax Reform Center of the People's Solidarity for Participatory Democracy issued a statement on the 7th criticizing that it would effectively provide tax exemption benefits to high-net-worth individuals. They argued that abolishing spousal inheritance tax would reduce taxes levied when inheritance passes from the spouse to children after the spouse's death, intensifying wealth inheritance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)