As the stock price of Tesla, the 'favorite stock' of foreign investors, has nearly halved from its peak, domestic investors have been buying up shares worth trillions of won to average down their costs.

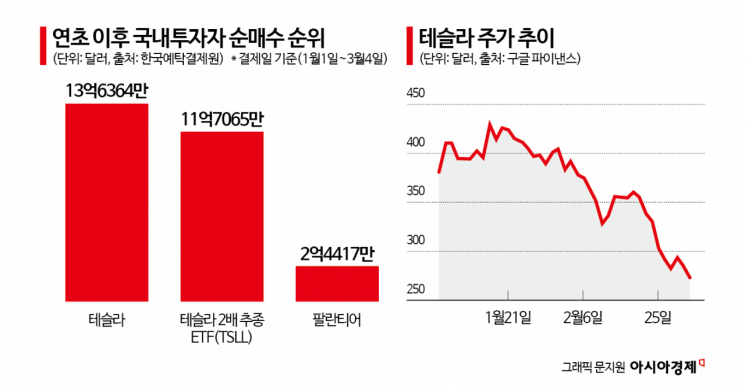

According to the Korea Securities Depository on the 5th, domestic investors have net purchased Tesla shares worth $1.363 billion (about 2 trillion won) as of the 4th (settlement date) this year. Despite Tesla's stock price falling 32.64% this year and dropping about 41% from its previous peak ($479.86), domestic investors maintained their position as the top net buyers. In particular, over the past month, they have aggressively bet by purchasing about $50 million more of the Direxion Daily Tesla Bull 2X (ticker TSLL) exchange-traded fund (ETF), which tracks Tesla's daily returns at twice the rate, than Tesla shares themselves.

Tesla, once considered the biggest beneficiary of the so-called 'Trump trade,' has seen its stock price fall by more than one-third since the inauguration of U.S. President Donald Trump due to successive tariffs and owner-related risks. In China, which has taken a confrontational stance against the U.S., Tesla's factory shipments (30,688 units) last month plunged 49% year-on-year, marking the lowest level since August 2022. Canada has also threatened to impose a 100% tariff on Tesla export vehicles if President Trump imposes a 25% tariff on Canadian exports, cooling investor sentiment.

Samsung Securities researcher Lim Eun-young said, "Tesla was considered the biggest beneficiary of Trump's election, but it has instead become a victim due to retaliatory tariff threats and boycott campaigns," pointing out that Tesla has surrendered the gains it enjoyed from the Trump trade and still faces several challenges. Bank of America (BoA) also significantly lowered its target price from $490 to $380, citing "risks such as declining European sales, Musk phobia, and tariffs imposed by Canada and Mexico."

Foreign investors who responded to the falling Tesla stock price by averaging down are expected to have suffered significant damage to their investment returns. Especially for the Tesla 2X leveraged ETF, whose year-to-date return has fallen below -58%, the decline rate doubles when Tesla's stock price drops, making it critical. The fact that U.S. index-tracking products, which have fallen 2-5% this year, ranked 1st to 5th in net ETF purchases by domestic investors during the same period also signals a warning for investors' profit and loss evaluations.

However, the momentum for Tesla's robo-taxi in June is a piece of good news. Researcher Lim said, "If Tesla's first cycle was about monetizing electric vehicles and expectations for autonomous driving technology, the second cycle is about monetizing autonomous driving and expectations for humanoid robots," adding, "With the start of robo-taxi services in Austin, Texas, this June, the stock price momentum is expected to resume."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.