Construction and Civil Engineering Top 'Worsening' Responses

High Exchange Rate and Inflationary Pressures Take a Toll

Corporate Fund Demand Expected to Rise Through Year-End

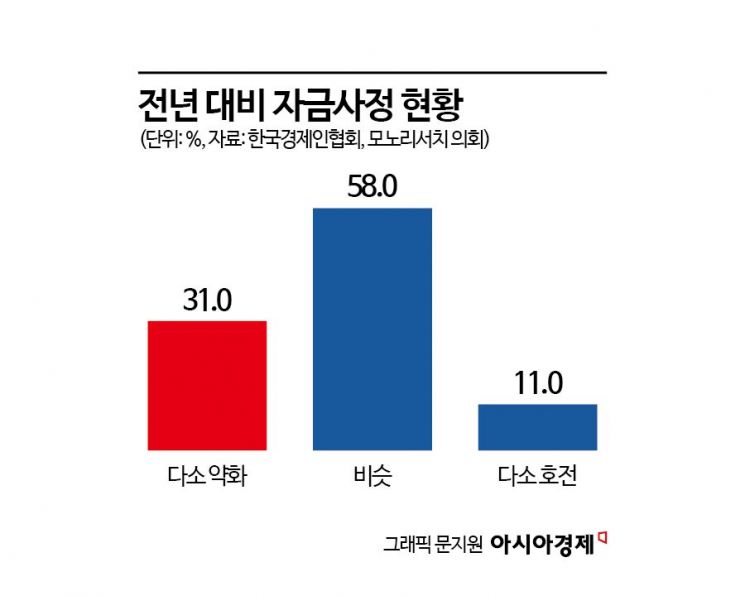

In the ongoing economic recession, 3 out of 10 of the top 1,000 companies by sales reported worsened financial conditions compared to last year.

The Korea Economic Association commissioned Mono Research, a market research firm, to survey the financial conditions of the top 1,000 companies by sales (excluding public and financial companies, with 100 companies responding) from the 12th to 18th of last month. The survey results (with a 95% confidence level and a sampling error of ±9.29 percentage points) showed that 31.0% of companies responded that their financial conditions have deteriorated this year compared to the previous year. This figure is three times higher than the 11.0% of companies that reported improved financial conditions.

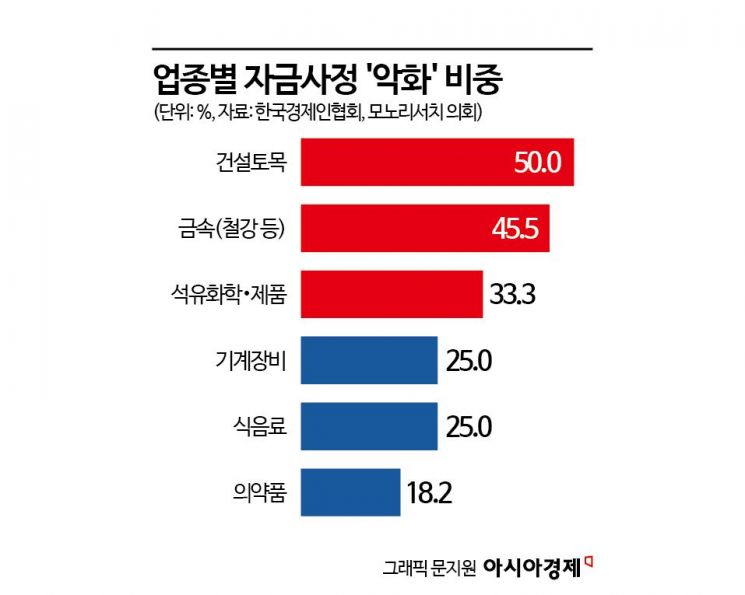

By industry, the proportion of companies reporting worsened financial conditions was highest in ▲Construction and Civil Engineering (50.0%), ▲Metal (45.5%), and ▲Petrochemicals and Products (33.3%). The Korea Economic Association noted that these industries are experiencing prolonged downturns due to demand slowdown caused by the economic recession and global oversupply, resulting in significant difficulties in raising funds.

Companies pointed to high exchange rates and inflationary pressures as factors negatively impacting their financial conditions. Specifically, the factors were ▲Exchange rate increase (24.3%), ▲Rising raw material prices and labor costs (23.0%), and ▲High borrowing interest rates (17.7%).

Although financial conditions are difficult, corporate demand for funds is expected to increase until the end of this year. The proportion of companies expecting an increase in fund demand compared to last year was 36.0%, more than three times the 11.0% expecting a decrease. More than half of the companies anticipated expenditures to remain at levels similar to last year.

The sector where fund demand is expected to mainly occur was raw material and component purchases (39.7%), followed by ▲Facility investment (21.3%), ▲Loan repayments (14.3%), and ▲Labor and administrative costs (14.0%).

Although the Bank of Korea lowered the base interest rate by 0.25 percentage points from 3.0% to 2.75%, one in five companies still responded that they find it difficult to cover interest expenses with operating profits. The proportion of companies that indicated their threshold for manageable base interest rates is lower than the current base rate (2.75%) was ▲2.5% (14.0%), ▲2.25% (4.0%), and ▲2.0% (2.0%).

Among companies, the prevailing expectation is that there will be no further base rate cuts until the end of this year. Six out of ten companies (58.0%) forecast that the year-end base rate will either remain at the current level (2.75%) (36.0%) or even increase one or more times (22.0%).

Companies predicted that the highest point of the KRW-USD exchange rate this year will approach 1,500 won (average 1,495.8 won). Specifically, the most common response (28%) expected the exchange rate to be in the 1,475?1,500 won range, followed by 1,500?1,525 won (24%) and 1,450?1,475 won (23.0%).

For stable fund management, companies prioritized efforts by policy authorities to resolve domestic and international uncertainties (34.3%). Other key requests included minimizing volatility in the foreign exchange market such as exchange rates (25.7%), expanding policy financial support (15.3%), and stabilizing the supply of raw materials, materials, and components (12.3%).

Lee Sang-ho, Head of the Economic and Industrial Division at the Korea Economic Association, said, "Despite recent interest rate cuts, companies, especially in construction, steel, and petrochemicals, which are experiencing severe economic downturns, continue to face worsening financial conditions. It is necessary to reduce exchange rate volatility to alleviate corporate foreign exchange risks and to provide financial and tax support such as expanding policy finance and temporary investment tax credits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)