Net Profits of Overseas Modular Subsidiaries Declined Last Year

Due to the Downturn in the European Real Estate Market

Heo Yoonhong, CEO of GS Engineering & Construction (then President of the New Business Division), is taking a commemorative photo after signing the acquisition documents with Jacek Swiczki, President of Danwood, at the acquisition ceremony held at Danwood headquarters in Poland in January 2020. Photo by GS Engineering & Construction

Heo Yoonhong, CEO of GS Engineering & Construction (then President of the New Business Division), is taking a commemorative photo after signing the acquisition documents with Jacek Swiczki, President of Danwood, at the acquisition ceremony held at Danwood headquarters in Poland in January 2020. Photo by GS Engineering & Construction

Heo Yoonhong, CEO of GS Engineering & Construction, has seen the net profits of overseas modular construction subsidiaries, identified as new growth engines, sharply decline. With the European real estate market downturn and geopolitical issues compounding, some subsidiaries have even increased their losses, raising concerns about the weakening growth momentum.

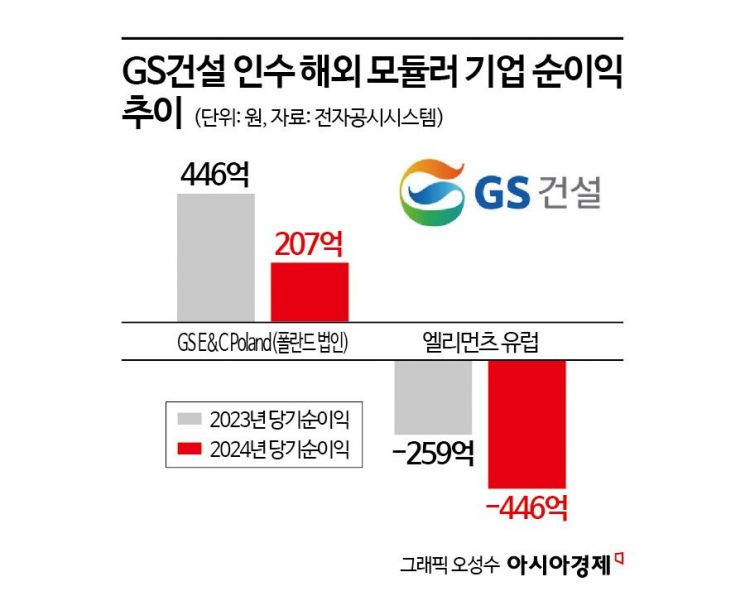

According to the Financial Supervisory Service's electronic disclosure system on the 6th, GS E&C Poland, a GS Engineering & Construction subsidiary, recorded a net profit of 20.7 billion KRW last year, a 53.6% drop compared to the previous year. The Polish subsidiary's main business entity is Danwood S.A., a modular company. Before acquiring Danwood in 2019, the Polish subsidiary's net profit was only 2 million KRW. However, after investing over 180 billion KRW to acquire Danwood, it transformed into a different company. The net profit of the Polish subsidiary increased to 14.4 billion KRW in 2020.

Modular construction is a building method where 70-80% of the construction process, such as basic framing and electrical wiring, is pre-fabricated in a factory and then assembled like Lego blocks. Danwood, located in Poland, also supplies modular wooden houses in Germany, ranking 4th in sales in the German modular housing market.

The Russia-Ukraine war caused local inflation, which impacted performance declines. Rising raw material costs, labor expenses, and financing costs have lowered the profitability of modular buildings.

For the same reasons, Elements Europe, another overseas modular subsidiary of GS Engineering & Construction, recorded a net loss of 44.6 billion KRW last year. The loss widened from 25.9 billion KRW in 2023. This company is a modular firm in the UK that builds assembly homes based on steel frames.

These two companies are the ones CEO Heo identified as new growth engines. At the time of acquisition, he personally traveled to Poland and the UK to attend the signing ceremonies. Following the underground parking lot collapse accident in Geomdan, CEO Heo has been pushing for a major organizational restructuring and business portfolio reorganization at GS Engineering & Construction, which faced a crisis. He has especially focused on nurturing new businesses. As a result, the proportion of new business sectors in GS Engineering & Construction's total sales rose from 6% in 2020 to 10.5% in 2023.

A GS Engineering & Construction official said, "Along with the global economic recession, interest rates remained high through this year, making the European real estate market difficult. Recently, interest rates have somewhat decreased, creating some optimism. We are continuously reviewing market conditions, including the possibility of a real estate market recovery."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)