- Hotel and Resort Investment Market Expected to Grow Steadily with Interest Rate Cuts and Recovery in Tourism Demand

- Luxury Hotel Market Gains Spotlight Amid Upscale Accommodation Trends

According to JLL Korea's report "2025 Outlook for the Korean Hotel Investment Market," last year’s domestic investment market grew more than threefold compared to the previous year, driven by an increase in tourists. The transaction volume reached 1.6 trillion KRW, and this year it is expected to rise to 2.2 trillion KRW due to interest rate cuts and economic stimulus expectations.

Foreign investors' domestic hotel investments are also on the rise. This is because investment conditions have improved with interest rate cuts, increased tourism demand, and exchange rate stability. In particular, hotels are evaluated as having excellent responsiveness to inflation because, unlike leased real estate, room rates can be adjusted in real time. In fact, room rates have increased at a rate exceeding inflation since the COVID-19 pandemic.

As the tourism market, which had been stagnant after the COVID-19 pandemic, recovers, the domestic hotel and resort investment development market is gaining momentum. According to the Korea Tourism Organization, last year the number of foreign tourists visiting Korea reached 16.3 million, recovering to 93.5% of the pre-COVID-19 level. Thanks to the popularity of Hallyu, it is expected to surpass 17.5 million this year.

With a clear preference for luxury hotels and resorts, this has become a major factor driving changes in the hotel investment market. Investment in domestic quasi-5-star and 5-star hotels accounts for more than 30% of all tourist accommodation facilities, highlighting a trend toward upscale development. In 2024, the revenue per available room (RevPAR) of luxury hotels in Seoul is expected to increase by 62% compared to pre-COVID-19 levels, while mid-range and budget hotels show only about a 20% increase, showing a clear contrast.

■ Analysis and Outlook of the 5-Star Hotel Market in Haeundae, Busan

In February last year, the number of foreign tourists visiting Busan was 26,800, about 3.3 times higher than the same month the previous year. In particular, Haeundae Beach was found to be highly preferred by foreign tourists.

Busan ranked first nationwide in foreign tourists' marine tourism spending. According to the Korea Maritime Institute (KMI), last year foreign tourists’ marine tourism expenditure in Busan reached 321.8 billion KRW, with Haeundae District accounting for 201.2 billion KRW, or 62.5% of the total.

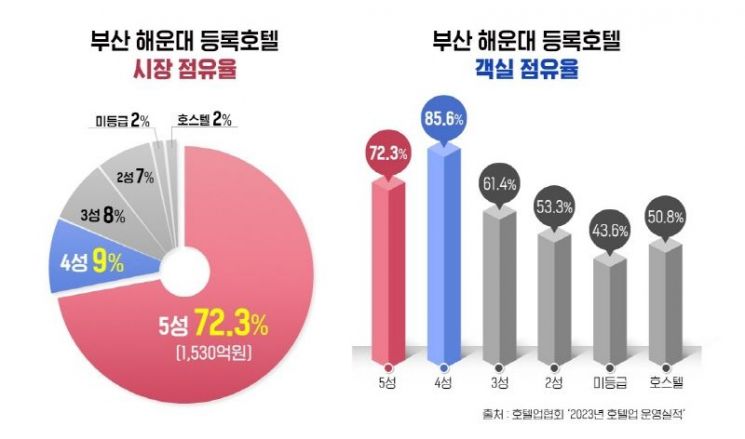

Following this trend, the hotel and accommodation market in Haeundae, Busan, is showing a clear tendency toward luxury. According to a 2023 survey by the Hotel Association, 5-star hotels account for more than 70% of the total registered hotel sales in Haeundae, highlighting a concentration on high-end accommodations. The average daily rate (ADR) of 5-star hotels in Haeundae is about 350,000 KRW, more than twice that of 4-star hotels, and the occupancy rate is maintained at a high level of 72%.

However, due to high construction costs, financing costs, and land prices, the supply of new luxury hotels and resorts is expected to be limited. Considering that new hotel supply takes 3 to 4 years, the preference and scarcity of existing 5-star hotels and resorts are expected to continue for the time being.

■ Hillsstate Haeundae Central’s Entry into the Luxury Hotel Market Draws Industry Attention

According to officials of the luxury residence (accommodation facility) "Hillsstate Haeundae Central," scheduled for completion in September this year, “Considering the demand and supply situation of the 5-star hotel market in Haeundae, Busan, we are developing and supplying luxury residences at a 5-star level, and they will be entrusted and operated by Sono International, a subsidiary of Daemyung Sono Group, which operates the largest number of rooms in Korea.” They also stated, “All rooms are suites, including large grand suites with a ceiling height of 3.7 meters, allowing families of three to four or more to stay comfortably.”

This is evaluated as achieving luxury and differentiation by configuring mainly medium and large suites, unlike existing hotel rooms which are small rooms for one or two people. An official said, “Hillsstate Haeundae Central is a newly built residence targeting the 5-star hotel market in Haeundae, Busan, and will feature high-end interior, furniture, and fixtures.” Due to the sharp increase in real estate development costs, it is difficult for competing luxury accommodations to be established in the Haeundae area of Busan, so the competitiveness and rarity of Hillsstate Haeundae Central are expected to be maintained for a considerable period.

In particular, Hillsstate Haeundae Central is attracting attention as it is entrusted to Sono International, Korea’s largest hotel and resort company, which is expected to provide overwhelming value in terms of reliability and premium service.

According to a representative from the accommodation operator Palatium, “The quality of service, customer attraction ability, and room operation performance (Occ, ADR, RevPAR) of residences and accommodation facilities vary depending on the capability of the entrusted operator. Therefore, professional operation by a large entrusted operator with experience, expertise, and transparency is essential.” They added, “Expectations are growing for Hillsstate Haeundae Central, which will be entrusted to Sono International.”

An official from Hillsstate Haeundae Central said, “Currently, ahead of the scheduled completion and opening in the second half of this year, Sono International and the project entity (entrusted operation SPC) plan to post recruitment announcements for accommodation operation staff in the first half of this year. We are preparing detailed accommodation operation plans, including the FF&E package list (items, quantities, prices) and opening preparations.” They added, “Key matters regarding residence operation will be notified to all Hillsstate Haeundae Central unit owners (accommodation facility trustees) in March this year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.